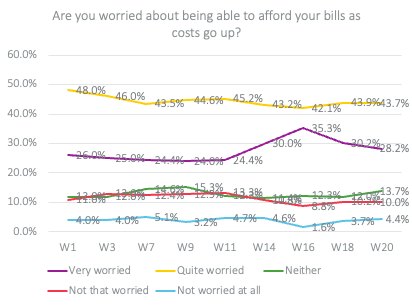

Three out of ten British folks at the moment are ‘very fearful’ about their capability to pay family payments, in response to the most recent value of residing report from Client Intelligence.

The proportion has lowered from its 35% peak in late August, following the announcement of the vitality worth cap on 8 September. It does, nevertheless, stay increased than it was over the summer time. The survey was performed on 25 and 26 September, and won’t mirror the complete affect of mortgage charge rises following the Chancellor’s Progress Plan announcement of 23 September.

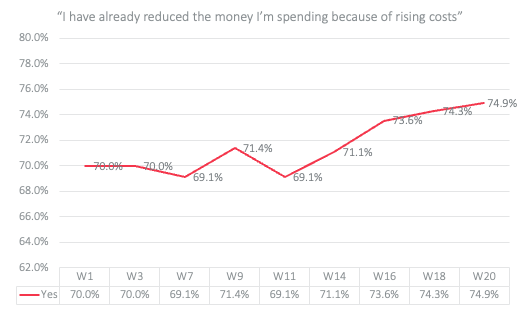

And it’s not simply the fear. The quantity of people that have already in the reduction of on spending has reached a brand new excessive of 75%, whereas half the inhabitants now reviews having in the reduction of on heating.

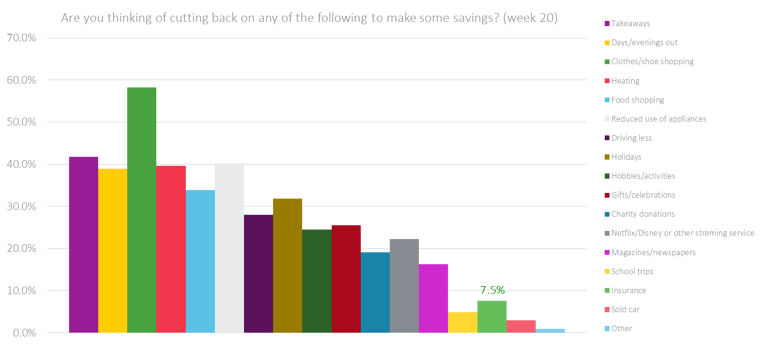

Up to now, the insurance coverage trade has been fortunate, coming in direction of the underside of the listing of cuts folks have began to make, or are planning to make. However the newest figures recommend it’s not immune. Seven per cent stated that they had in the reduction of on insurance coverage prices within the final three months, whereas these pondering of cancelling or buying and selling down insurance coverage is as much as 7.5% from 6% in June. It’s not an enormous statistical leap, however in actual phrases, it means round 2 million clients trying to slash their insurance coverage spend.

In the meantime, after a surge of holidays in summer time 2022, it’s price noting precisely how many individuals are pushing aside their subsequent one. 32% are going to chop again on holidays sooner or later, and 28% will probably be driving much less – each of which may additionally have an effect on insurance coverage – and particularly on new enterprise volumes.

Different way of life milestones being delayed embody having a child, 4%, shopping for a brand new automotive 9%, home purchases, 6%, and home renovations, 16%.

-1.png#keepProtocol)