To maintain the working gag going: No fish this time and just a few ships, however a number of different stuff on this random collection of 15 Norwegian shares. 4 out of those 15 certified for my prelimiary “watch” record. Let’s go:

91. Wilson ASA

Wilson is a 270 mn EUR market cap shiping firm that operates ~130 smaller vessels. As different delivery firms, they trades at very low valuations, on this case 3,5x 2022 P/E. Working margins have elevated from 2,5% to 40% in 2022. I don’t know how sustainable these margins are, however traditionally the height has been round 20% and on common perhaps 10-15% with a excessive volatility. Apparently, the share worth hovered round 20 NOKs for 20 years earlier than going up greater than 3x in 2021:

Nonetheless, risky delivery shares aren’t my space of experience, “move”.

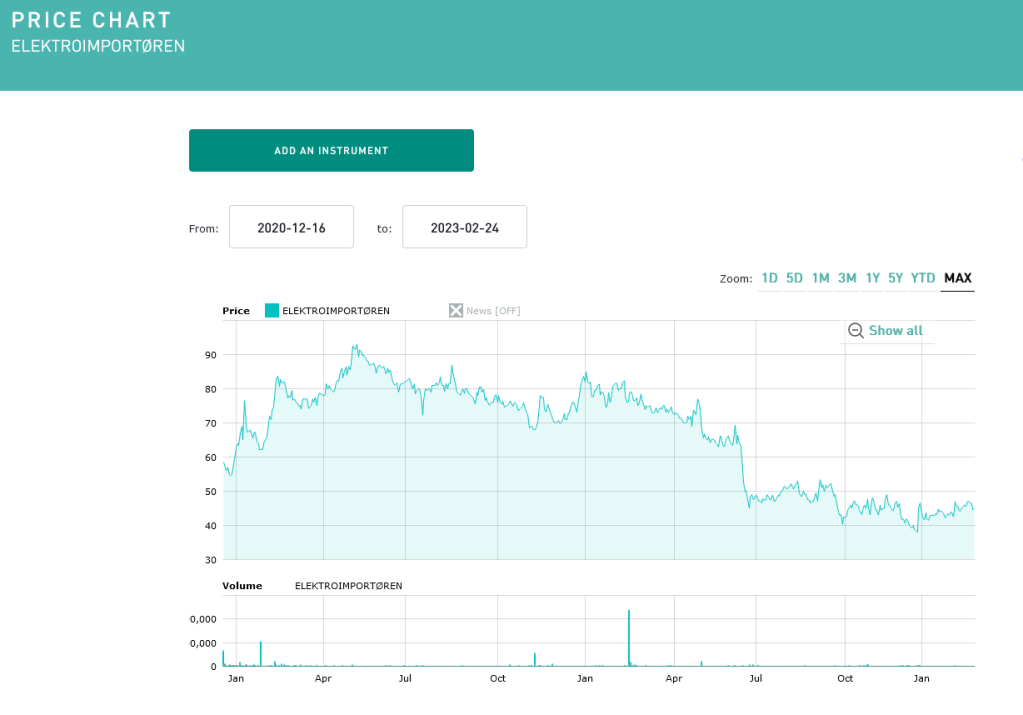

92. Elektroimportoeren ASA

Because the identify indiactes, this 84 mn EUR market cap firm retails and distributes tools for electrical installations (gentle, electrical energy and so on.). The corporate has grown properly over the previous 5 years, nevertheless EPS halfed in 2022 which led to a big drop within the share worth beneath the extent of the IPO in 2020:

They appear to have entered the Swedish market in 2022 however general, Gross margins and like-for-like gross sales struggled and curiosity bills elevated, resulting in a giant discount in income. At 19x trailing p/E and 15x trailing EV/EBIT, the inventory will not be low-cost and the IPO appears to have been “properly timed”. “Move”.

93. Entra

Entra is a 1,9 bn EUR market cap actual property firm that principally owns workplace buildings in Norway. The inventory misplaced virtually -50% from its high, just like many different actual property shares. I at all times discover it arduous to grasp the industrial actual property KPIs like EPRA NAV and these items, their P&L is kind of messy because the present mark-to-market positive aspects and losses within the P&L. Actual property is one thing I might solely take into account in very particular circumstances which this isn’t. “Move”.

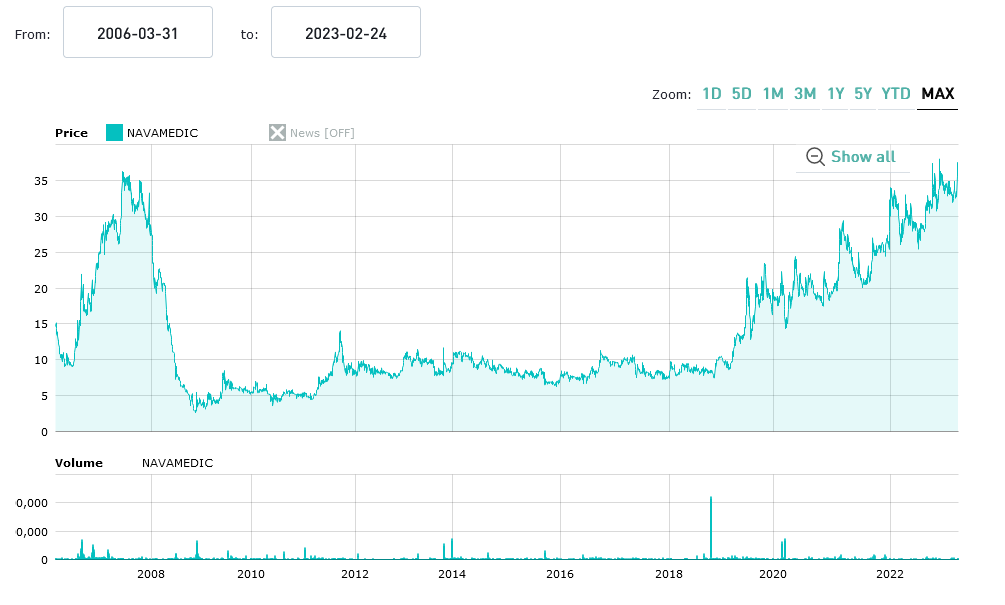

94. Navamedic

Navamedic is a 57 mn EUR market cap “Nordic pharma firm supplying hospitals and pharmacies with pharmaceutical and medical vitamin merchandise”. The corporate has been loss making for a few years however, surprisingly, grew to become worthwhile in 2022. That is mirrored within the share worth which is now near ATH:

The corporate appears to have a large protfolio of OTC and prescribed drugs in addition to “medical vitamin” with some deal with obesitiy, but in addition antibiotics and different stuff. At lower than 20x P/E, the inventory will not be too costly and the corporate plans o develop by way of M&A and so on to 1bn NOK in income and 150 mn NOK in EBITDA. In the intervening time, I’ll put them onto the prolonged “watch” record

95. Cyviz

Cyviz is a 44 mn EUR market cap “international expertise supplier for standardized convention rooms, management rooms and expertise facilities.” The corporate was IPOed in December 2020 and is loss making, however primarily based on TIKR a minimum of money circulation optimistic.

If I perceive their enterprise accurately, they set up management rooms for the protection sector in addition to top quality board rooms atc all over the world:

Someway I discover this firm fairly attention-grabbing, particularly as it’s nonetheless rising fairly rapidly (+50% full 12 months, +80% q-o-q). This appears to be one of many higher 2020/2021 IPOs, subsequently “watch”.

96. Elliptic Laborator

Elliptic is a 160 mn EUR market cap firm that does some “”attractive” issues like “AI Based mostly 3D gesture Software program sensors”. Nevertheless, Income is just 5 mn EUR, stagnating and they’re making losses. One of many weaker 2020/202 IPOs, “Move”.

97. ATEA

ATEA is a 1,2 bn EUR market cap “main Nordic and Baltic resolution supplier of IT infrastructure with over 7,000 workers. Atea is current in 85 cities in Norway, Sweden, Denmark, Finland, Lithuania, Latvia and Estonia. “

With working margins of 2-3%, the bsuiness mannequin appears to be extra of a reseller or distributor. The corporate is comparatively reasonably valued at 14x P/E and return on capital/fairness is at present at round 20% or extra.

Atea has internet money, is paying a reasonably beneficiant dividend (~5% yield) and has been rising properly over thy previous few years. The share worth nevertheless doesn’t totally replicate this:

Though related IT distributors are equally low-cost, I put ATEA on “watch”.

98. Inexperienced Minerals

Inexperienced Minerals is a 5 mn EUR Nano Cap that claims to be the ” pioneer in marine minerals on the Norwegian Continental Shelf”. The corporate has little income and is burning cash, with a runway of lower than 2 years left. “Move”.

99. Norwegian Block Trade

This 10 mn EUR market cap 2021 IPO runs a Crypto alternate. In fact they’re burning money they usually have raised addtional cash in Q3 2022. “Move”.

100. Questback Group

Questback is a “main platform for conducting Worker and Buyer Expertise surveys”. The market cap of solely 5 mn EUR signifies that enterprise will not be so nice. They’ve been rising in 2022 however are CF destructive and have substantial debt. Additional fairness financing is probably going required as they’ve lower than 1 12 months runway left. “Move”.

101. Actual Therapeutics

Actual is a 31 mn EUR market cap inventory that IPOed in 2022 and misplaced round 2/3 of its worth since then. They develop expertise ” for focused therapeutic enhancement – Acoustic Cluster Remedy (ACT®). ACT® sonoporation is a singular strategy to ultrasound-mediated, focused drug enhancement”, no matter which means. The corporate has no revenues, “move”.

102. Solstad Offshore

Solsatd is a 320 mn EUR market capo firm that “operates offshore service and building vessels for offshore and renewable power business worldwide. It offers platform provide vessel, anchor dealing with vessel, subsea building, and renewable power companies.”.

Trying on the inventory chart, the corporate went by arduous instances and was restructured in 2022 together with a debt-to-equity swap.

Operationally, issues look comparatively good nowadays, however the firm nonetheless carries a number of debt (~2 bn EUR) and is making losses on GAAP foundation. Largest Shareholder appears to be Aker who snapped up different Norwegian gamers up to now. “Move”.

103. Adevinta

Adevinta is a 8,4 bn EUR market cap on-line classifieds firm that was spun-off from Schibsted in 2019. Schibsted owns ~34,8% and apparently Ebay owns virtually the identical quantity. Trying on the chart, we are able to see that originally the inventory perforemd very properly earlier than than affected by 2022 on:

The enterprise as such appears engaging. Excessive development charges (+40% in 2022) and respectable working margins. Nevertheless, a big Goodwill impairment in 2022 led to a GAAP loss.

Based mostly on the projections, the inventory is valued a ~15x EV/EBITDA for 2023 they usually anticipate to develop at “low double digits” for the subsequent years. Though the inventory will not be low-cost, it’s defintely one to “watch”.

104. Nel ASA

Nel is a (a lot hyped) 2,2 bn EUR market cap firm that’s lively within the Hydrogen Economic system. Nal manufactures Electrolyzers and Hydrogen Filling station tools. Trying on the chart we are able to see that Nel has been round for a while and had a frist hype cycle simply earlier than the monetary disaster:

In comparison with different firms in that area, NEL really does have gross sales (~90 mn EUR in 2022), however will not be being profitable. Losses are literally increased than gross sales. Personally, I don’t consider in a mass marketplace for Hydrogen as a automobile or truck gasoline a minimum of for the subsequent 10 years or so, therfore I’ll “move”.

105. Arctizymes Techno

This “fancy identify” firm has a market cap of 180 mn EUR does one thing with enzymes and stunning to me is definitely making a small revenue. Nonetheless, at round 13xEV/Gross sales and 50x EV/EBIT with solely average development, I don’t assume that that is attention-grabbing. “Move”.