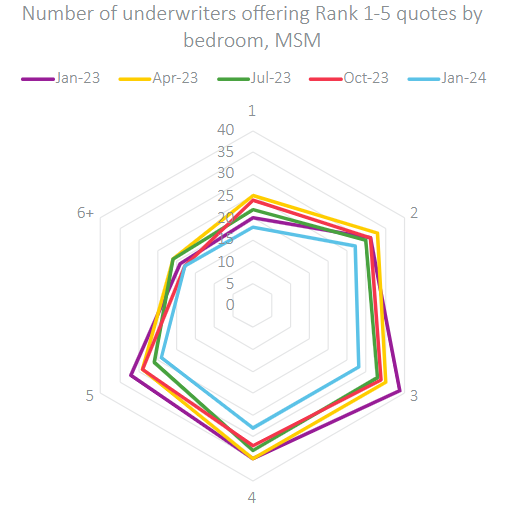

Within the ever-evolving panorama of dwelling insurance coverage, a noticeable shift has occurred over the previous yr: the autumn within the variety of aggressive underwriters out there. The decline we’ve noticed is most pronounced after we have a look at three-bedroom properties — a staple of the UK housing market. Right here, we have noticed a major discount within the range of underwriting choices, nevertheless most regarding is the 30% discount within the variety of completely different underwriters represented among the many high 5 best insurers.

Our Insurance coverage Perception Supervisor, Max Thompson, feedback on what this might imply for the insurance coverage panorama, “There can be pressure on brokers. Many of those are smaller corporations, with much less sources than direct insurers. They’re seeing extra overheads with inflation, extra compliance by means of Shopper Obligation, and probably now fewer aggressive alternatives with the must be on high of the market to compete.

“Moreover, there can be higher deal with MGA relationships, the place the middleman has underwriting authority with an insurer. Insurers may use the higher flexibility allowed by MGA underwriting to focus on areas, reasonably than completely different panel members”.

Our value benchmarking information collected from MoneySuperMarket signifies a stark discount within the whole variety of underwriters — from 45 in January 2023 to simply 34 in January 2024. This development suggests a tightening market, the place fewer monetary backers are keen to tackle the dangers related to insuring properties.

Max provides, “We haven’t seen many new entrants prior to now yr or so. If this was pushed by the uncertainty in claims prices, although, with inflation steadying we would have a extra secure market that might carry capital in”.

The idea of managing threat appears to underpin a lot of this shift. As an illustration, wanting on the information from January 2024, we discover that the variety of underwriters out there for claimants has dropped considerably. The place there have been as soon as 45 underwriters desperate to handle claims, solely 32 stay. This lower is especially noticeable in water injury claims, which have seen probably the most notable decline in underwriter urge for food.

With this development set to evolve, it’s crucial that each one gamers within the insurance coverage market – directs, brokers and underwriters alike – carry on high of those actions, which have the potential to considerably affect each competitiveness and quotability. We’ve got seen this occur over the previous couple of months, with some manufacturers not with the ability to quote competitively and diversely sufficient to stay on the forefront of the market, and others rising to the highest of the competitiveness charts. Utilizing our Market View device, you possibly can guarantee your model avoids being hit by surprising modifications within the underwriting panorama, while fuelling assured determination making.