Investing in dividend paying shares is standard, however not with out it’s disadvantages. On this article you’ll be taught the whole lot you must learn about dividend investing. You’ll discover out what dividends are, the place they arrive from, dividend inventory myths, execs and cons. Lastly, you’ll uncover how and the place to put money into dividend paying shares.

This text could include affiliate hyperlinks which means that – at zero value to you – I would earn a fee if you happen to join or purchase by the affiliate hyperlink.

What are Inventory Dividends?

The inventory market presents income in two distinctive methods. The primary is by way of shopping for a inventory at a low value and promoting at the next value, for a capital acquire. The second is by way of money dividend funds.

A dividend-paying inventory usually pays buyers dividends quarterly, 4 occasions per yr. Dividend buyers are primarily amassing a few of the income and/or revenue of the corporate all year long. A development inventory, in distinction, usually seeks to boost earnings development by reinvesting its income and revenue as a substitute of paying shareholders, and thus dividend payers are often mature firms versus the recent, new tech startups.

In principle, a agency pays a dividend provided that the corporate’s stability sheet is wholesome and if dividends supply a greater danger/reward profile for the shareholders than reinvesting capital into development actions. Relying on an organization’s monetary objectives, the dividend can change over time. For instance, some dividend shares are thought of dividend aristocrats and are recognized for rising their dividends yearly, whereas different shares minimize or preserve their dividends to keep up a wholesome stability sheet.

The place do Dividends Come From?

When an organization has income, they’ve a number of decisions concerning these income.

1. The corporate pays the money to the investor within the type of dividends. Then the investor can spend that cash in any method she chooses. That possibility leaves the corporate with no funds to reinvest within the development of the corporate. If the agency doesn’t reinvest of their development, the corporate would possibly discover it tough to prosper.

2. The company can take all of their income and reinvest them in development alternatives and acquisitions. If the corporate invests its capital properly, the corporate will develop and it’s inventory value will enhance. This advantages the stockholder with the next worth inventory. When the investor sells this rising firm, he receives the next value for the inventory. This revenue known as a capital acquire.

3. The corporate can mix choices one and two. The corporate can take a part of its income and provides them again to the investor within the type of a dividend and reinvest the remaining within the development of the corporate. The p.c of the corporate’s earnings, paid to buyers known as it’s dividend payout ratio.

So that you see, whether or not an organization pays a dividend or not has little to do together with your long run return. You both obtain the corporate revenue alongside the way in which as a dividend, on the finish of your holding interval, as a capital acquire, or just a little of each. The vital level for buyers is to put money into rising firms whereas paying a good value.

The one distinction between dividends and capital positive aspects is within the timing of funds and tax remedy.

What’s Dividend Yield?

The dividend yield is just the quantity paid as a dividend divided by the inventory or fund value. If a $20.00 inventory pays $1.00 in dividends per yr, then the dividend yield is $1.00/$20.00 or 5.0%. Dividend yields are used to judge the potential dividend earnings from a inventory or fund. Regardless of how typically the dividend funds are made to shareholders, dividend yield is said as an annualized determine.

As a result of a dividend cost is a selected greenback quantity per share, the dividend yield varies with the inventory value. If a inventory value runs up over the yr and the dividend quantity stays fixed, then the yield shrinks. Thus, in dividend inventory investing, timing your buy interprets on to getting higher and/or worse yields. Paying much less for shares will translate into the next dividend yield.

In dividend investing, yields are additionally used as a information to the soundness of the corporate. A excessive dividend yield, above 10%, is usually related to larger danger. Decrease dividend yields, beneath 5%, are often related to stability.

Dividend Inventory Myths and Misconceptions

There’s lots of dividend inventory and fund misinformation and we’re right here to separate the info from fiction.

- Fantasy: Established firms pay greater dividend yields. Reality: Perhaps and possibly not. Corporations set their dividend cost based on many components, together with different development alternatives for the agency. If an organization’s dividend yield is excessively excessive (like over 6%+), the corporate might need some kind of hassle. Excessive dividend yields is usually a results of buyers promoting off the inventory and declining inventory costs, not a results of annual dividend will increase.

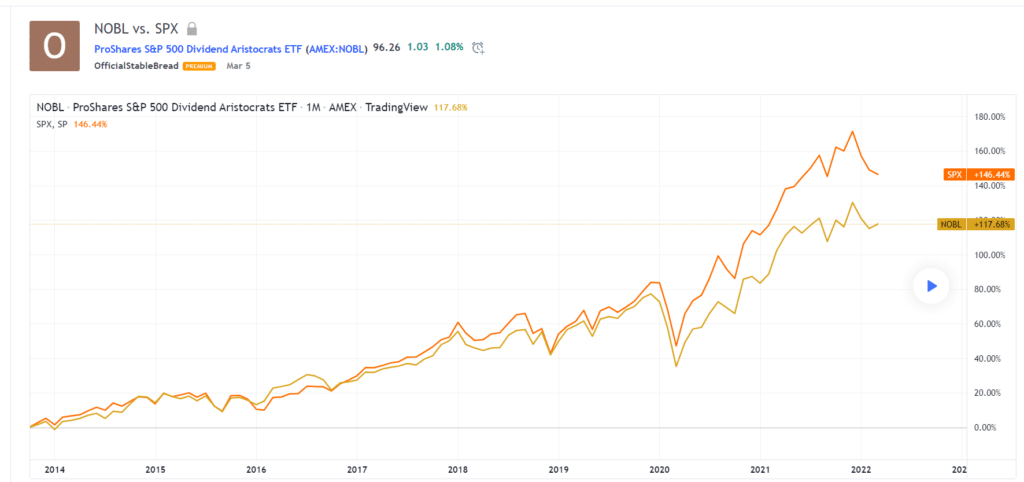

- Fantasy: Dividend shares outperform development shares. Reality: Since 2014, development shares have handily beat dividend shares. Within the above chart, which displays the comparability of the NOBL dividend aristocrat fund and SPX S&P 500 benchmark, you’ll discover that the S&P 500 handily outperformed NOBL since 2014. In case your investing technique employs dividend shares, guarantee it’s for the appropriate motive; outperformance just isn’t a very good motive.

- Fantasy: Dividend payers are the one shares to return money to shareholders. Reality: Shares that don’t pay a dividend also can return fairness to shareholders by way of buybacks. In some sense, a buyback plan is only a fancy dividend. Additionally, capital appreciation will increase worth to buyers as properly and development shares might be offered to create money movement.

- Fantasy: Shares which have minimize their dividends usually are not value investing in. Reality: Dividend shares that minimize their dividends would possibly resolve to enhance their stability sheet on the expense of the dividend. The corporate may also have development or acquisition opportunties that can in the end result in larger inventory value appreciation. Consider the corporate earlier than discarding it as a consequence of a decreased dividend cost.

- Fantasy: Dividend investing is just for older buyers, these nearing retirement. Reality: Whereas dividend earnings is seen as safer and desired by those that want to obtain secure money funds in retirement, younger buyers also can profit from dividend investments. When you maintain a inventory paying dividends over a number of a long time, your dividend on the preliminary capital will probably be very excessive, whereas the on-paper yield is low. For instance, your annual dividend payout may very well be 20% of your preliminary capital, whereas the dividend yield for present buyers is a mere 5%.

- Fantasy: Dividends are a big tax burden. Reality: Whereas bizarre dividends are taxed at the next price than capital appreciation, certified dividends can scale back that tax burden. As well as, in case you are single and making a low five-figure earnings or married and making a mid five-figure earnings, dividends may not even be a tax concern in any respect.

Dividend Shares vs Development Shares

Including dividend shares to your portfolio can enhance money movement. Development shares, in distinction, sacrifice that money movement for the potential for capital or wealth accumulation. Dividend paying firms can present money movement however usually don’t present the big value positive aspects which can be achievable with development shares.

Many buyers go for the earnings that comes with dividend investing, however doing so limits your collection of shares. For instance, tech shares are usually development shares, and so looking for solely shares that pay dividends limits your portfolio publicity to this sector. Nevertheless, a dividend investing technique tends to decrease portfolio volatility greater than a development inventory technique. So, a dividend portfolio lowers danger on the expense of upper returns.

Development shares are all about capital appreciation in the course of the development section of an organization. In a method, an funding in a development inventory might be extra of of venture than investing in a gradual dividend payer. Dividend investing is a secure funding technique, and a dividend investor can proceed to generate earnings even throughout a market crash, similar to that of 2008 or 2022.

Needless to say dividend shares could over or underperform the overall inventory market or development shares throughout a selected interval. From 2014 to 2022 development shares returned greater than dividend shares. But, from Jan 1, 2022 to April 19, 2022 the NOBL Dividend Aristocrat ETF declined -1.8%, whereas the S&P 500 and IWY a development ETF every declined -6.8%, and -12.7% respectively. So, throughout this current inventory market drop, dividend payers held up higher than the general market and development shares.

Professionals and Cons of Dividend Paying Shares

You is likely to be stunned to listen to that within the investing group, the topic of dividend shares is definitely a divisive one. In any case, simply concentrate on the professionals and cons of this investing technique earlier than you go all-in. Finally, you don’t should fully subscribe to 1 college of thought or the opposite.

Listed here are vital execs and cons of dividend investing.

Professionals

- Passive earnings is a significant professional right here, particularly if you end up investing in firms rising their dividends. Dividend development shares epitomize the advantage of dividend investments. You’ll be able to maintain a inventory and obtain more and more massive quarterly funds with out the necessity to truly promote the inventory.

- Dividends present common earnings to buyers throughout sideways markets. Thus, dividend buyers are profiting regardless of the share value not shifting, an impossibility for development inventory buyers.

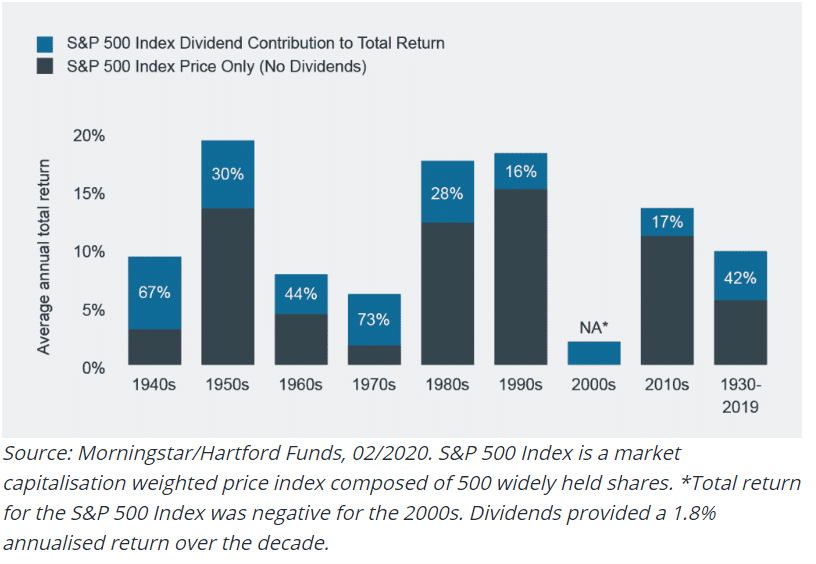

- Dividends might be reinvested, lowering the fee foundation and rising the quantity of shares held. This additionally will increase the chance for compound development. Between 1930 and 2019, dividend development added roughly 1.8% yearly to the S&P 500 returns, based on a research by Hartford Funds, and proven within the chart above.

Cons

- Dividend shares include tax disadvantages for some buyers. Whereas “certified dividends” are taxed at low charges, “bizarre dividends” are taxed at your marginal earnings tax price. In distinction, capital development isn’t taxed till the inventory or fund is offered, and enjoys decrease tax charges.

- Dividends usually are not assured. Dividend aristocrats and different dividend payers can minimize dividends at will.

- Investing in solely dividend-paying shares excludes a big swath of the worldwide funding market. Traders who solely put money into dividend shares and funds are hurting their portfolio’s diversification.

The tax price on certified dividends is 15% for many taxpayers. (It’s zero for single taxpayers with incomes beneath $40,000 and 20% for single taxpayers with incomes over $441,451.) Nevertheless, “bizarre dividends” (or “nonqualified dividends”) are taxed at your regular marginal tax price.

Kiplinger

The best way to Make investments In Dividend Shares?

When you’re comfy utilizing a inventory screener and researching particular person shares, then you possibly can put money into particular person dividend paying equities by your funding brokerage account. Mutual funds and ETFs, in distinction, are good for individuals who don’t wish to carry out the analysis crucial to pick out particular person shares and for individuals who favor computerized diversification. The record of dividend funds is huge with decisions devoted to riskier excessive yield funds, dividend rising aristocrat funds and extra.

When investing in particular person shares or funds, think about using a screener to slender down your dividend funding decisions. Helpful screening standards embrace:

- Dividend yield. Watch out with 10%+ yields, as these firms usually have underlying basic and monetary issues. For prime quality firms or funds, persist with a yield vary of two% to six%.

- Sort of funding. You’ll be able to choose from particular person shares, inventory and bond ETFs, and REITs (actual property funding trusts, which provide month-to-month dividends).

- Sectors. Excessive dividend paying sectors embrace utilities, financials, vitality and others.

- Expense ratio. For value aware buyers, decrease expense ratio funds might be correlated with larger total returns.

You could find first rate screeners at most funding brokerage corporations. For those who favor pre-made dividend funding options, M1 Finance presents a number of dividend inventory, and bond portfolios. Following are photos of the pre-made dividend portfolios at M1 Finance.

The best way to Put money into Dividend Shares With Little Cash?

Wish to construct a portfolio that can pay dividends however don’t have the capital simply but? No worries. As of late, you have got a number of workarounds:

- Partial share investing. Partial – or fractional – shares mean you can purchase a fraction of a share of a inventory. If that inventory pays dividends, you’ll get the equal quantity of dividend funds. For instance, if you happen to make investments $50 in a $100 inventory that pays $4 per share in dividends, you’ll obtain $2 in dividends.

- Robinhood. Robinhood was initially arrange for novice buyers who couldn’t afford the trade normal commissions on the time. Now, the app nonetheless presents low-capital buyers many instruments, similar to computerized recurring investments, dividend reinvestment plans (DRIP), and Roth IRA choices. Robinhood additionally presents partial share investing and low minimums.

- SoFi. SoFi used to supply fractional shares per value (e.g., spend XXX quantity on a sure inventory to get the suitable quantity of shares). As of 2021, although, now you can state your buy by way of the fraction itself (e.g., 3/4 of a share). You can begin with as little as $5.

- Schwab. Schwab is a bit behind its rivals within the fractional share recreation. For instance, you can’t buy partial shares on exchange-traded funds (ETFs) such because the SPY or QQQ. You’ll be able to, nevertheless, purchase fractional shares for any inventory within the S&P 500 for over $5. So, if you happen to’re not enthusiastic about buying partial shares of ETFs, Schwab continues to be a very good possibility.

FAQ

Is investing in dividend shares a good suggestion?

With dividend shares, you get three advantages: dividend development, if the corporate raises its dividend; capital appreciation, from the inventory costs rising; and earnings, from the dividend itself. Compounding, do you have to reinvest earnings, is also in play. General, dividend shares is usually a helpful a part of a balanced portfolio.

What’s the draw back to dividend shares?

Some buyers take into account dividend shares to be inferior to different shares within the broader market. Taxes are usually a downside for dividend shares as properly. You even have the truth that the dividend tends to be priced into the inventory, which is why dividend shares drop by the dividend quantity on the ex-dividend date. Dividend shares may not expertise the worth appreciation of development shares.

Are you able to get wealthy from dividend shares?

When you get began early sufficient, give attention to yields which can be moderate-to-high, and select firms which can be rising their dividends, you possibly can, over time, develop a small quantity of capital into a big one. Compound returns is the secret. If dividends is your methodology, one dependable possibility is to open a Roth IRA as early as you possibly can, put money into high-yield actual property funding trusts that pay at the very least 10% yearly, all tax-free, as compounding that 10% will develop your account a lot quicker than most would anticipate.

Is it sensible to put money into high-dividend shares?

If in case you have lots of capital to start with, investing in protected dividend payers might usher in sufficient earnings to assist your way of life. For everybody else, chasing high-yield dividend shares appears to be the choice possibility. Whereas high-yield dividend shares can deliver you some important ROI in your funding – even perhaps sufficient earnings to pay on your way of life – additionally they include danger. The inventory market is basically a stability of danger and rewards, and high-dividend shares discover themselves on the considerably extra dangerous aspect. You would possibly end up with a excessive dividend payer who’s value sinks 50 to 75%. Then the excessive dividend isn’t sufficient to offset the return. When investing in excessive dividend shares, perceive the underlying fundamentals of the corporate and the chance of lack of principal.

Ought to I Put money into Dividend Paying Shares? Wrap Up

Whether or not you must put money into dividend-paying shares is a private query that depends in your monetary objectives and danger tolerance. Maybe a greater query is whether or not a specific dividend-paying inventory is value your cash. If an organization is top of the range with optimistic development prospects then buyers are usually rewarded, whether or not the agency pays dividends or not. Finally, analyzing at an organization’s earnings, value, development alternatives and monetary well being might be extra vital than the dividend. In sturdy rising firms, if earnings enhance, dividends are inclined to rise, and the inventory value rallies. So, selecting the best firm through which to take a position is the last word technique right here. Dividends are only a bonus from this attitude.

You additionally want to think about the present rates of interest, as dividends yields change into much less enticing when rates of interest are excessive. To some extent, the macro surroundings also needs to be thought of when dividend investing. Dividend development, for instance, ought to outpace the rates of interest.

Ultimately, crucial piece of recommendation for investing, whether or not you select to go the dividends route or not, is to begin early and start incomes compound returns, which is the true driver of long-term wealth.

For Extra Nice Articles From Barbara Friedberg, learn these:

- How To Make investments A Million {Dollars} For Earnings

- Is Passive Earnings Actual? Myths vs Actuality

- SoFi Weekly Dividend ETF Overview

- Which Funding Sort Carries The Least Threat?

- Speculative Investments – How A lot Ought to I Make investments?

Disclosure: Please observe that this text could include affiliate hyperlinks which signifies that – at zero value to you – I would earn a fee if you happen to join or purchase by the affiliate hyperlink. That stated, I by no means advocate something I don’t personally consider is efficacious.