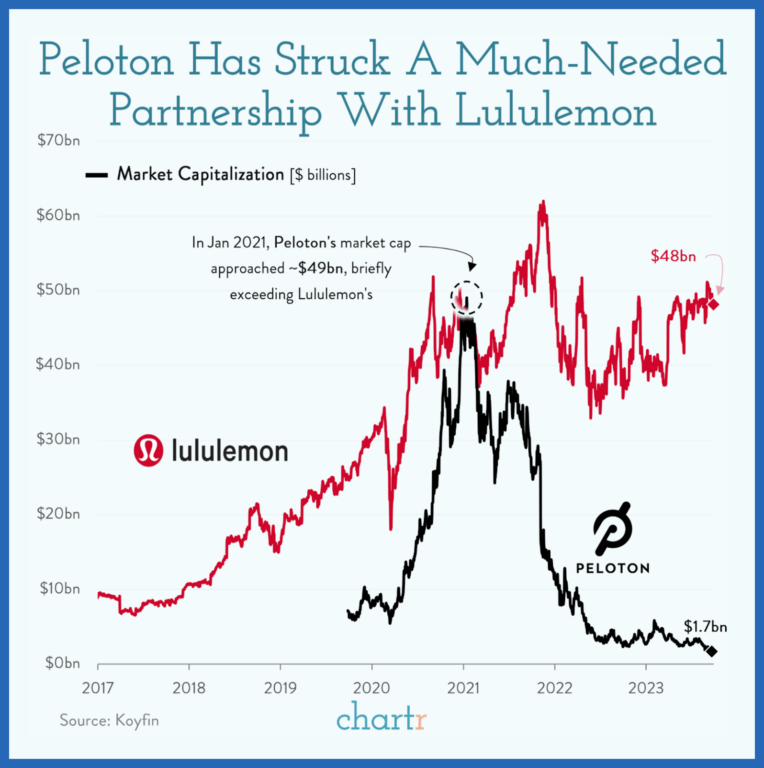

Lulu and Peloton are swolemates

Canadian athleisure large Lululemon (LULU/NASDAQ) is teaming up with the previously mighty health machine maker Peloton (PTON/NASDAQ). The deal, introduced on Monday, detailed that the 2 firms will enter a five-year strategic partnership. It appears they’ve settled their variations—this time final yr, they’d simply settled a lawsuit by which Lulu accused Peloton of creating copycat attire.

Highlights of Lululemon and Peloton’s strategic partnership

- Lululemon’s attire shall be accessible at Peloton stores and on Peloton’s attire web site.

- Lululemon’s All-Entry Members (loyalty program) can stream Peloton’s courses.

- Lululemon will not be competing within the health {hardware} or train courses area.

Dion Camp Sanders, chief rising enterprise officer at Peloton, said:

“By bringing collectively the very best in health content material with the very best in athletic attire, we’ll give our communities one-of-a-kind experiences and particular content material that may encourage them to attain their objectives.”

The deal comes amid indicators of resilient energy for Lulu, however with Peloton reeling after watching 97% of its share worth disappear. (Market watchers chalk it as much as fewer individuals understanding at house, a big drop in subscribers and the ballooning price of a seat recall.) It’s fascinating to notice that within the topsy-turvy pandemic world of 2021, Peloton was briefly the bigger of the 2 firms.

Whereas the strategic partnership is prone to convey co-branding worth to each firms, it’s successfully an admission of failure by Lulu with regard to its USD$500-million acquisition of Mirror—one other at-home sensible health gadget—in 2020. With Lulu discontinuing gross sales of Mirror earlier this yr so as to make room for the brand new Peloton partnership, one may assume there’ll now be a long-term truce within the two firms’ authorized battle.

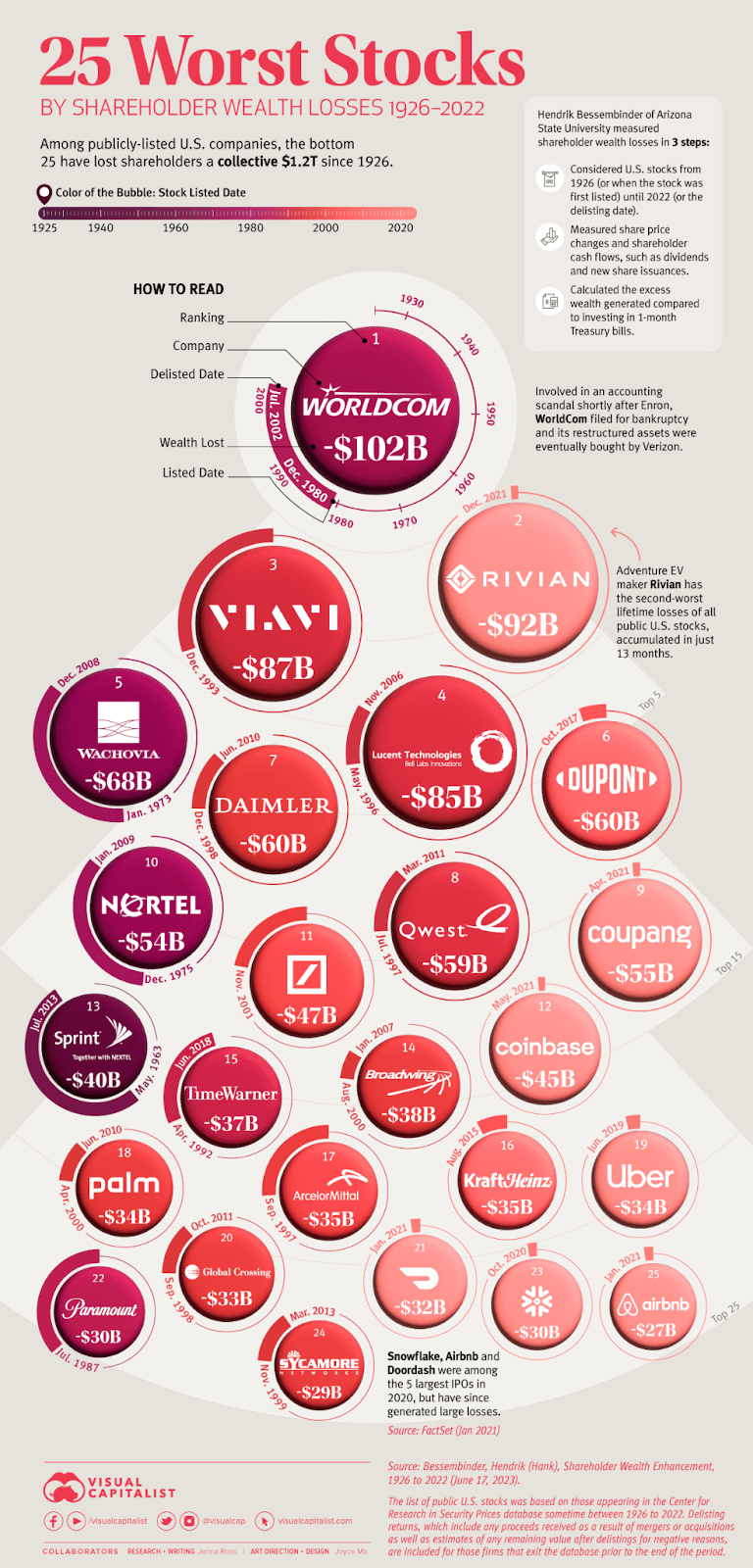

Inventory bust: The worst of the worst

We’ve beforehand regarded on the best-performing shares. However now let’s take a look at the worst shares of the final 100 years.

The above Visible Capitalist graphic exhibits the 25 worst shares in the united statesA. to have owned between 1926 and 2022. These firms have collectively misplaced shareholders USD$1.2 trillion over the past 100 years (14% of all shareholder losses).

Canadians, little doubt, acknowledge homegrown disappointment Nortel Networks (NRTLQ) on the left. It was as soon as Canada’s largest firm—at one level, it made up a outstanding 35% of the Toronto Inventory Change. For context, at this time, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN) and Meta (META) collectively make up 23% of the S&P 500.

Even with its gargantuan losses, Nortel solely ascends to the quantity 10 spot. The heavyweight champ of evaporating shareholder worth is WorldCom (WCOM). Earlier than turning into embroiled in a large accounting scandal, WorldCom was a long-distance phone telephone firm. It declared chapter in July 2002.