Want lifelong insurance coverage protection?

Let’s take a better have a look at common life insurance coverage vs complete life.

Discovering methods to guard your family members after you’re gone is a crucial step that nobody ought to miss. Life insurance coverage protection is an easy option to accomplish this.

However one factor that isn’t easy about life insurance coverage? Understanding the distinction between the numerous kinds of life insurance coverage in the marketplace.

Whereas a time period life insurance coverage coverage is without doubt one of the hottest kinds of life insurance coverage, you’ve extra choices. On this weblog publish, we’ll evaluate the 2 most typical kinds of everlasting life insurance coverage: common life insurance coverage vs complete life.

What Is Common Life Insurance coverage?

Common life insurance coverage is a sort of everlasting life insurance coverage, which signifies that—so long as you pay your premiums and fulfill some other necessities—protection lasts till you move away. (That is distinct from a time period life coverage, which solely lasts for a set variety of years.)

Below a common life insurance coverage coverage, your premium goes towards two issues: the dying profit (which is able to go to the beneficiaries of your selecting upon your dying) and a money worth element, which you should use in quite a lot of methods.

In some ways, your coverage’s money worth is much like a checking account—your money worth element earns curiosity in keeping with the market and for those who cancel your coverage, you’ll obtain the full money worth.

So, how are you going to make the most of your money worth?

A method is to borrow and even withdraw cash from the money worth you’ve accrued. You should utilize this cash to pay payments, go on trip, or the rest you need. You even have the choice to make use of your money worth to pay your premiums.

One other function of common life insurance policies is that the dying profit quantity is versatile. So if you wish to scale back (or enhance) the quantity your beneficiaries are paid, this may be adjusted, offered you meet sure necessities. For instance, you might must bear one other bodily examination if you wish to enhance your dying profit quantity.

Some insurance policies additionally permit you to embody any remaining money worth within the dying profit to present your family members some added safety.

Professionals and Cons of Common Life Insurance coverage

Benefits

- Premiums are versatile – In case you pay greater than the minimal quantity, the additional goes into your money worth. In case you pay much less, the insurance coverage firm will use your money worth accumulation to cowl the remaining.

- Dying profit is versatile – In case your wants change, you possibly can regulate the phrases of your coverage.

- Potential for increased money worth – If rates of interest are excessive, you’ve extra potential for robust money worth progress.

Disadvantages

- Extra danger – As a result of your rate of interest fluctuates, money worth progress can’t be assured.

- Extra complicated – Premiums are versatile, however withdrawing an excessive amount of (or paying too little) may end up in charges and even cancellation of your coverage. Due to this fact, common life insurance coverage insurance policies have to be intently monitored to be sure to stay “money constructive.”

What Is Complete Life Insurance coverage?

Complete life insurance coverage is one other kind of everlasting life insurance coverage. Identical to common life, complete life insurance coverage protection lasts till you move away and has a money worth element you could withdraw or borrow in opposition to.

With an entire life insurance coverage coverage, nonetheless, you are likely to have much less flexibility.

First, the dying profit quantity can’t be modified. If you wish to enhance protection afterward, you should buy extra insurance policies, however you won’t be able to cut back the quantity your beneficiaries obtain.

Second, complete life insurance coverage has mounted premiums solely and your money worth progress occurs at a set rate of interest set by your insurance coverage firm.

One other space the place common and complete life differ is dividends.

If you are going to buy an entire life coverage from a mutual insurance coverage firm, the corporate could supply dividend funds in keeping with their income. Dividend funds can be utilized to pay your premiums, pay your payments, or add to the money worth of your coverage.

Take note, dividends are by no means assured. You could obtain totally different quantities from 12 months to 12 months, or obtain nothing in any respect. Common life doesn’t supply dividends.

Professionals and Cons of Complete Life Insurance coverage

Benefits

- Much less danger – Fastened rates of interest means your money worth progress is extra constant.

- Much less monitoring – Premium funds, rates of interest, and dying advantages are mounted, so no monitoring is required.

Disadvantages

- Excessive premiums – Complete life insurance coverage premiums are typically increased than each time period and common insurance policies.

- Much less flexibility – Rates of interest, premiums, and dying advantages can’t be modified as your wants change.

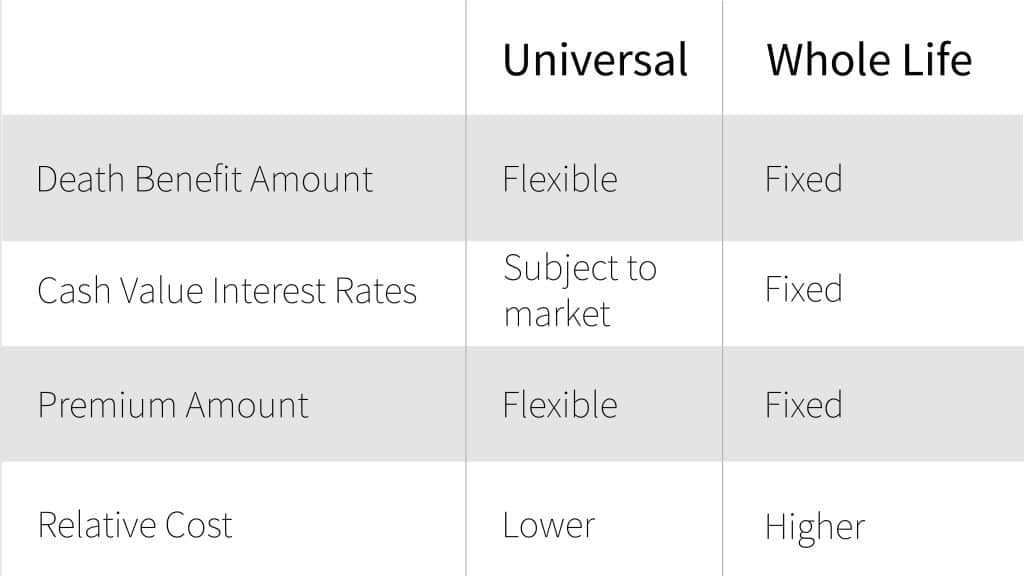

Common Life Insurance coverage vs. Complete Life

As everlasting life insurance coverage insurance policies, each supply lifelong safety in addition to a money worth element. Nonetheless, there are a number of main variations between complete life vs common life.

Total, it is best to count on a better degree of involvement with common life insurance coverage vs complete life.

As a result of premiums and money worth progress are each versatile, you’ll have to spend extra time monitoring your common life insurance coverage coverage to make sure your protection doesn’t lapse. Nonetheless, premium charges do are typically extra inexpensive than an entire life coverage.

Complete life insurance coverage, alternatively, lacks the flexibleness of a common coverage, however requires a lot much less monitoring.

Life Insurance coverage That Matches Your Wants

Deciding between the varied kinds of life insurance coverage in the marketplace generally is a daunting expertise, particularly for those who’re not accustomed to the main points of every one.

Hopefully, this text has given you a greater concept of the variations between common life insurance coverage vs complete life, however for those who want extra clarification, we’re at all times right here to assist!

Our pleasant brokers are blissful to debate your targets, life-style, funds, and danger tolerance that can assist you discover an insurance coverage coverage that works for you. Whether or not you’re searching for protection to your life, residence, automobile, or enterprise, we are able to collect a number of quotes from high quality insurance coverage firms.

Name at the moment or go to our web site for a free quote.