Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!

Collector’s Nook Introduction

I at all times needed to introduce this class of shares that usually I’d not purchase as a bigger place, however for some purpose or the opposite I wish to personal nonetheless. Lots of such shares I had handed on previously and so they typically carried out higher than I’d have thought. So as an alternative of a typical Funding portfolio, that half would reasonably be a “assortment of superb shares” and this sequence will due to this fact be the collector’s nook. The purpose right here could be a small pocket of “particular” shares which may look not so engaging from a purely monetary perspective, however nonetheless have are engaging to me. This could possibly be luxurious shares but additionally some very unusual shares that I discover fascinating for different causes. I’m now lengthy sufficient within the inventory market that I can’t afford myself a number of “responsible pleasures”.

I don’t have a goal allocation right here however this could keep beneath 10% total at portfolio degree. Additionally, don’t anticipate a brilliant detailed analyis as with greater positions.

And, by coincidence, I have already got the primary inventory for the “collector’s nook:

The primary candidate: Laurent-Perrier SA

For the previous 10 years or so, i’ve continuously appeared on the Laurent Perrier share worth by mistake, as I really needed to look upGerard Perrier, my long run French inventory holding. I at all times instructed myself to have a look at the opposite Perrier inventory sooner or later however by no means did, regardless of the a lot nicer Emblem in comparison with G. Perrier.

Extra just lately nevertheless, I learn an fascinating snippet from the legendary John Practice on Laurent Perrier which then made me look into Laurent Perrier once more:

Personally, I’m not an enormous Connaisseur of Champagne however I get the idea of a prestigious model. LVMH, the large luxurious Juggernaut has its roots in Champagne as nicely (the M is for Moet Chandon which was a part of the preliminary merger).

To qualify as Champagne, the next wants to use:

Champagne, the wine, is named after the area the place it’s grown, fermented, and bottled: Champagne, France. Nestled within the nation’s northeastern nook, close to Paris, the one labels which can be legally allowed to reveal the title “Champagne” are bottled inside 100 miles of this area (in line with European Legislation).

That naturally restricts the quantity of Champagne that may be planted and harvested. The most important manufacturers can command costs as much as a number of lots of of Euros and even 1000’s for older vintages.

I feel what the Champagne Indusry did nicely is to put Champagne as THE (very costly) drink to have a good time at particular events. In accordance with some sources, this custom began accidentally in 1961 in Le Mans. Undecided whether it is true, however I assume it’s a widespread customized all around the world to celbrate success with a glass of Champagne. Apparently, Laurent-Perrier by no means sponsored the formulation One. However Moet & Chandon did for over 30 years. Apparently, since 2021 an Italian model is the F1 sponsor (Ferrari Trento).

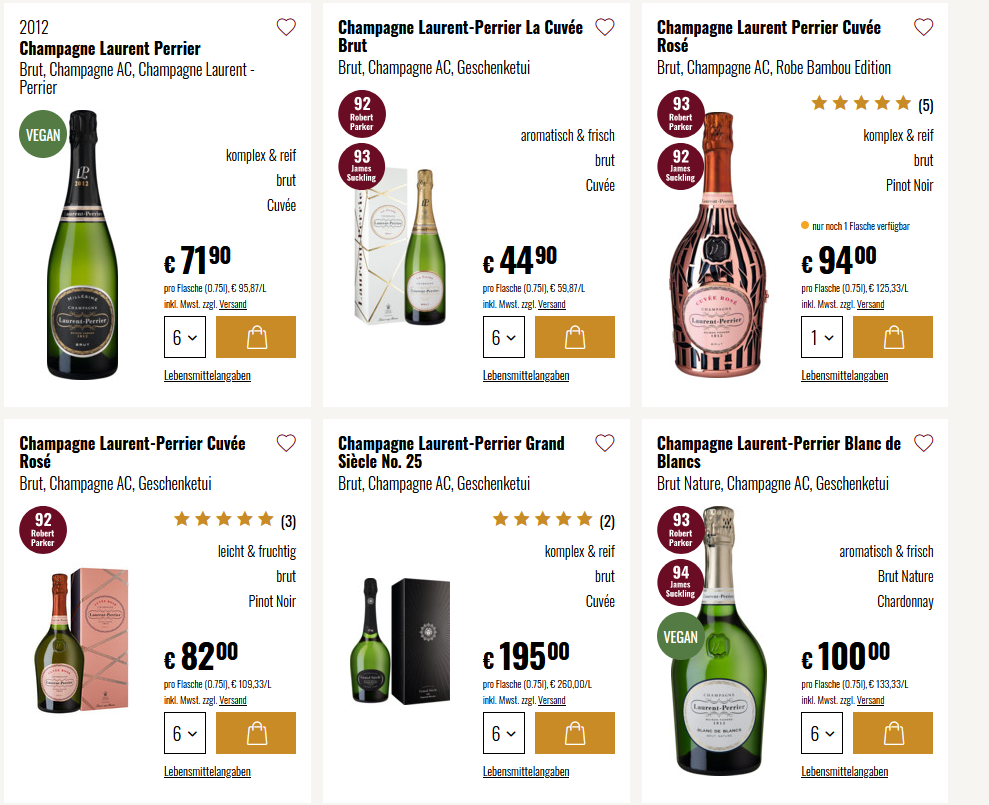

And Laurent-Perrier is clearly one of the vital well-known and finest promoting Champagne manufacturers (relying on the place you look, they’re prime 5 or so with a world market share in Champagne of ~5%). Wanting on the Hawesko web site one can see that the most affordable bottle begins at 45 EUR and goes as much as 200 EUR:

Elsewhere I’ve seen bottles for 300-400 EUR as nicely.

One of many fascinating points of Champagne is that regardless of being mosty white wine, it ages nicely. Within the regular bottle (750 ml), 40 years isn’t any downside, massive bottles may need a shelf lifetime of over 100 years when saved nicely.

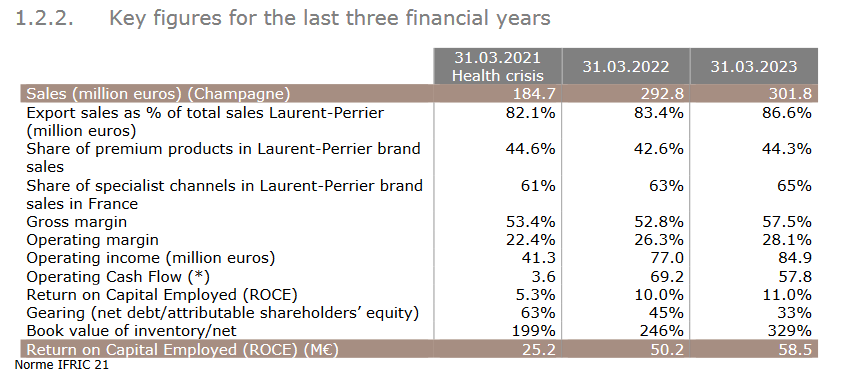

Prime Champane is a excessive margin luxurious product, nevertheless, the way in which Champagne is made, means additionally that it’s fairly a capital intensive enterprise. This exhibits within the numebrs.

Whereas EBIT margins (till currently) at all times have been 17-18%, return on capital and ROE have been solely 5-7%. Laurent-Perrier holds on common 2 years of gross sales stock which is sort of logical as Champagne must ripen and ferment for some years with a view to be (costly) Champagne. I assume that the stock at Laurent-Perrier (and different Champagne producers) include fairly some hidden reserves, as the nice vinatages typically improve in worth which isn’t proven within the stability sheet or P&L.

Now comes the fascinating half : Over the past 10 years, EPS at all times hovered arond 3-4 EUR per share earlier than abruptly leaping to eight,49 in 2021/2022 and virtually 10 EUR per share in 2022/2023.

On the present share worth, this values Laurent-Perrier at a really cheap 12x traillng earnings and round 11xEV/EBIT which isn’t costly for a real luxurious model. In accordance with TIKR, LP solely traded at that valuation proper after the GFC.

The query clearly is: What result in this drastic improve in profitability ? The primary purpose has been a robust restoration after Covid and worth will increase. The 12 months led to March 2023 clearly exhibits this: Though quantity gross sales declined barely, they managed to extend costs by +10%. As they had been promoting merchandise that haven been bottled 2 years agao, this worth improve roughly drops on to the underside line.

This desk from the registration doc summarizes nicely the final 3 years:

The excellent registration doc provides additionally a number of info on Champagne right down to very fascinating particulars.

The share worth has reacted positively over tha previous 2 years however not a lot as reflecting the numerous improve in earnings over the past 2 years:

As well as, LP has diminished debt from near 300 mn a number of years in the past to presently lower than 180 mn. So regardless of much less danger, the inventory has really turn out to be cheaper. It appears that evidently presently buyers don’t imagine in these excessive margins to persist.

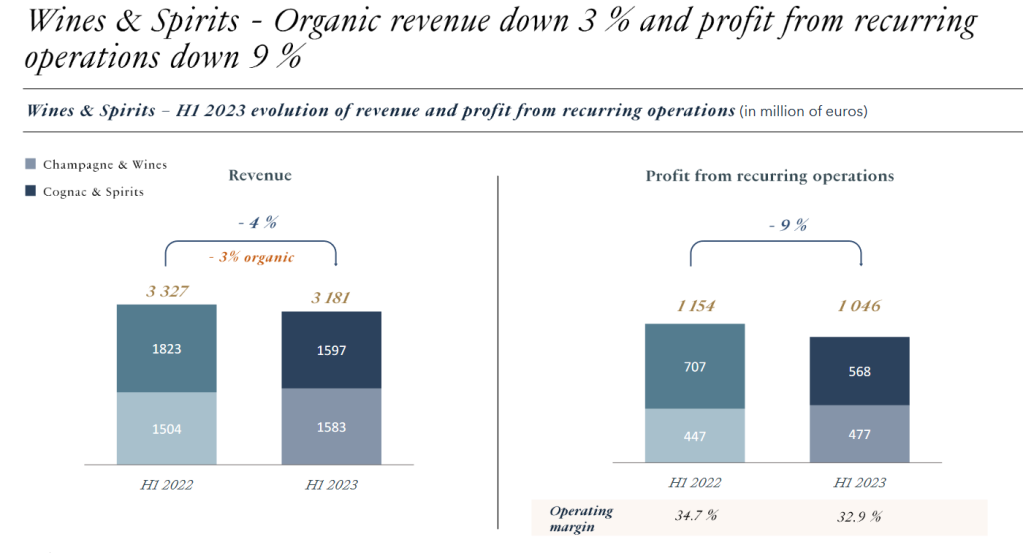

Apparently, in LVMH’s 6M 2023 report, we will see that inside the Spirits & Champagne phase, Champagne continues to be doing fairly nicely, in distinction to the laborious spirits:

Nearly all of Laurent-Perrier shares are owned by the Nonancourt household (65%) which purchased the property in 1939. US worth store First Eagle owns round 10%.

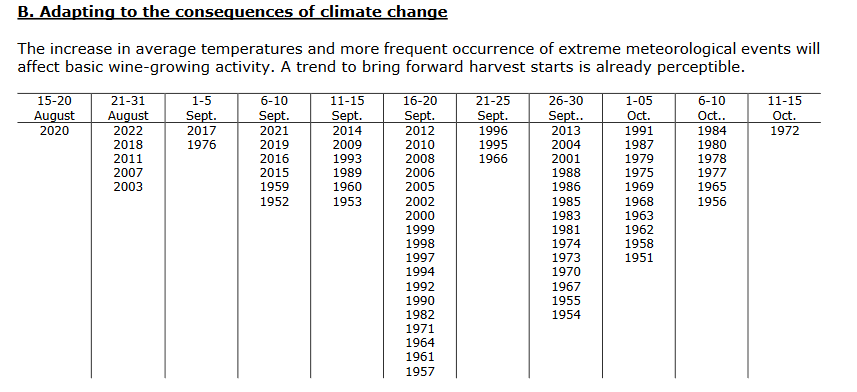

On the chance aspect, Local weather danger is clearly one of many dangers that LP is going through. As the world the place Champagne will be made is small, a rise in temrperature may hurt the product. LP exhibits this fascinating desk on the beginning dates of the harvest over the past 50 years or so. A pattern is clearly seen right here:

On the damaging aspect, they don’t pay a lot dividend, and solely ocassionally purchase again some inventory. Within the final years, cashflow was used to pay again largely debt which, contemplating the rise in rates of interest was possibly a good suggestion.

The massive query in fact is that if and the way Laurent Perrier can maintain this degree of profitability going ahead and the way they allocate capital. I actually don’t know and that’s why I solely purchase this share for my “assortment”.

Abstract:

Wanting all of the years mistakenly on the incorrect Perrier share worth, I’m now very completely happy to welcome Laurent-Perrier to my “Collector’s Nook”. A pure, high-end Champagne producer is an effective begin for this sequence. I allotted 1% of the portfolio at a share worth of round 124 EUR into my new “bucket” and hope for the perfect.