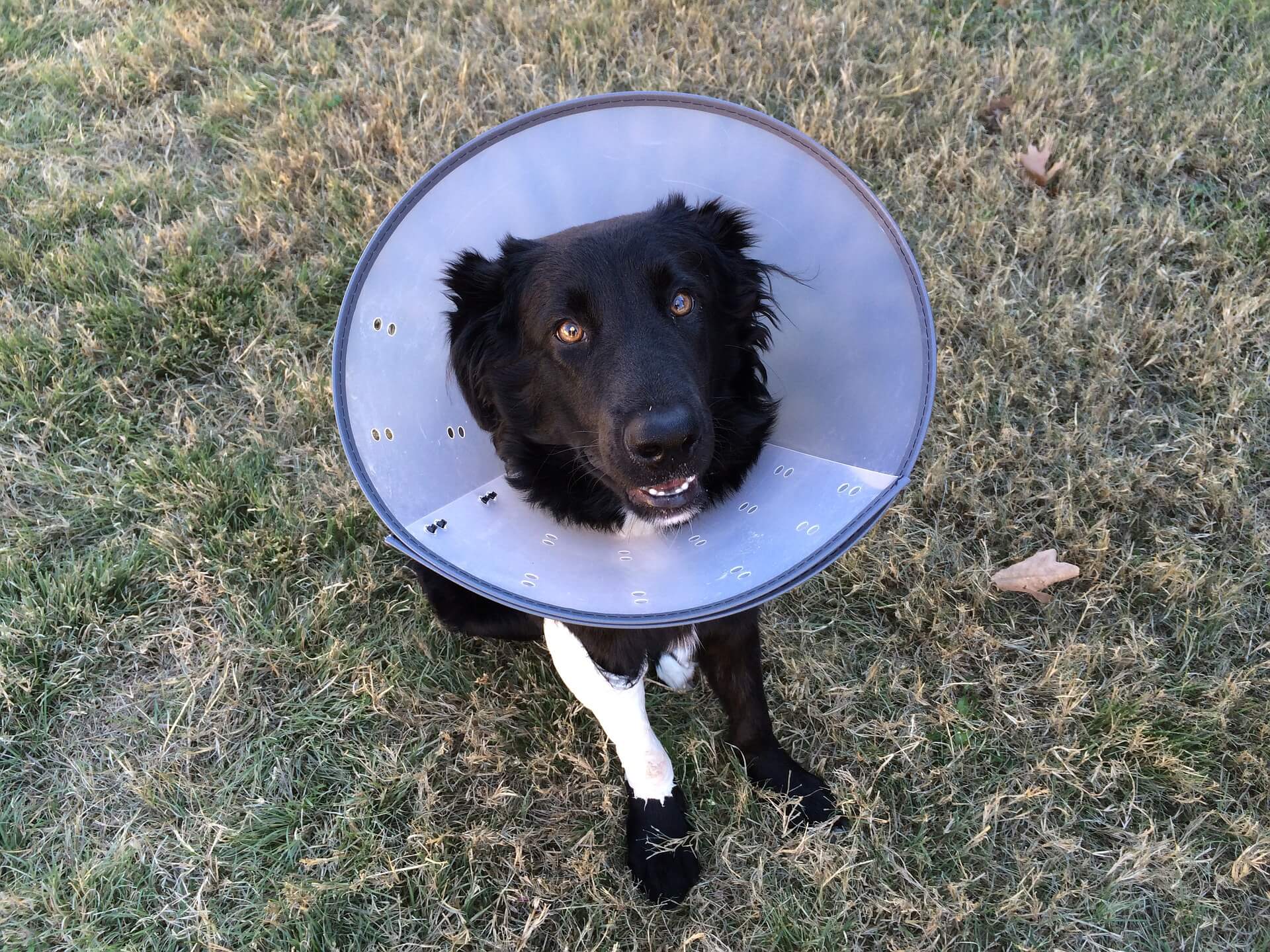

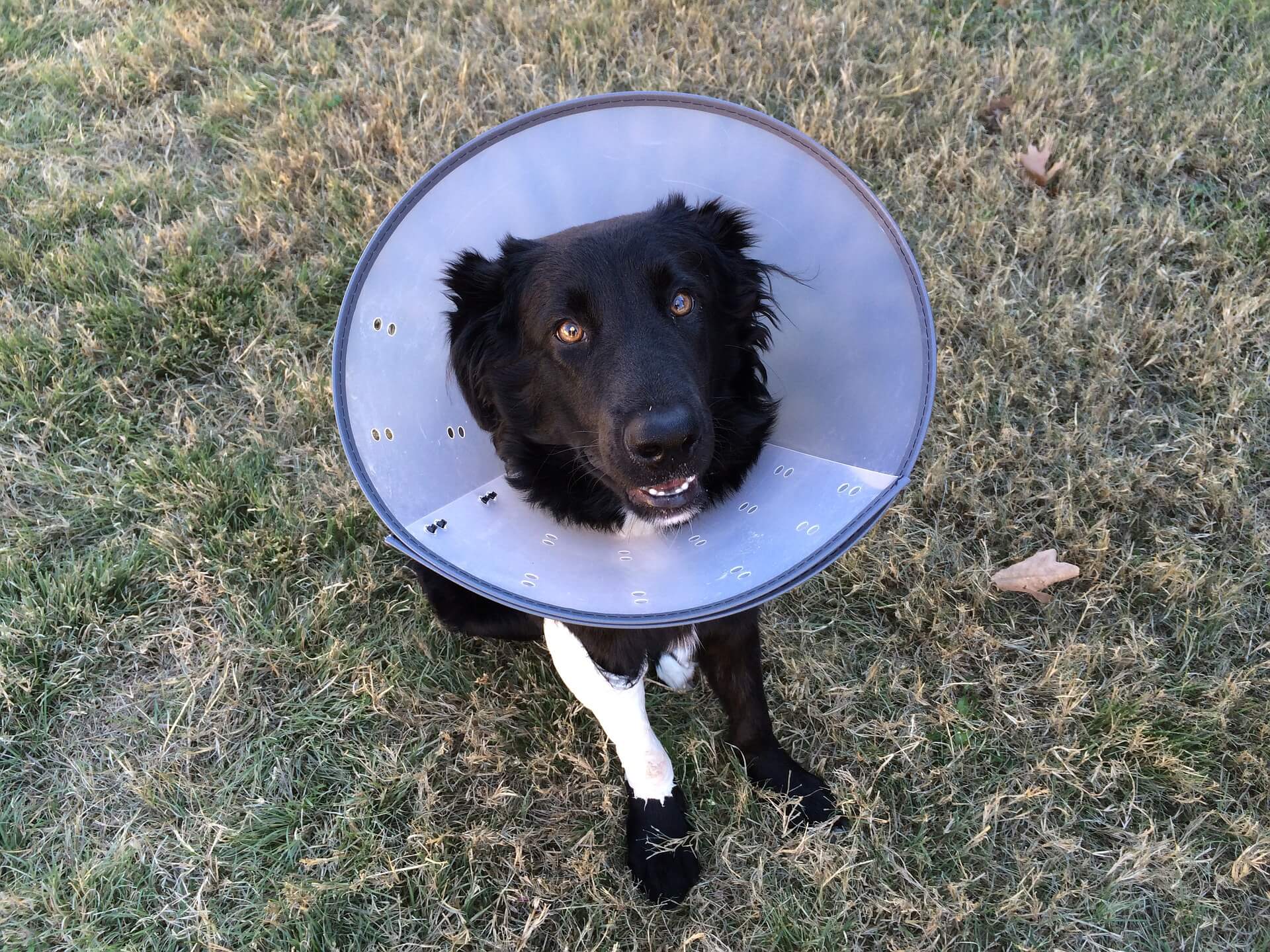

In the event you’re a pet proprietor, you already know that our furry pals are extra than simply pets—they’re household. And similar to we defend our family members, it’s necessary to think about how we are able to defend our pets, too.

That’s the place pet insurance coverage is available in.

Your pet’s well being is necessary, however do you know that pets can even play a job in your house and auto insurance coverage insurance policies? On this submit, we’ll dive into how pet insurance coverage works, why it’s price contemplating, and the way your pets may have an effect on your different insurance coverage insurance policies—as a result of preserving your pets secure and coated must be so simple as potential.

What Is Pet Well being Insurance coverage?

Pet insurance coverage is like medical insurance to your furry companions. It will probably assist cowl the price of vet visits, therapies, and even surgical procedures when your pet will get sick or injured. Relying on the coverage you select, pet insurance coverage can cowl something from accidents and diseases to routine wellness care like vaccinations and checkups.

It’s price noting that pet medical insurance is just not the identical as a vet low cost plan, the place you pay a month-to-month charge to your vet in alternate for reductions on companies. Vet low cost plans are usually rather more costly than insurance coverage and aren’t regulated in the identical manner.

Take into accout, similar to with human medical insurance, pet insurance coverage insurance policies have deductibles, co-pays, caps, and will not cowl sure pre-existing circumstances. There are additionally several types of pet insurance coverage—some insurance policies cowl solely emergencies, whereas others embrace routine care. You possibly can select what works greatest to your funds and your pet’s wants.

In the long run, one of the best pet insurance coverage plan is one you’re feeling snug with.

How Does Pet Insurance coverage Work?

At Harry Levine Insurance coverage, we provide pet medical insurance by way of Figo.

Figo presents three varieties of plans that cowl a variety of medical bills, together with accidents, diseases, and even some routine care. They’re recognized for providing easy-to-understand insurance policies and a tech-friendly strategy, together with an app that helps you handle the whole lot from submitting claims to accessing your pet’s medical data.

Right here’s how Figo works: when you’ve chosen a plan, you pay a month-to-month premium based mostly in your pet’s age, breed, and the place you reside. In case your pet wants medical consideration, you’ll pay the vet instantly after which submit the veterinary invoice by way of Figo’s app or web site. Figo presents a reimbursement share (usually 70%, 80%, or 90%, relying in your plan), minus your annual deductible.

Figo presents customizable protection with choices like:

- Accident and Sickness Protection: Covers the whole lot from damaged bones to severe diseases.

- Wellness Care Add-ons: Routine checkups, vaccinations, and preventive care may be included.

- Limitless Annual Advantages: With some plans, you received’t have to fret about hitting a protection restrict for the yr.

Figo’s app additionally consists of further perks like 24/7 entry to a reside vet for these pressing “Is that this severe?” moments. It’s a contemporary and stress-free manner to ensure your pet will get the care they want with out breaking the financial institution.

Different pet insurance coverage firms provide both accident solely plans or accident and sickness plans, however Figo presents accident and sickness protection in all plans.

Pets and Insurance coverage

Pet medical insurance isn’t the one insurance coverage coverage you need to be involved about as a pet proprietor. You must also take into account how your pets have an effect on your property, renters, and auto insurance coverage as properly.

Owners/Renters Insurance coverage

Your normal house owner’s insurance coverage coverage seemingly record exclusions and/or limitations for:

- damage to your pet in your property,

- your pet damaging your individual property,

- sure canine breeds,

- canine with a historical past of violent or aggressive habits.

A typical owners insurance coverage coverage could cowl bills you might be responsible for within the occasion your canine injures somebody or their property (often known as Animal Legal responsibility). Nevertheless, protection is commonly topic to restrictions and even sub-limits. Some house owner insurance policies fully exclude Animal Legal responsibility, so you will want the extra coverage.

In case your owners insurance coverage doesn’t cowl any animal-related claims, this doesn’t imply you’re by yourself. You will have the choice to buy separate Animal Legal responsibility Insurance coverage.

Animal Legal responsibility Insurance coverage

Animal legal responsibility insurance coverage is an addition to your owners insurance coverage or a stand-alone coverage that helps cowl sure bills in case your pet injures somebody (or damages their property).

In response to the Insurance coverage Info Institute, the typical value of a canine chew declare in Florida is greater than $66,000. What’s worse? Many Florida insurers restrict animal legal responsibility to $25,000. The remaining $41,000 on this instance can be purely out of pocket. In case your house owner’s coverage restrict is just not this excessive (or for those who’re not coated in any respect) you’ll want animal legal responsibility protection to shut the hole.

Fortunately, most insurance policies aren’t costly, costing solely about $250-500 a yr. That’s properly definitely worth the added peace of thoughts.

Nobody can in truth say that their canine won’t ever chew anybody or their cat won’t ever scratch anybody. Even probably the most mild-mannered canine, cat, gerbil, or different pet can lash out in the event that they really feel threatened.

Auto Insurance coverage

Our furry pals are sometimes on the go together with us: to the park, the vet, or a weekend away. However what occurs if they’re injured in a automotive accident?

Some auto insurance coverage insurance policies cowl damage to your pet within the occasion of an accident brought on by one other driver. In spite of everything, your pet is legally your property, and your auto legal responsibility protection is particularly for harm another person does to your property.

If you need your pet to be coated within the occasion that you simply trigger an accident, examine together with your insurance coverage firm to see if they’ve any plans that cowl your pet underneath your collision protection (most don’t provide this as a typical). In the event that they inform you that your pets aren’t coated, discuss together with your unbiased insurance coverage agent to see how one can get a coverage that may.

Theft & Life Insurance coverage

Typically your pet is greater than a furry companion. In some circumstances, they’re your livelihood.

In case your canine, cat, or horse is a present animal or has a job (in modeling, appearing, or with the police power), it’s price getting theft or life insurance coverage protection on them.

With one of these protection, you’d get reimbursed within the occasion your pet is stolen or dies underneath sure circumstances.

Conclusion

We all know how a lot your pets can really feel like household, so defending them towards any hurt that will come their manner is necessary to you.

Whether or not you’re on the lookout for medical insurance, auto insurance coverage, life insurance coverage, legal responsibility insurance coverage, or another sort of protection to your four-legged pals, tell us how we might help.