With residence costs out of attain for a lot of right now, an apparent query has been when will the housing market crash?

To be trustworthy, this query will get requested just about yearly, and it’s a sure cohort of the inhabitants that all the time appears to need it to occur.

I get it – homeownership needs to be inside attain for everybody on this nation, however recently costs and elevated mortgage charges have made it a bridge too far for a lot of.

Regardless of this, I do consider it’s going to get higher as time goes on, due to moderating residence value positive factors (even some losses) together with extra engaging mortgage charges.

Perhaps even wages will catch up whereas we’re at it. However a housing crash? In all probability not with the present mortgage inventory.

As we speak’s Mortgages Simply Aren’t the Early 2000s Ones

As similar to some people need to consider that right now’s mortgages are similar to those we noticed within the early 2000s, they merely aren’t.

And I’m truly sick and bored with individuals making an attempt to make that argument. I used to be there. I originated loans in 2004, 2005, 2006, 2007, and so on.

I noticed the poisonous loans that had been getting permitted each day, which finally led to the worst mortgage disaster in trendy historical past.

It’s simply not that approach right now, regardless of the widespread availability of said revenue and even no-doc mortgage merchandise.

First off, these loans are actually area of interest, supplied by so-called non-QM lenders that aren’t the default (no pun meant) possibility for residence consumers right now.

The ATR/QM rule made it far more troublesome for lenders to supply loans with restricted documentation or unique options like damaging amortization or 40-year mortgage phrases.

So whereas these things is obtainable, it’s simply not as widespread, and represents a fraction of the general lending universe.

In 2004-2007, your typical mortgage was said or no doc and it had zero down fee. Completely different days.

It Continues to Be an LTV Story within the Mortgage World

After all, life occurs, and with it comes mortgage delinquencies. These have been on the rise recently, with FHA loans one space of concern.

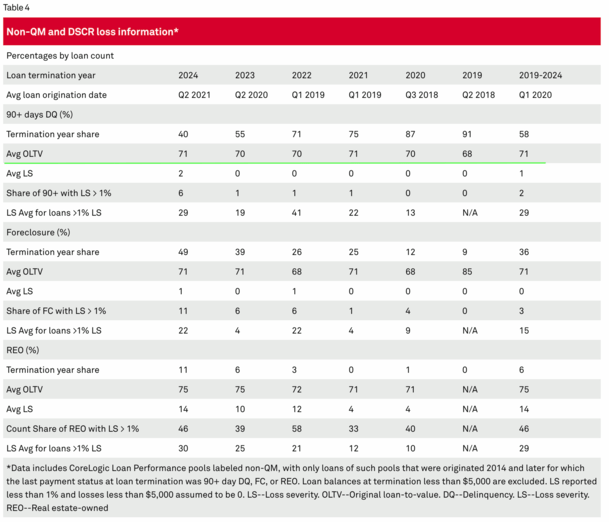

There are additionally non-QM loans and DSCR loans, which have seen mortgage lates improve in recent times.

Regardless of this, the housing market is holding up very well right now. However why? Shouldn’t costs crash if individuals can’t make their funds or afford to take out new mortgages?

The reply is definitely fairly easy: LTVs. Low ones. In contrast to within the early 2000s when you can get a no-doc mortgage at 100% LTV/CLTV.

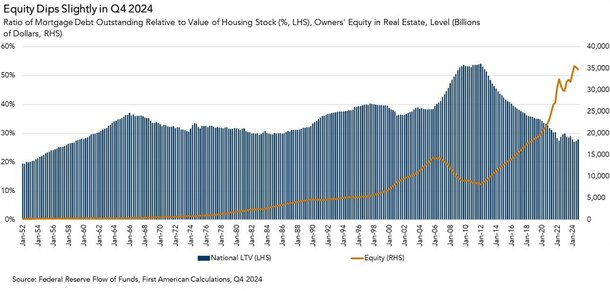

The nationwide loan-to-value ratio (LTV) could be very low right now, at round 28% eventually look, per First American. In 2008, it was hovering close to 55%.

You’ll be able to thank bigger down funds, decrease most LTV limits, and surging residence costs, which have led to document excessive residence fairness.

Oh, and householders aren’t even touching that residence fairness most often, with HELOCs and residential fairness loans nonetheless untapped by most.

And people dangerous no-doc and said revenue loans that resurged in recent times? Properly, most lenders require huge down funds, similar to 30% down or extra.

This explains why aren’t we seeing foreclosures and quick gross sales regardless of rising delinquencies on DSCR and non-QM loans that require no revenue documentation.

Distressed Residence Sellers Can Promote with no Loss

As we speak, these distressed debtors are capable of “promote the property, extract fairness, and fulfill the mortgage obligation,” per a brand new evaluation from S&P credit score analysts.

In 2008, should you fell behind on the mortgage, you typically had zero fairness since you put nothing down, which meant both a brief sale or foreclosures had been the one choices.

Clearly this wreaked havoc on residence costs and led to one of many worst downturns in historical past.

The excellent news is due to that occasion, mortgage underwriting tips improved tremendously.

If you would like one thing outdoors the norm of Fannie, Freddie, the FHA, or a VA mortgage, you’ll want numerous pores and skin within the sport.

It helps to have 30% fairness or down fee once you get a mortgage. As a result of you probably have a lack of revenue or inadequate money movement to service the mortgage fee, you may promote the property with out taking a loss.

That is good for lenders and the debtors, and the housing market total. It buffers residence costs.

Talking of, the “housing inventory nationally continues to be provide constrained (due largely to mortgagors’ reluctance to promote houses and quit traditionally low mounted charges), which has been a consider stopping value declines on the nationwide stage.”

So the vast majority of the excellent house owner universe is unwilling to promote as a result of their mortgage price is mounted at 2-4%.

This additional buffers the housing market and retains provide tight, limiting draw back to residence costs. And as famous, we’ve got a lot decrease LTV maximums than we had within the early 2000s.

That wasn’t the case within the early 2000s, when you can get a no-doc funding property mortgage with zero down!

Clearly having zero pores and skin within the sport made it very straightforward for the property to turn out to be a brief sale or foreclosures as soon as the borrower couldn’t make funds. Not so anymore.

Taken collectively, sure, it’s truly completely different right now. But when lenders had been handing out said revenue and no doc loans at 100% LTV once more, I’d be a part of the doomer camp instantly.

Happily, you continue to want an enormous down fee to get a said/no-doc DSCR mortgage or non-QM mortgage.

If/when that adjustments, I’ll fear.

Learn on: Will the housing market crash in 2025?