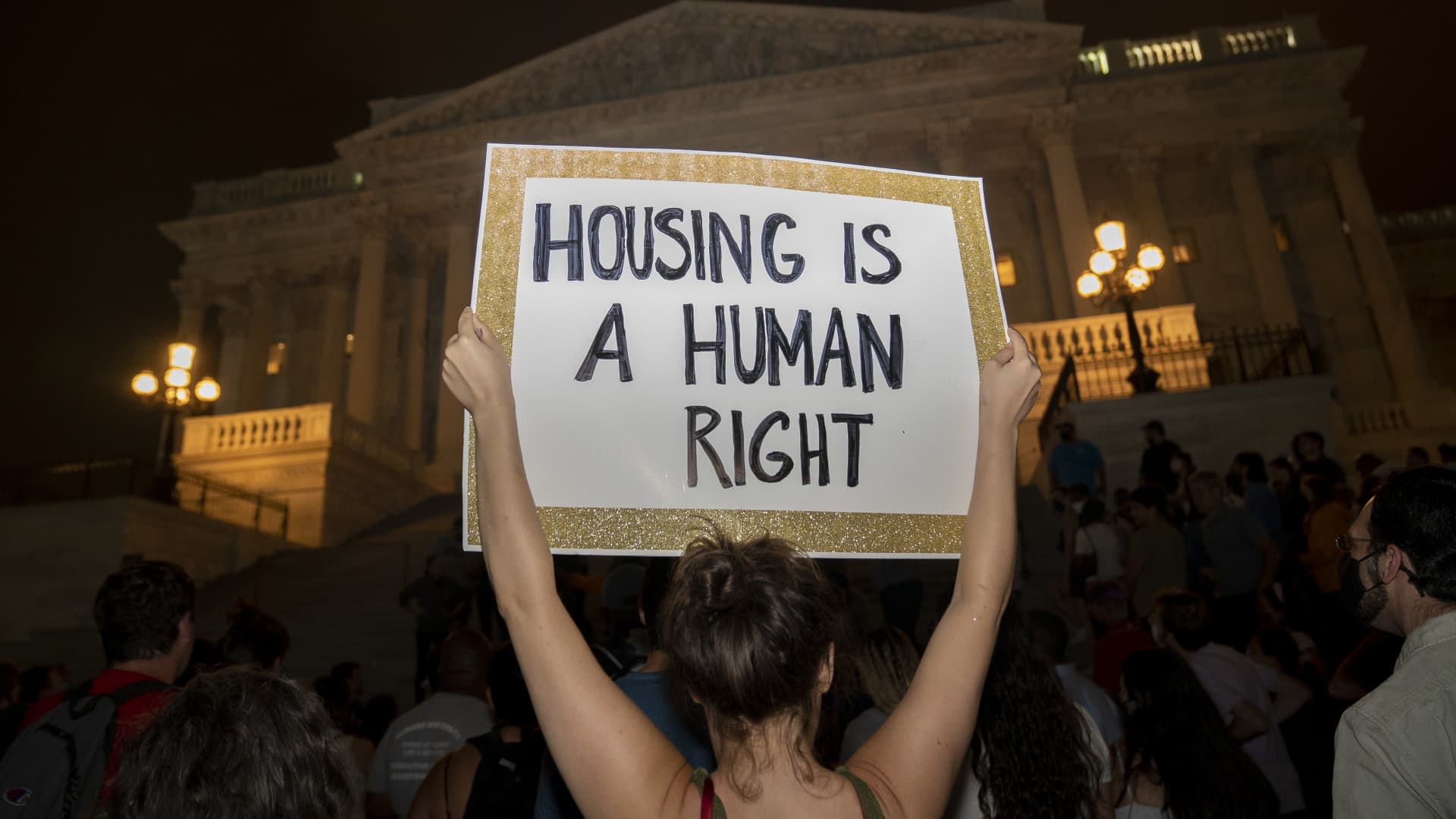

Demonstrators collect throughout a protest towards the expiration of the eviction moratorium exterior of the U.S. Capitol in Washington, D.C., U.S., on Sunday, Aug. 1, 2021.

Stefanie Reynolds | Bloomberg | Getty Pictures

Renters burdened by unaffordable housing prices could also be at a better threat of dying sooner, in accordance with a brand new research revealed within the journal Social Science & Drugs.

A person paying 50% of their earnings towards lease in 2000 was 9% extra more likely to die over the following 20 years in contrast with somebody paying 30% of their earnings towards lease, in accordance with the research from researchers at Princeton College and the U.S. Census Bureau’s Middle for Economics Research. Somebody paying 70% of their earnings towards lease, in the meantime, was 12% extra more likely to die.

“We have been shocked by the magnitude of the connection between prices and mortality threat,” mentioned Nick Graetz, a postdoctoral analysis affiliate at Princeton College and the research’s lead creator. “It is an particularly huge downside once we take into account how many individuals are affected by rising rents. This is not a uncommon incidence.”

Extra from Private Finance:

Even excessive earners take into account themselves ‘not wealthy but’

Bank card debt is ‘the largest risk to constructing wealth’

People are ‘doom spending’

Rising rents have far outpaced wages, leaving the everyday renter within the U.S. paying 30% or extra of their earnings for housing. In 2019, 4 in 5 renter households with incomes under $30,000 have been rent-burdened.

The Princeton researchers collaborated with the Census Bureau to create a dataset that allowed them to observe particular person renters from 2000 on. They analyzed tens of millions of information to know the hyperlink between lease burden, eviction and mortality for individuals.

Along with the implications of unaffordable lease, they discovered that even being threatened with eviction was related to a 19% improve in mortality. Receiving an eviction judgment was related to a 40% improve within the threat of loss of life.

CNBC interviewed Graetz in regards to the research findings. The interview has been edited and condensed for readability.

‘As rents go up, households reduce on different spending’

Annie Nova: What’s it about being rent-burdened that will increase mortality?

Nick Graetz: We all know housing is the first price for American households, and as rents go up, households reduce on different spending, together with on necessities that have an effect on their well being.

For instance, poor households with youngsters who’re reasonably rent-burdened, devoting 30% to 50% of their earnings to lease, spend 57% much less on well being care and 17% much less on meals in comparison with comparable unburdened households.

AN: Why is eviction, much more than being rent-burdened, linked to greater mortality?

NG: Eviction is a very traumatic occasion that results in disenrollment from social security internet applications, comparable to Medicaid. It may additionally result in job loss and a number of different adverse penalties.

Eviction can compromise an individual’s bodily and psychological well being by exposing them to extended durations of intense housing precarity, together with homelessness and acute stress.

As well as, eviction can improve publicity to infectious illness, as seen through the Covid-19 pandemic. Even simply having an eviction submitting in your file can restrict your means to safe future protected and steady housing, which might have impacts on well being outcomes.

Present system makes it ‘tough to retain housing’

AN: What efforts for change do you hope to see in response to your findings?

NG: We exhibit on this new paper that as lease burdens hit file highs at the moment, we needs to be contemplating insurance policies to cut back evictions and assure reasonably priced housing as not simply housing coverage, however as vital well being coverage.

Generally, we dwell beneath a system that makes it actually tough to retain our housing at any time when we expertise an issue. A sudden well being concern in your loved ones, a automotive crash or another sudden downside can result in an eviction in a short while.

It is particularly vital to behave now: eviction filings are rising in each metropolis and state that we observe.

AN: Are there any insurance policies presently in impact which can be making the issue higher?

NG: Throughout the U.S., cities and states are attempting totally different and generally overlapping insurance policies to advertise housing stability and keep away from evictions.

Some vital authorized help applications embrace the suitable to counsel. When tenants are supplied authorized counsel, the chances of them remaining of their properties improve dramatically. Below New York Metropolis’s proper to counsel in eviction courtroom, 84% of represented renters dealing with eviction stay housed. In Cleveland, 93% of represented renters dealing with eviction keep away from displacement.

Many states and cities, comparable to Rhode Island and DC, are contemplating applications like lease management and social housing, characterised by being mixed-income, mixed-use and with extra resident involvement in governance than conventional public housing.

We have to create a rustic the place high quality housing is reasonably priced to everybody.

Do not miss these tales from CNBC PRO: