Have you ever ever been in an emergency state of affairs the place you want money however don’t have an ATM card? Withdrawing money from ATMs will be useful particularly the place on-line funds and UPI aren’t quite common. Nonetheless, carrying a debit card all the time has its personal dangers as it may be used to make contactless funds with out PIN. It may also be used to dupe accountholders whereas utilizing unauthorized ATMs. For security of accountholders, they will now withdraw cash even with out utilizing debit playing cards. This may be carried out by means of UPI-ATM ICCW.

ICCW or Interoperable Card-less Money Withdrawal is a facility that permits account holders to withdraw cash from their account with out utilizing a debit/bank card. This service is simple to make use of for the reason that card holder wants to make use of his/her cell banking app to lift a request for card-less money withdrawal. Since there was an increase in making digital transactions, ICCW ensures that prospects are in a position to make card-less money withdrawals simply. The service offers prospects the liberty to withdraw money at their very own comfort.

Prospects should use their UPI apps as a substitute to withdraw money from the ATM. This service will add further layers of safety when it comes to withdrawing money from ATMs. To entry this service, prospects have to have a UPI-enabled cell banking app or any UPI app.

Options of the UPI-ATM (ICCW) Service

Primary options of this facility are talked about beneath:

- The service permits seamless card-less transactions

- People don’t want to hold their debit/bank card for making money withdrawals from ATMs

- It is going to permit customers to withdraw money from a number of accounts utilizing UPI app

- Transaction restrict of this facility is as much as Rs. 10,000. Nonetheless, it could range from financial institution to financial institution. The restrict is roofed beneath the overall switch restrict by means of UPI day-after-day (Rs. 1 Lakh).

- Two-step verification is used that helps add safety and cut back probabilities of fraudulent transactions

Withdraw Money at ATM utilizing UPI-ATM ICCW

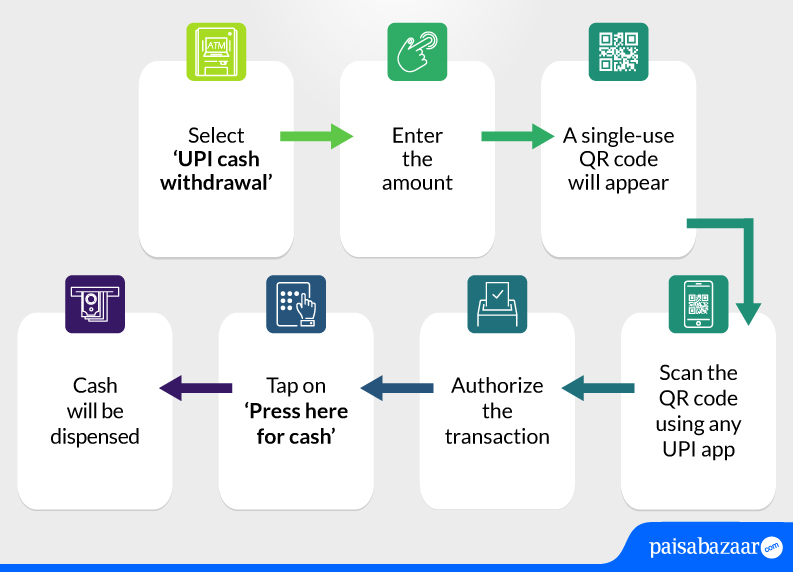

Step 1: On the ATM, choose ‘UPI money withdrawal’ choice

Step 2: ATM will ask you to enter the quantity that you just wish to withdraw

Step 3: You can be prompted with a single-use QR code on the display screen

Step 4: Scan the prompted QR code on the display screen utilizing any UPI utility in your cell

Step 5: Authorize the transaction. UPI can be debited upon authorization

Step 6: On the ATM, faucet on ‘Press right here for money’

Step 7: Your money can be allotted

Banks Providing UPI-ATM (ICCW) Companies

Beneath-mentioned is the checklist of banks which are presently energetic on ICCW service:

| Financial institution of Baroda | Metropolis Union Financial institution |

| Canara Financial institution | Central Financial institution of India |

| IndusInd Financial institution | YES Financial institution |

| Ujjivan Small Finance Financial institution | The Mehsana City Co-operative Financial institution |

Please be aware that card-less transactions by means of ATMs are restricted to Financial institution of Baroda and Metropolis Union Financial institution ATMs presently. Nonetheless, prospects of different banks which are talked about within the checklist above could make card-less money withdrawals by means of ATMs of Financial institution of Baroda and Metropolis Union Financial institution. Additionally, BHIM UPI app can also be energetic on ICCW facility.

Key Factors of ICCW

- Needn’t carry a number of card to withdraw money from ATM

- The power will remove skimming, cloning and different card associated frauds

- Prospects who aren’t issued bodily playing cards can use this service

- Paperless transaction

Charges and Expenses

Prospects are allowed to hold 5 transactions (together with monetary and non-financial transactions) in a month from their very own financial institution ATMs. They’re additionally eligible to hold out free transactions from different financial institution ATMs (together with monetary and non-financial transactions) i.e. three transactions in metro centres and 5 transactions in non-metro centres. Thereafter, prospects can be charged Rs. 20 per transaction.

Most Withdrawal by means of UPI-ATM

As per the preliminary preparations, a most of Rs. 1 Lakh each month will be withdrawn as one can perform a transaction solely as much as Rs. 1 Lakh by means of UPI each month. It additionally has an higher capping of Rs. 10,000 day-after-day. Nonetheless, if one makes use of the identical account for different UPI transactions, the general withdrawal restrict would lower accordingly.

Regardless that this new facility is safer and extra handy, it could take a while for the banks to implement it on a big scale. Although this facility continues to be in preliminary phases, extra banks are anticipated to hitch the platform and supply this facility and adaptability to their prospects. Nonetheless, capping on the utmost withdrawal restrict is anticipated to remain related until the ability will get in style amongst lots.

The publish Withdraw Money from ATM utilizing UPI appeared first on Evaluate & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.