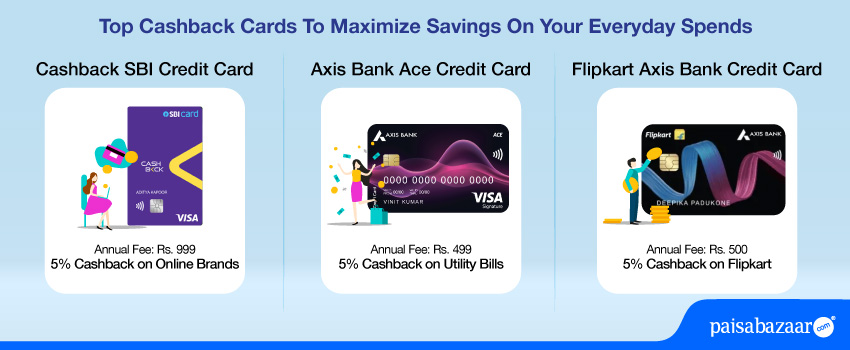

Cashback SBI Card, Axis Financial institution Ace Credit score Card and Flipkart Axis Financial institution Credit score Card are among the many high cashback bank cards in India. With these playing cards, you’ll be able to earn advantages on all of your bank card purchases, with accelerated worth again throughout chosen on a regular basis classes like grocery and invoice funds, and throughout fashionable way of life manufacturers like Flipkart, Ola, Zomato, and so forth.

For the reason that options are centered on providing advantages on day-to-day bills, you’ll be able to simply maximize advantages even if you end up not a excessive spender. Nevertheless, it’s essential to select the cardboard that may give you the utmost return in your main spending class. On your assist, we’ve in contrast these playing cards on the premise of cashback and different options, to find out the most worth again provided. Learn on to know the detailed comparability to search out the proper card for you.

A cashback bank card may help you earn the very best rewards within the easiest method, by providing a portion of your buy as direct cashback. Compared to incomes rewards, cashback is much less difficult, as there isn’t any trouble of accumulating and redeeming; worth again is straight credited into your card account or a linked pockets.

Which card supply the very best cashback advantages?

The completely different cashback options provided on these playing cards, is listed as follows:

Cashback SBI Credit score Card: Appropriate for on-line transactions

- 5% cashback on on-line spends with none service provider restrictions

- 1% cashback on offline spends

- Cashback capped at Rs. 5,000 monthly

Cashback not relevant on Service provider EMI, Flexipay EMI transactions, Utility, Insurance coverage, Gasoline, Hire, Pockets, Faculty & Instructional Providers, Jewellery, and Railways.

Axis Financial institution Ace Credit score Card: Appropriate for utility invoice funds

- 5% cashback on invoice funds by way of Google Pay

- 4% cashback on Swiggy, Zomato & Ola

- 2% cashback on all different spends: limitless cashback

- Cashback for five% and 4% class, capped at Rs. 500 monthly cumulatively

Flipkart Axis Financial institution Credit score Card: Appropriate for Flipkart loyalists

- 5% cashback on Flipkart

- 4% cashback at most well-liked merchants- Swiggy, Cleartrip, Cult.match, PVR, Tata Play, and Uber

- 1.5% cashback on flight and resort funds at Flipkart & Myntra

- 1.5% cashback on all different spends

- No capping on cashback, limitless cashback monthly

Which card affords the utmost worth again?

As we’ve talked about above, every card affords most worth on one class together with first rate cashback throughout all different transactions. It’s best to select a card that aligns along with your spending preferences and yields you the utmost advantages in your main spending class. Listed here are a number of factors to maintain in thoughts:

- You’ll be able to earn the utmost worth again in your on-line spends with Cashback SBI Credit score Card, in case you should not have any service provider preferences.

- Then again, Axis Financial institution Ace Credit score Card will serve you the very best, in case you desire incomes returns in your utility invoice funds. In addition to, the cardboard affords the best base fee of two% which will likely be relevant throughout all transactions (each on-line and offline) with none capping. This makes it an appropriate selection for incomes returns on all transactions together with utility invoice funds, which is usually excluded by different playing cards.

- Flipkart Axis Financial institution Credit score Card can supply the utmost worth again to Flipkart loyalists , preferring purchasing at Flipkart and different most well-liked retailers. In addition to, it additionally occurs to supply first rate journey advantages, compared to the opposite two playing cards, as you get complimentary lounge entry, 1.5% cashback on flight and resort bookings on Flipkart and 4% cashback on partnered journey model Cleartrip. Thus, you’ll be able to maximize financial savings simply with this card, if you’re a Flipkart loyalist, who additionally loves touring.

Should you don’t have any such preferences as listed above, for choosing the proper card, you’ll be able to test the utmost worth these playing cards can supply throughout a number of classes and types. On your assist, we’ve curated an illustration beneath with a complete month-to-month spend of Rs. 50,000, divided throughout a number of spends, to derive how a lot it can save you in a month with these playing cards.

| Transaction | Model | Quantity | Cashback SBI Credit score Card | Axis Financial institution Ace Credit score Card | Flipkart Axis Financial institution Credit score Card |

| Meals supply | Swiggy | Rs. 2,000 | Rs. 100 | Rs. 80 | Rs. 80 |

| On-line Procuring | Flipkart | Rs. 4,000 | Rs. 200 | Rs. 80 | Rs. 200 |

| Flight tickets bookings | Flipkart | Rs. 5,000 | Rs. 250 | Rs. 100 | Rs. 75 |

| Procuring | Myntra | Rs. 3,000 | Rs. 150 | Rs. 160 | Rs. 45 |

| Health classes/membership | Cult.match | Rs. 1,000 | Rs. 50 | Rs. 20 | Rs. 40 |

| Resort bookings | Cleartrip | Rs. 4,000 | Rs. 200 | Rs. 80 | Rs. 160 |

| Film tickets bookings | PVR | Rs. 1,000 | Rs. 50 | Rs. 20 | Rs. 40 |

| Touring | Ola Cabs | Rs. 2,000 | Rs. 100 | Rs. 80 | Rs. 30 |

| Touring | Uber | Rs. 2,000 | Rs. 100 | Rs. 40 | Rs. 80 |

| Grocery purchasing | Blinkit | Rs. 4,000 | Rs. 200 | Rs. 80 | Rs. 60 |

| Magnificence Merchandise | Nykaa | Rs. 1000 | Rs. 50 | Rs. 20 | Rs. 15 |

| Miscellaneous purchasing | Amazon | Rs. 2,500 | Rs. 125 | Rs. 50 | Rs. 38* |

| Electrical energy invoice funds | Google Play | Rs. 4,000 | 0 | Rs. 200 | 0 |

| Cell Recharge | Google Play | Rs. 500 | 0 | Rs. 25 | 0 |

| Web Invoice Cost | Google Pay | Rs. 1,000 | 0 | Rs. 50 | 0 |

| Gasoline spends | – | Rs. 2,000 | 0 | 0 | 0 |

| Offline purchasing | Buyers Cease | Rs. 8,000 | Rs. 80 | Rs. 160 | Rs. 120 |

| Miscellaneous offline spends | – | Rs. 3000 | Rs. 30 | Rs. 60 | Rs. 45 |

| Complete Quantity | Rs. 50,000 | Rs. 1,685 | Rs. 1,255 | Rs. 1,028 | |

*rounded off to the closest determine.

From the above illustration, we are able to infer the next:

(i) Each Axis Ace and Flipkart Axis Financial institution supply accelerated cashback on Swiggy, of 4%. As per the illustrated quantity above, each these playing cards supply equal worth again of Rs. 80 on spending Rs. 2,000 in a month.

Nevertheless, the state of affairs right here would possibly change with the rise within the spending worth, as a result of month-to-month capping on incomes cashback. You’ll be able to earn a most of Rs. 500 on Swiggy cumulative with the opposite spends eligible within the 4-5% on Ace bank card. Thus, even in case you spend Rs. 30,000 completely on Swiggy, you’ll earn a cashback of Rs 500.

With Flipkart Axis Financial institution there isn’t any most capping, so as an illustration, in case you spend Rs. 30,000 on Swiggy you’ll be able to earn the next cashback worth of Rs. 1,200.

(ii) Due a excessive cashback fee of 5%, compared to different playing cards, Cashback SBI surpasses the worth again provided, even on the co-branded companions with Axis Ace and Flipkart Axis. As an example, on Swiggy, each these playing cards supply a return of Rs. 80 on a price of Rs. 2,000, however SBI card affords Rs. 100.

(iii) Flipkart Axis Financial institution and Cashback SBI Card supply no returns on Utility invoice funds, a serious class left uncovered even whereas these playing cards goal ‘on a regular basis spends’. Thus, Axis Ace is a transparent winner on this class. Nevertheless, the profit right here is proscribed to invoice funds on Google Pay. Thus, appropriate for many who already use Google Pay, or can think about switching from different sources of funds like Paytm, PhonePe and so forth.

(iv) After the current devaluation on the Flipkart Axis Credit score Card the cardboard now affords highest cashback solely on Flipkart. Earlier, you may additionally earn 5% on journey bookings by way of Flipkart which is now lowered to 1.5% Thus, with a excessive worth again of 5% throughout all on-line spends, Cashback SBI wins over Flipkart Axis Financial institution in providing higher journey advantages even on the key accomplice, Flipkart.

(v) Should you would additionally think about using your cashback card for offline spends, you’ll be able to select Axis Ace because it affords the best cashback on this class, with no capping. Thus, it seems to be a transparent winner for these, preferring purchasing offline.

(vi) For fashionable and untapped manufacturers like Nykaa, Blinkit, and so forth. and common grocery spends, Cashback SBI could be a nice choice, as the cardboard affords the best cashback of 5%, with none service provider and class biases on-line. As an example, in case you regularly store groceries on-line, you might think about getting the SBI card, as with it you’ll be able to earn 5% again on Blinkit, BigBasket, Zepto, and so forth.

(vii) In case you are somebody who regularly commutes by way of Ola Cabs and Uber, you’ll be able to be aware that Axis Ace and Flipkart Axis supply 4% cashback on these manufacturers, respectively. Once more, Axis Ace has capped the utmost capping to Rs. 500, whereas there isn’t any capping on Flipkart Axis. Thus, Flipkart Axis is a transparent winner right here. Nevertheless, Cashback SBI Card affords 5% cashback on these on-line funds as effectively, giving the best worth.

(viii) Perceive that deriving the utmost worth again, is topic to the spending patterns and most significantly, on month-to-month cashback limitations provided on the cardboard. On that foundation, Flipkart Axis Financial institution has an edge over the opposite two playing cards, because it comes with no money again capping throughout all classes.

| Cashback SBI Credit score Card | Rs. 5,000 monthly |

| Axis Financial institution Ace Credit score Card | Rs. 500 for utility payments+Zomato, Swiggy & Ola; Limitless throughout different classes |

| Flipkart Axis Financial institution Credit score Card | Limitless cashback throughout all classes |

No capping on flipkart axis financial institution is a transparent win, particularly for heavy spenders, who want to put most bills on their bank card.

Comparability on non-cashback options

Welcome Advantages: Amongst the three, solely Flipkart Axis Financial institution Credit score Card affords the cardboard activation profit, as follows:

- Rs. 500 reward voucher from Flipkart

- 15% off on Myntra as much as Rs. 500

- 50% instantaneous low cost on Swiggy as much as Rs. 100

At a becoming a member of payment of Rs. 500, Flipkart Axis Financial institution affords a welcome advantage of round Rs. 1,100, thus, the worth surpassed the payment charged. Moreover, it may be utilized throughout a number of day-to-day manufacturers, including extra to the general saving quotient for the cardboard.

As compared, Cashback SBI Playing cards and Axis Financial institution Ace don’t supply any welcome advantages. Nevertheless, contemplating that Axis Financial institution Ace Credit score Card, comes at a low annual payment, and even affords ‘limitless’ cashback on a sure class (non-partnered spends), this will nonetheless be accepted. However for Cashback SBI Card, no welcome profit could be a huge downside, because it comes at a relatively highest payment, but additionally limits the cashback incomes throughout all classes to a complete of Rs. 5,000 a month.

Charge Waiver: The annual payment waiver situations provided by these playing cards are as follows:

- Cashback SBI: Annual fee- Rs. 999 | Waived off on annual spends of Rs. 2 Lakh

- Axis Financial institution Ace: Annual fee- Rs. 499 | Waived off on annual spends of Rs. 2 Lakh

- Flipkart Axis Financial institution Credit score Card: Annual fee- Rs. 500 | Waived off on annual spends of Rs. 3.5 Lakh

To achieve the annual payment waiver on the Cashback SBI Card and Axis Financial institution Ace Credit score Card, you want to spend round Rs. 17,000 monthly. The goal on these playing cards is comprehensible, and attainable, retaining in view the advantages provided. You’ll be able to simply meet it by placing most of your bills in your bank card, even if you end up not a excessive spender.

Nevertheless, Flipkart Axis Financial institution has set the payment waiver goal to the best with Rs. 3.5 Lakh a 12 months. Thus, you want to spend round Rs. 30,000 monthly. For a low-fee card, focused in direction of newbies, and largely co-branded advantages provided, the goal appears excessive.

Lounge Entry: Each Flipkart Axis Financial institution and Axis Financial institution Ace supply entry to 4 home lounge visits in 1 / 4. Cashback SBI Card, alternatively, affords no lounge entry even with the comparatively highest payment charged. Whereas it may not influence somebody getting this card just for advantages on on-line transactions, it’d hamper the wants of these, anticipating at the least fundamental journey advantages on their card. Moreover, it could be a priority for newbies, who solely personal a single card, as that means, they don’t have any free lounge entry to get pleasure from!

Eating: Each Flipkart Axis Financial institution and Axis Financial institution Ace Credit score Card each supply direct eating reductions of as much as 20% off at accomplice eating places in India (as much as Rs. 500). SBI Card alternatively, affords no direct advantages on eating, nonetheless, with 5% cashback on-line with none service provider restrictions, you’ll be able to nonetheless save in your dining- supplied you employ your card for eating funds throughout on-line platforms like Zomato, Swiggy,and so forth. Right here is how one can save on eating:

Illustration: We now have assumed Rs. 4,000 as spent on eating, throughout partnered eating places for Flipkart Axis and Axis Ace, whereas paid by way of Swiggy/Zomato for Cashback SBI Card.

| Credit score Card | Function | Calculation | Most Cashback |

| Axis Financial institution Ace Credit score Card | As much as 20% off at accomplice eating places in India (max dis. Rs. 500) | 20% of Rs. 4,000 = Rs. 800 | Rs. 500 |

| Flipkart Axis Financial institution Credit score Card | As much as 20% off at accomplice eating places in India (max dis. Rs. 500) | 20% of Rs. 4,000 = Rs. 800 | Rs. 500 |

| Cashback SBI Card | 5% cashback on all on-line spends | 5% of Rs. 4,000 = Rs. 200 | Rs. 200 |

With the cashback SBI Card, you’ll be able to earn cashback provided that you make on-line transactions however an essential level to contemplate is that, the cardboard affords a capping of Rs. 5,000 monthly on incomes cashback throughout all spends. Thereby, incomes an enormous worth again on eating regularly, would possibly imply compromising cashback on different main classes like grocery or attire purchasing. Nevertheless, if eating is your main expense, you’ll be able to maximize this characteristic conveniently.

Which Card Ought to You Get?

Which Card Ought to You Get?

Getting the proper cashback bank card may help you save lots, particularly once you put a lot of the day-to-day bills in your card. To decide on the very best card, it’s essential to examine the cardboard’s options and advantages, and select one which matches greatest along with your spending patterns and way of life habits. You can also make a selection as per the next:

Select Cashback SBI Credit score Card, if:

- You spend lots on-line

- You don’t have any particular service provider preferences

- You don’t journey by way of airways, thus, no lounge entry is just not a priority

- You personal different bank cards, and need a card unique for cashback advantages

- You don’t use your bank card for utility invoice funds

- You’ll be able to spend round Rs. 17,000 monthly, to avail the annual payment waiver of Rs. 2 Lakh

- You’ll be able to pay a barely increased annual payment of Rs. 999

| Most Financial savings With CashBack SBI Credit score Card | ||||

| Function | 5% cashback on on-line transactions | 1% cashback on offline transaction | Annual Charge Waiver on spending Rs. 2 Lakh | 1% gas surcharge waiver |

| Financial savings per Month | Rs. 5,000* | – | Rs. 100 | |

| Financial savings per Annum | Rs. 60,000* | Rs. 999 | Rs. 1,200 | |

| Complete Financial savings: Rs. 5,100 monthly | Rs. 62,199 every year | ||||

*To earn a most cashback of Rs. 5,000 monthly or Rs. 60,000 per 12 months, you want to spend round Rs. 1 Lakh a month, or Rs. 12 Lakh per 12 months.

Select Axis Financial institution Ace Credit score Card, if:

- You utilize your bank card for utility invoice funds

- You don’t thoughts sticking to GooglePay for maximizing cashback profit on utility funds

- You regularly order meals on-line by way of Swiggy and Zomato

- You commute by way of Ola Cabs regularly

- You wish to earn limitless cashback on retail transactions

- 4 lounge entry in 1 / 4 is enough for you

- You dine out occasionally, and might maximize the eating low cost provided throughout partnered eating places

- You need a low annual payment bank card

- You’ll be able to spend round Rs. 17,000 monthly to avail the annual payment waiver

| Most Financial savings With Axis Financial institution Ace Credit score Card | ||||||

| Function | 5% cashback on utility invoice funds by way of GooglePay | 4% cashback on Swiggy, Zomato & Ola | 2% cashback on all different spends | As much as 20% off at accomplice eating places | Annual payment waiver on sending Rs. 2 Lakh | 1% gas surcharge waiver |

| Financial savings monthly | Rs. 500 | Limitless | Rs. 500** | – | Rs. 500 | |

| Financial savings per Annum | Rs. 6,000 | Limitless | Rs. 6,000 | Rs. 499 | Rs. 6,000 | |

| Complete Financial savings: Min. Rs. 1,500 monthly | Min: Rs. 18,499 | ||||||

*The estimated values are calculated excluding the limitless 2% money again provided on ‘different spends’. The entire financial savings could thus range throughout the spend worth for different transactions. As an example, in case you spend round Rs. 30,000 monthly on this class, you’ll earn a cashback of Rs. 600 monthly and Rs. 7,200 per 12 months. Thus, your complete month-to-month and annual financial savings will rise to Rs. 2,100 monthly and Rs. 25,699 a 12 months.

** We now have assumed one eating transaction finished in a month.

Select Flipkart Axis Financial institution Credit score Card, if:

- You’re a Flipkart loyalist for purchasing throughout a variety of things from giant home equipment and devices to books, attire and groceries

- You utilize Flipkart for journey bookings throughout resort and airways

- You don’t thoughts switching on the partnered manufacturers like Swiggy, Cleartrip, Cult.match, PVR, Tata Play, and Uber to maximise the 4% cashback profit

- 1 lounge entry in 1 / 4 is enough in your

- You dine out as soon as some time and might maximize the eating low cost throughout partnered eating places

- You need a low annual payment money again bank card

- You’ll be able to spend round Rs. 30,000 monthly to avail the annual payment waiver

| Most Financial savings with Flipkart Axis Financial institution Credit score Card | |||||

| Function | 5% cashback on Flipkart | 1.5% money again all different classes | 1% gas surcharge waiver | As much as 20% off accomplice eating places | Annual payment waiver on spending Rs. 3.5 Lakh |

| Financial savings monthly | Limitless Cashback | Rs. 400 | Rs. 500* | – | |

| Financial savings per Annum | Limitless Cashback | Rs. 4,800 | Rs. 6,000 | Rs. 500 | |

| Complete Financial savings: Rs. 900 monthly + limitless cashback as per spending worth | Min: Rs. 11,300+limitless cashback as per spending worth | |||||

The above calculation is finished excluding the limitless cashback class. For the precise complete financial savings, together with spends eligible for limitless cashback, the worth would possibly range relying upon how a lot you spend.

Let’s assume you spend Rs. 20,000 on Flipkart and Rs.10,000 on different spends,a month. You’ll earn a cashback of Rs. 1,000+ Rs. 150= Rs. 1,150 in a month. Thereby, your complete financial savings will rise to Rs. 2,050 on spending Rs. 1 Lakh a 12 months, and to Rs. 35,900 on spending Rs. 12 Lakh a 12 months.

* We now have assumed one eating transaction finished in a month.

The publish Examine Prime Cashback Playing cards: Cashback SBI Vs. Axis Financial institution Ace Vs. Flipkart Axis Financial institution Credit score Playing cards appeared first on Examine & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.