We’ve examined the JamDoughnut cashback app

JamDoughnut is a well-liked cashback app amongst Be Intelligent With Your Money readers. It’s barely totally different to different cashback apps, as you earn cashback within the type of factors while you purchase present playing cards fairly than having to trace particular person transactions.

We determined to place JamDoughnut to the take a look at to seek out out if this app will actually make you cash in your regular spending.

Some articles on the weblog include affiliate hyperlinks, which give a small fee to assist fund the weblog. Nevertheless, they received’t have an effect on the worth you pay or the weblog’s independence. Learn extra right here.

What’s JamDoughnut?

JamDoughnut is a cashback app the place you earn factors on present vouchers that you just purchase by way of the app, that are then transformed into cashback.

You may consider present vouchers as one thing to offer as presents — it’s actually within the identify. Nevertheless, on this case, they’re for making your regular, on a regular basis purchases.

This gist is that you just head out to your chosen store, then while you’re headed to the checkout you purchase a present voucher for the quantity that you just’re about to spend.

On the checkout, you scan the barcode inside the app to spend the present voucher. You get factors on the worth of the present card, which may then be transformed into cashback. 1 level = 1p, so when you get 1,000 factors, you may money out £10.

What’s cashback

There are two varieties of cashback. The one you get from specialist debit or bank cards, and the one we’re speaking about right here – the type of cashback is the place you get a reward for buying from particular retailers by way of a cashback web site.

There’s so much occurring within the background – with the cashback websites and retailers agreeing on offers that permit them each to make cash from the transaction.

Different cashback websites embody TopCashback, Quidco and Cheddar. In some circumstances, you will get cashback from transactions made in your debit or bank card for those who hyperlink them up.

How does JamDoughnut work?

With conventional cashback websites, you click on by way of to a retailer from the cashback web site and make a purchase order. How JamDoughnut differs is that you just purchase present playing cards for particular retailers or eating places and earn cashback on the quantity you purchase.

Which means forward of purchasing in-store or on-line, you may seek for a retailer within the app, purchase a present card for the worth of your buy, after which make your buy with the vouchers, which will be discovered within the app.

In lots of circumstances, the present card buy is immediate, so you might do it whereas standing within the queue. In some circumstances, it might take a bit longer, which is the place the app may get a bit annoying.

You’ll immediately earn factors in your buy, which is likely one of the largest advantages of JamDoughnut over different cashback websites. These will be transformed into cashback while you withdraw your factors.

How a lot cashback are you able to earn with JamDoughnut?

Don’t count on to be raking within the money – this stands for all cashback websites! You will get some good additional money in your on a regular basis spending with JamDoughnut – to this point I’ve earned about 80p (plus a £2 welcome bonus) from about £40 of spending I’d have finished anyway.

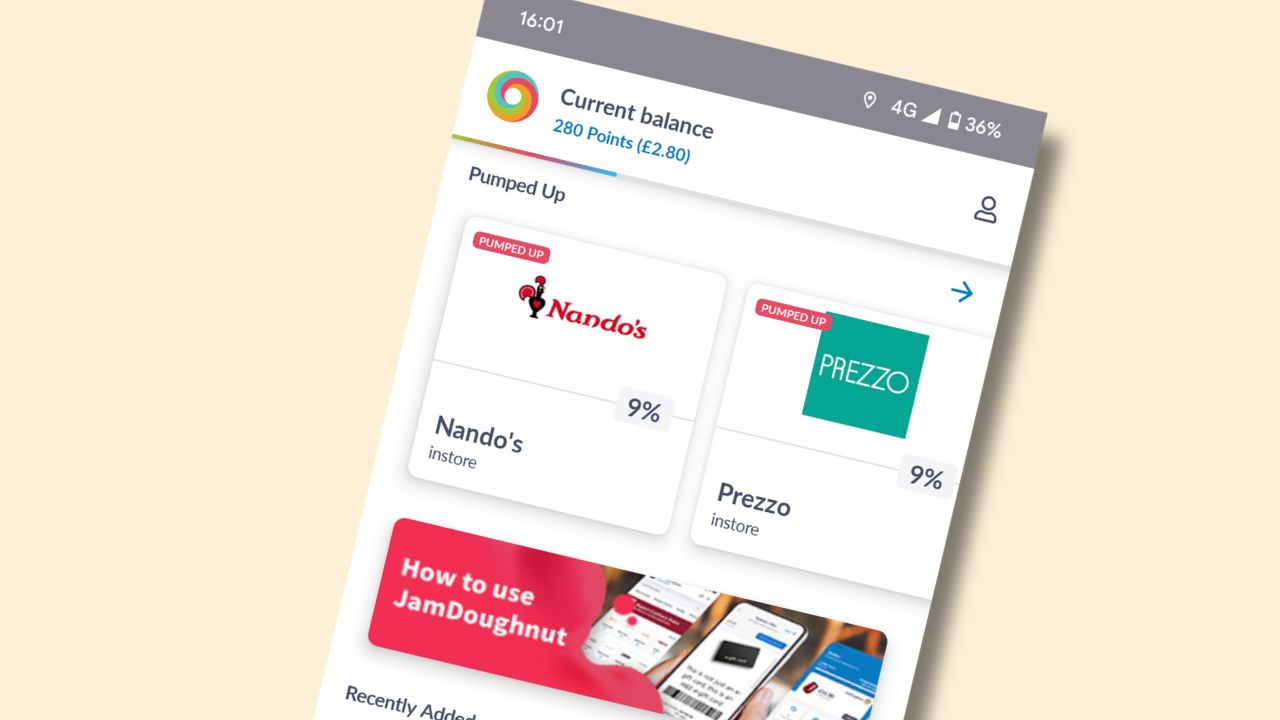

Typically cashback quantities are “pumped up”, which implies they’re quickly increased than regular. For instance, after I examined JamDoughnut, Tesco was pumped as much as 4% (cashback is often 2%). On the time of writing, Nando’s is pumped as much as 9%, whereas it’s often 7%. This lasts for as much as a day.

How you can earn much more with JamDoughnut

There are just a few methods to earn much more cashback with JamDoughnut.

Join your checking account

JamDoughnut pays out extra while you join your checking account with Open Banking. In case your financial institution is on the checklist, it’s value doing this to get the upper cashback accessible.

Stack cashback

In case you have one, you may double down in your cashback by paying with a cashback card, similar to Chase. This implies you can earn cashback by way of JamDoughnut and your financial institution. You’ll wish to guarantee your chosen financial institution will be accessed by way of Open Banking to benefit from this.

Simply remember you may get a decrease cashback charge in comparison with utilizing Open Banking connections. As well as, some banks might not pay out cashback on this occasion – it’s value a strive although, so tell us the way you get on.

As well as, you may strive stacking cashback utilizing JamDoughnut with different cashback websites. You’d do that by shopping for a present card by way of JamDoughnut, then clicking by way of to the retailer utilizing one other cashback web site, similar to TopCashback or Quidco, then making your buy with the present card you acquire with JamDoughnut.

Nevertheless, cashback websites may not pay out for those who use a present card. It’s typically listed on the particular service provider pages however not at all times -, so it’s one other one to check out.

Take advantage of “pumped up” cashback

JamDoughnut quickly will increase the cashback it pays out on a regular basis — this varies by retailer and adjustments day by day. It’s value taking a look within the app to see for those who can benefit from this. For instance, for those who’re frequently visiting Tesco, you will get your self present playing cards when it’s pumped up to make use of while you do your grocery store.

In fact, don’t simply maintain a bunch of cash on present playing cards – we element the dangers of this extra under.

JamDoughnut app manufacturers: the place are you able to save?

JamDoughnut has 157 manufacturers on its app on the time of writing, together with a spread of supermarkets, eating places and style manufacturers. Listed below are a few of our favourites, with the cashback quantities on the time of writing for those who use Open Banking to make the acquisition:

| Meals out/in | Buying | Journey |

| Nando’s – 7% Costa – 8% Turtle Bay – 7% Pizza Hut – 7% Miller & Carter – 8% Simply Eat – 5% Uber Eats – 4% Deliveroo – 4% |

Morrisons – 3.5% M&S – 5.5% Sainsbury’s – 2% Tesco – 2.5% Asda – 2.5% Apple – 3% Currys – 4.5% Argos – 4% Primark – 8% |

Nationwide Specific – 10% Lastminute – 4% Eurostar – 3% Morrisons Gasoline – 4% |

This checklist isn’t in depth, and we advocate checking the web site and app to see the present cashback charges as they alter on a regular basis.

How will you pay with JamDoughnut?

You’ll be able to pay for present playing cards utilizing Apple Pay, Google Pay and by linking your checking account to the JamDoughnut app utilizing Open Banking. You’ll get extra cashback while you make the acquisition with Open Banking – that is outlined while you make a purchase order.

Listed below are the banks that can help you pay by way of Open Banking:

| – Barclays – Nationwide – HSBC – Santander – NatWest – Halifax – Lloyds – Virgin Cash – Tesco Financial institution – Danske Financial institution – Monzo – Revolut |

– Financial institution of Scotland – Starling – Financial institution of Eire UK – First Direct – TSB – Royal Financial institution of Scotland – Chase – Sensible – Allied Irish Financial institution – Cashplus – Ulster Financial institution |

I paid with Google Pay on my preliminary take a look at — a rookie error, as I earned much less cashback on the acquisition, however I’ve realized my lesson.

How do you utilize your present playing cards?

Your present playing cards are saved within the “Pockets” part of the app, listed below “Your lively prepay codes”. They don’t appear to vanish while you’ve used them — you must inform the app that you just’ve used them, so this is usually a little complicated for those who use JamDoughnut frequently with the identical retailers.

To make use of your present card, all you’ve bought to do is click on on the retailer and it’ll present the barcode. From my expertise to this point, I’ve been ready so as to add the present playing cards to Google Pay. There’s no choice so as to add it to every other apps, similar to Stocard, however you may take the barcode quantity and manually add it if you wish to.

If you wish to print the voucher or ship it to a pal, you may share it by way of e-mail, textual content and WhatsApp and ship it to your printer.

You should utilize it on-line by getting into the barcode quantity the place there’s a “pay with a present card” choice. Chances are you’ll want a PIN for this, which can be on the voucher in your app.

There are generally restrictions with some present playing cards – for instance, some can’t be used on-line, some can’t be used in-store and a few need to be printed. Within the case of some supermarkets, you may’t use the voucher to purchase gas, although Morrisons has a separate “Morrisons Gasoline” choice for those who do wish to purchase gas.

Are present playing cards secure?

It’s value noting that present playing cards aren’t a really safe technique of holding money – in case you have £50 in a Tesco present card and Tesco go below, you’ll probably lose the cash. As well as, present playing cards are likely to have expiry dates.

You’ll be able to counteract this by ensuring you solely purchase present playing cards you’ll use in full and don’t preserve lots of cashback racked up within the account. We’ve written extra in regards to the dangers of present playing cards and tips on how to keep away from them.

Get one of the best of Andy’s cash saving content material each Thursday, straight to your inbox

Get a £17 Quidco bonus (new members solely). Extra particulars

Get one of the best of Andy’s cash saving content material each Thursday, straight to your inbox

+ Get a £17 Quidco bonus (new members solely). Extra particulars

How do you entry your cashback?

When you’ve bought £10 in your jar, you may withdraw it to your checking account. All you’ve bought to do is choose “money out” within the “Pockets” part of the app and enter your identify, kind code and account quantity.

JamDoughnut says it’ll take 5 days for the money to achieve your checking account.

JamDoughnut referral code

Get £4 for signing up (deal field)

We’ve managed to snag a cheeky boosted welcome supply for Be Intelligent With Your Money readers. You will get £4 additional cashback – double the usual welcome bonus.

It’ll be paid as two units of 200 factors while you make your first buy.

The primary 200 factors you get are customary for first-time customers of JamDoughnut, whereas the additional 200 factors are for coming by way of our hyperlink.

What’s the JamDoughnut app like?

The JamDoughnut app is very easy to make use of – you may see which manufacturers are “pumped up” and you will get a simple sense of how a lot cashback each can pay out.

The app is break up into classes, plus you may seek for retailers to seek out what you’re searching for.

Is JamDoughnut secure?

You’ll be able to pay securely with JamDoughnut, nonetheless the cashback you maintain within the account isn’t safe — if JamDoughnut have been to go bust, you’d lose the cashback. It’s value frequently testing fairly than letting it rack up – nonetheless, you may solely do that while you hit £10 of earned cashback.

What occurred after I used JamDoughnut

I wished to place JamDoughnut to the take a look at — and actually wanted cat meals — so I made a decision to check out JamDoughnut with a fast journey to Tesco.

I purchased a £30 present card inside the app, which was uploaded straight into my Google Pockets, and on the until, all I needed to do was scan it and pay the remaining few kilos.

It was a reasonably easy approach to earn myself 60p, and if finished with the “pumped up” cashback quantities, it may rack up fairly shortly. I’m fortunate to have all of the supermarkets inside a brief drive of me, which implies that I may choose the place to do my purchasing primarily based on the cashback accessible.

Abstract: is Jam Doughnut any good?

Cashback websites can typically really feel like a bit extra effort than they’re value, however I’ve been pleasantly shocked with JamDoughnut. I’ve managed to earn some cashback with little or no effort and on purchases I’d have made anyway, and it’s prone to be one thing I keep it up utilizing.

You do need to watch out to not overspend simply since you’ve already spent the cash. Reward playing cards can idiot you into considering that your buy is free.

This may be a good way to rack up some cashback on spending you’ll do already, particularly for those who can benefit from pumped-up cashback, stack a number of cashback websites or use it with different offers.

And bear in mind, there are fallbacks. Vouchers is probably not accessible to spend shortly sufficient and so they might have some restrictions – so go into this with an open thoughts.

Hearken to Money Chats, Andy’s award-winning podcast. Episodes each Tuesday.

Professionals and cons of JamDoughnut

Professionals

- Cashback is immediate

- Simple to make use of app

- Cashback will be “pumped up”

Cons

- It’s dangerous to go away some huge cash on present vouchers

- Not all present vouchers are immediate

- A little bit of a faff – particularly for those who’re attempting to make use of it in-store

- Minimal £10 payout for earned cashback

Often requested questions

What are JamDoughnut lives?

Typically Jam Doughnut goes reside by way of its app to run promotions the place you may earn additional rewards in your jar.

What does Pumped Up imply on JamDoughnut?

Pumped Up is the time period JamDoughnut makes use of to let you realize the cashback quantity is increased than regular. It’s solely “pumped up” for a brief time frame.

Does JamDoughnut have IKEA?

Sure, JamDoughnut does have IKEA on its app. You should purchase as much as £500 in present playing cards in every transaction.

Does JamDoughnut have Aldi?

Whereas JamDoughnut has Aldi within the app, there’s not at the moment any cashback accessible for it. It has had cashback accessible for Aldi earlier than, so it’s prone to come and go.

Is Tesco on JamDoughnut?

Sure, Tesco is on JamDoughnut! On the time of writing, we examined the app with Tesco, which was “pumped up” to 4% cashback (for those who use Open Banking to make the acquisition – it was 2% for those who used Apple/Google Pay).