Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!!!!

Abstract:

In my relentless effort to create essentially the most boring and unremarkable inventory portfolio possible, I believe I recognized a really perfect candidate with SFS Group from Switzerland. Regardless of having a market cap of ~4 bn CHF, this majority family-owned firm is just not very well-known and its merchandise and B2B enterprise mannequin look similarily unremarkable.

The corporate doesn’t have an simply identifiable moat, doesn’t pay excessive dividends or buys again inventory, is just not tremendous low-cost and likewise not tremendous worthwhile, doesn’t develop like loopy and doesn’t have attractive merchandise that one can see within the grocery store.

However I do suppose it’s an nice addtion to my portfolio as it’s attractively priced and each, the enterprise in addition to the administration are of excessive (Swiss) high quality. Primarily based alone estimates, the inventory trades at a PE of ~12x for 2023, regardless of having delivered EPS progress in EUR of round 15% p.a. since its IPO in 2014 and maintaing double digit EBIT margins throughout the cycle.

Because the publish has change into fairly lengthy, right here an summary of the chapters:

- Background

- Firm Historical past

- Enterprise Mannequin

- Why did I change into ?

- The place does the expansion and margin improve come from ?

- Moat and competivie benefits

- The Hoffmann Group acquisition

- Administration

- Shareholders

- Valuation

- Dangers

- Different stuff

- Professional’s and Con’s

- Abstract & Return expectations

- Sport plan

1. Background:

SFS Group has been on my watchlist since 2021 after I encountered them in my “All Swiss shares” sequence. Again then, the inventory seemed too costly regardless of displaying some engaging traits (EBIT margins, ROC and so on.). Within the meantime, they’ve made a major M&A transaction and the share worth got here down by-25%.

2. Firm historical past:

Regardless of being a 95 yr previous firm, SFS Group solely IPOed in 2014 at a share worth of 64 CHF. In response to the very detailed firm historical past, they went worldwide in 1971 and added new enterprise and enterprise traces alongside the way in which on an opportunistic foundation. SFS Group’s Web site, it isn’t really easy to grasp what they’re truly doing. Due to this fact let’s bounce into the enterprise first:

3. Enterprise mannequin

Successfully, they’re lively in 3 completely different segments that I attempt to describe in my very own phrases:

a) Manufacturing of a various vary of very small however “Mission essential” excessive precision elements for quite a lot of clients. SFS parts could be present in automobiles, cellphones and even Airplanes

b) Manufacturing of fastening and riveting options which can be used within the building and industrial sector

c) Distribution of instruments to manufacturing companies. Initially solely in Switzerland however since 2022 additionally through an acquisition internationally.

What these segments have in frequent, that they’re all targeted on B2B enterprise fashions catering to bigger corperates. Inside these 3 segments, SFS operates 8 completely different divisions that appear to be kind of impartial:

To get a a primary overview on their vast number of merchandise, their very own product web site is an efficient start line.

One in all their slogans is “native for native”, in order that they manufacture domestically in round 100 websites in 26 nations all over the world. The HQ primarily coordinates and helps if additional know-how is required, for example to develop new particular machines.

4. Why did I change into ?

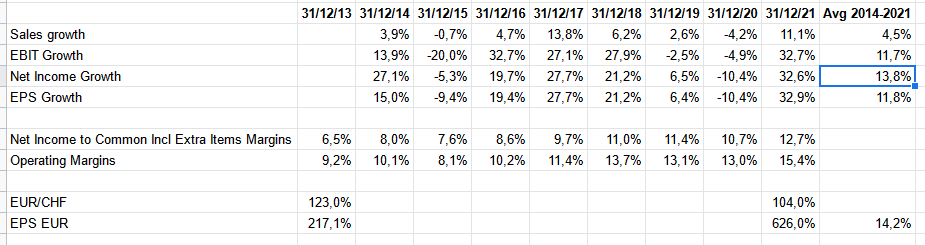

Since its IPO in 2014, SFS Group has delivered very stable outcomes regardless of having confronted finally 2 disaster and a really sturdy CHF. That is how margins and earnings developed from 2014 to 2021:

Regardless of growing gross sales solely by 4,5% (in CHF), SFS managed to enhance Internet earnings by ~14% p.a. and EPS in virtually 12% by annum since its IPO. This was primarily achieved by bettering margins signifcantly. EBIT margins improved from 9-10% to fifteen% and web earnings margins virtually doubled.

As an Euro investor, one must also keep in mind, that over this era, the CHF elevated considerably towards the EUR from 1,23 to 1,04. So in Euro, EPS would have elevated even 14,2% p.a. vs. the 11,8% in CHF.

Now comes the fascinating half: This improve in margins and earnings went together with a steady lower in valuation as we will see within the subsequent desk:

Perhaps the valuaion on the IPO was priced too wealthy, however for a “Swiss high quality” firm, SFS doesn’t look costly as of late. As we will see within the inventory chart, IPO traders may not be too completely happy, as SFS has even underperformed the SMI because the IPO:

To me, an organization with steadily growing margins is price taking a look at anyway and mixed with a declining valuation much more so.

5. The place does the expansion and margin improve come type ?

Wanting one stage beneath the Group to the segments, we will see a really fascinating, diverging improvement:

The three segments diverge fairly extensively. The smallest section, the Swiss targeted Distribution section has kind of stagnated, each in high line and working revenue. The most important section, Engineered Parts, has carried out very soldily. Nevertheless the star section was clearly the Fastening methods section that nearly doubled gross sales and improved working revenue by 5x. This section is clearly the primary driver in the intervening time and appears to have completed very effectively in 2022 as effectively.

6. Moat & Aggressive benefits

In my understanding, SFS doesn’t have a “arduous Moat”. Nevertheless, they appear to have some aggressive benefits. Particularly within the Engineered division, the competivie benefit appears to be the detailed know-how in sure manufacturing applied sciences, together with the design of particular machines, that permit them to provide excessive precision parts in areas all over the world.

Many merchandise that they produce are solely a small portion of the ultimate product in absolute worth, however fairly necessary for the performance which is commonly place to have as a provider. They appear to be very consumer centric and attempt to change into a improvement associate quite than an exchangeable provider for his or her shoppers.

On a extra strategic stage, the truth that SFS remains to be a household owned firm. appears to provide them entry to sure M&A transactions the place the vendor doesn’t wish to maximise the value however needs to guarantee that the corporate stays a comparatively independently run enterprise. So far as I perceive, the Hoffmann Deal was an instance but in addition doable as a result of hey are nonetheless household owned.

So total, no arduous moats however a mix of aggressive benefits that permit them to earn respectable margins and returns whereas rising at a passable pace.

7. The Hoffmann Group Acquisition

In late 2021, SFS introduced that they are going to take over the German Hoffmann Group, a privately owned, 1 bn EUR gross sales software distribution and producer. For SFS , that is clearly the most important transaction in its historical past and as such clearly a threat. SFS has paid ~1 bn for Hoffmann, I haven’t seen any specific EBIT/revenue numbers for Hoffmann but.

Just a few components may mitigate the dangers:

- SFS and Hoffmann collaborate since greater than 20 years and in line with Breu have comparable values and tradition

- Hoffmann will run as an impartial division

- The Hoffmann CEO will be part of the chief board

- A sure a part of the acquisition worth has been financed with on stability sheet money and shares, the remaining leverage is just not essential. (<1,5 Internet debt/EBITDA)

In one of many interviews, the CEO talked about that with this acquisition they plan to open up a 3rd platform on high of the manufacturing and Fastening sector, as distribution to this point was solely an area Swiss enterprise. In addition they appear to mean to develop this platform internationally. As well as, a few of SFS merchandise is perhaps bought through Hoffmann (Fastening).

The Acquistion was consumated as of Could 1st 2022. This leads to an fascinating impact that the 2022 outcomes will solely embody 8/12 of the earnings impression, whereas debt and addtional shares are already totally accounted as of yr finish. so EV/EBIT and EV/EBITDA at yr finish 2022 aren’t totally represetative.

Simply the impact of totally together with Hoffmann in 2023 will improve gross sales by one other ~12,4% vs. 2022 (all different issues equal).

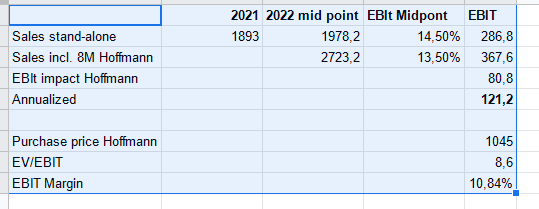

To date, SFS has indirectly talked about how worthwhile the acquired enterprise is. Nevertheless, administration has dropped some hints, particularly of their second investor day with this slide:

With this info, one can estimate the anualized 2022 EBIT of Hoffmann in addition to the EBIT margin and the implied a number of that SFS paid which I did on this desk utilizing mid factors for all estimated ranges:

So total, the Hoffmann acquisition appears to have been completed at a fairly affordable a number of. Though the EBIT margin is decrease than the typical EBITT margin of the SFS Group, a double digit EBIT margin remains to be good and buying this for an EV/EBIT of round 8,6 is clearly not overpaying.

It must be talked about nevertheless that Hoffmann didn’t grew that a lot for a few years. That is from a 2021 presentation and may clarify the comparatively low-cost worth:

One other fascinating side is that ~25% of Hoffmann’s gross sales appear to be their very own software manufacturers.

8. Administration

The CEO Jens Breu (since 2016) has an fascinating background. He’s not from the founding household and likewise not a “MBA/McK clone” however began as an industrial apprentice and labored his means up after becoming a member of SFS in 1995. I’ve watched a few movies with him and I’m actually tremendous impressed along with his down-to-earth method.

On the age of fifty years, he clearly has some years to go, however mixed already with numerous expertise. He’s additionally member of the Supervisory board of Daetwyler, one other, 3,5 bn market cap “Hidden Swiss Champion”. General evidently SFS Group principally develops Administration from inside as a substitute of hiring “Mercenaries”, an method I like quite a bit.

The supervisory board accommodates members of the founding famlies Huber and Stadler. The long run CEO and Supervisory board head Heinrich Spoerry retired (attributable to age) in 2021 and was changed by the previous CEO of Schindler, Thomas Oetterli. Oetterli himself was a part of the Supervisory board since 2011, so continuity appears to be ensured. The Supervisory board could be very Swiss, as a coicidence, one of many members (Urs Kaufmann) heads the Supervisor board at Schaffner Group, one other o my Swiss holdings.

Curiously, one member of the founding household, Claude Stadler is Govt Director and HEad of Company companies, proudly owning round 400K shares (or 40 mn CHF) however he appears to maneuver out by the top of 2024 with a purpose to give attention to the household workplace.

Compensation for the full govt board was ~7 mn CHF in 2021, with 1,6 mn CHF for the CEO which I believe is sort of low. Jens Breu owns ~28k shares and will get round 2500 shares per yr as a part of his compensation package deal.

9. Shareholders

Even after the capital improve to finance the Hoffmann transaction, the founding households Huber and Stader personal greater than 50%, joined now by the heirs of the Hoffmann Group with 4%. There aren’t any different “well-known” or noteworthy traders in line with TIKR.

10. Valuation

Utilizing SFS’s forecasts from above, the midpoint estimated EBIT for 2022 would by 370 mn CHF. Assuming ~10 mn of curiosity bills and 20% in taxes, this would lead to 7,55 CHF per share in Incomes for 2022 or, at a share worth of 105 CHF a trailing p/E of ~13,9. For a top quality firm like SFS this isn’t tremendous low-cost however fairly cheaup.

Nevertheless, wanting into 2023, issues seems much more fascinating. Assuming a 4,5% progress price in earnings plus the impact of the complete yr for Hoffmann, I count on round 433 mn EBIT and ~8,70 CHF EPS. This could imply a P/E of solely 12x and an EV/EBIT of ~11x for 2023.

another “Swiss high quality manufacurers”, we will see that this seems actually low-cost, though gamers like VAT and LEM are clearly extra worthwhile:

Daetwyler nevertheless, could be clearly a peer to SFS they usually commerce at round 2x the valuation of SFS Group.

What I discovered fascinating is, that promote aspect analysts who cowl SFS have considerably decrease estimates wich in my view don’t mirror the Hoffmann acquisition:

The Bloomberg consensus is simply 6,72 EPS GAAP for 2022 and seven,00 for 2023 which is considerably even beneath the low finish of managment estimates. For some causes, the promote aspect appears to disregard this acquistion.

Seeking to 2024 and additional, I believe it’s reasonable to imagine a stable mid-single digit progress price

11. Dangers

To date we’ve got targeted on whats good and fascinating. However there are clearly dangers. Amongst them are:

- the enterprise is geared in the direction of the manufacturing and building business. A significant and prolongued slowdown on this sectors can even hit SFS

- An M&A transaction in that measurement is at all times a threat

- The Hoffmann transaction will increase the load in the direction of Europe, particularly Germany

- The corporate has publicity to China particularly within the very worthwhile Fastening division

Structurally, the largest wager one is making with SFS is that European manufacturing is not going to die. Studying the press as of late, as soon as once more many individuals suppose that Europe will change into a historic theme park for wealthy Asian vacationers. This could be clearly not optimum for SFS. Personally nevertheless; I do consider that prime high quality manufacturing has truly a reasonably good future in Europe. The latest disaster has proven that suply chains shouldn’t be too lengthy and that the outsourcing of producing is just not a good suggestion.

As well as, the approaching Power transition requires numerous manufacturing and because it seems like, the US and Europe is not going to make the identical mistake once more and outsource every little thing to China. My feeling is that prime worth manufacturing might have a reasonably respectable future.

12. Different matters (Reporting, Capital allocation, Cashflow era and so on.)

What I do like about SFS that they’ve excellent reporting. One very particular merchandise that I like is how the current returns on capital. The present Return on invested capital (ROIC) in addition to ROCE.

Underneath Siwss GAAP, they’re allowed to deduct Goodwill immediately from Fairness once they make an acquisition. Due to this fact the ROIC (primarily based on Fairness and web debt) would look fairly good however they’re displaying and are monitoring the “actual” numbers:

As well as, they at all times present clearly which a part of the expansion is natural and which is due to M&A. Many firms don’t do that.

General, capital allocation in my view is nice. They appear to be disciplined in M&A, have a transparent dividend goal and are occassionally shopping for again some inventory though they used the present treasury shares for the Hoffmann acquistion. One shouldn’t count on massive and even debt financed share purchase backs from SHS. Following the Hoffmann acquisition, they’ve clearly communicated that they prioritize lowering debt and that they even goal a web money optimistic place. I can stay with this.

The enterprise as such is producing respectable cashflow. Clearly with Hoffmann, the dynamics may change a bit bit as distribution is a bit bit completely different to an industial.

My impression is that SFS is run very conservatively. They appear to personal most of inheritor actual property, slaary ranges for Managment are enough and steering is at all times conservative. SFS is “constructed to final”.

One different subject I discovered very fascinating is that SFS has been ranked because the quantity 8 of all Firms lively in Switzerland with regard to Digital Transformation. Throughout the Manufacturing business they had been rated #1. Though one ought to at all times be cautious with such rankings, that is clearly an fascinating side and an additional poece of the puzzle.

Lastly, I additionally like the truth that SFS doesn’t do quarterly stories. For a long run funding, this protects my no less than 2 occasions a yr the place I don’t have to learn or analyse stories.

13. Professionals and Cons

Earlier than shifting to a conclusion, as at all times I’ll attempt to summarize whats good and what’s not so good:

Professional:

- household owned, long run orientation

- an excellent enterprise (low worth however mission essential excessive precision consumable elements)

- a good valuation (particularly in comparison with Swiss friends)

- good managment

- Stable funds, conservatively run

- decentralized construction

- resilient enterprise (vitality, enter materials)

Cons:

- very massive acquisition closed in 2022

- unsexy and arduous to elucidate merchandise

- not tremendous low-cost

- no clear moat

- Publicity to manufacturing / China

14. Abstract & return expectations

SFS Group is neither an “glorious vast moat” firm nor a brilliant low-cost alternative. Nevertheless it’s a excellent enterprise/firm at a really respectable valuation. Getting excellent firms at respectable valuations is definitely my candy spot, particularly when I’m satisfied that the corporate is run with a view to the long run which I believe is right here the case.

I additionally like the truth that the corporate is just not very attractive from the surface. It doesn’t appeal to numerous consideration which is one other huge plus for me.

On the present valuation, I might count on a return of round 10% p.a. with out taking into consideration any a number of enlargement. That’s primarily based on a 2023 FCF yield of 4-5% and a long run progress price of additionally 5-6% that I believe is reasonable and even conservative, contemplating the monitor file. So my base case could be to double my cash in 7 years plus dividends..

I due to this fact determined to allocate ~4% of the protfolio into SHS at a mean worth of round 104 CHF/per share throughout January.

15. Sport plan

Though the discharge of the earnings on March third might possibly set off a sure revaluaton if EPS is available in as I count on, my plan is to carry this positon long run. If my EPS expectations grow to be appropriate and relying on their steering and the share worth response, I’d improve the place by one other 1% or 2%.

Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!!!!

Appendix: Some bonus materials.

https://www.moneycab.com/individual/jens-breu/

https://www.linkedin.com/posts/sfs-group_transformation-digitalisierung-invintingsuccesstogether-activity-6916751547762667520-mQGf?utm_source=linkedin_share&utm_medium=ios_app

Jens Breu, CEO SFS, im Interview