Paying for items and providers is an important a part of our every day lives. From shopping for groceries to paying for utility payments, we depend on the forex in our wallets to finish transactions. Nevertheless, what occurs when the one invoice now we have available is torn or broken? Can we pay utilizing a ripped greenback invoice to make a purchase order?

The reply is sure, however it could include some challenges.

Are Ripped Greenback Payments Acceptable?

A ripped or broken greenback invoice continues to be thought of authorized tender and can be utilized for funds. Nevertheless, the diploma of harm to the invoice will decide whether it is accepted by companies and monetary establishments. In line with the Federal Reserve, if a invoice is lower than 50% broken, it may be redeemed for full worth by most industrial banking establishments. When greater than half of the invoice is unbroken, it’s thought of acceptable forex.

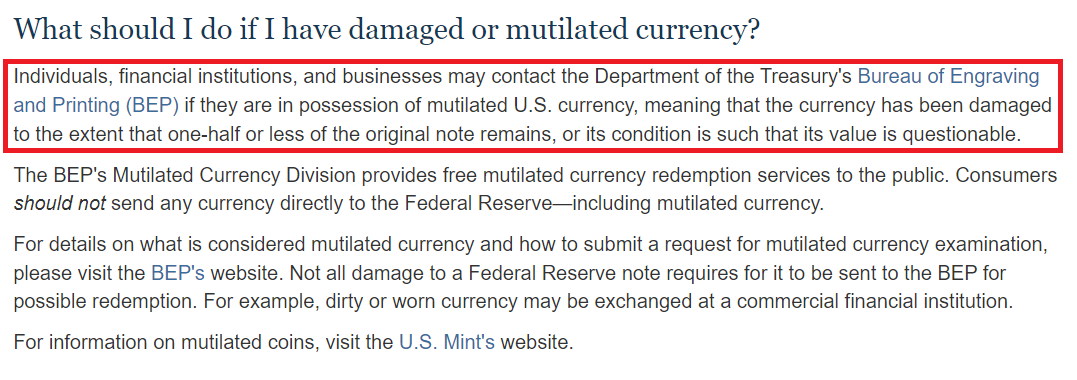

Right here is the wording from the Fed’s web site:

However what if the invoice is greater than 50% broken?

On this state of affairs, it’s as much as the discretion of the enterprise or monetary establishment to just accept the invoice. Some might refuse it, citing that it’s too broken for use, whereas others should settle for it however with some situations. For instance, they might ask for ID to confirm that the individual utilizing the invoice is the rightful proprietor. They could additionally ask for an additional invoice to exchange the broken one or supply a reduction on the acquisition value.

What Occurs to a Ripped Greenback Invoice?

So, what occurs to a ripped greenback invoice as soon as it’s accepted by a enterprise or monetary establishment? The reply is dependent upon the extent of the harm. If the harm is minimal, the invoice might be accepted and processed like some other invoice. Nevertheless, if the harm is important, the invoice might be taken out of circulation and despatched to the Federal Reserve for destruction. In some circumstances, the invoice could also be exchanged for a brand new one, relying on the situation of the broken invoice.

Why are broken payments taken out of circulation and destroyed? The principle motive is to stop counterfeiting and keep the integrity of the forex. A broken invoice may be simply manipulated and used to create faux payments, which may affect the economic system. Subsequently, it’s important to take away broken payments from circulation to make sure the trustworthiness of our forex.

If You Have a Ripped Greenback Invoice

If in case you have a ripped greenback invoice, there are methods to alternate it for a brand new one. Firstly, strive exchanging it at a financial institution. Most banks have machines that may detect counterfeit payments and decide if a broken invoice continues to be usable. If the financial institution is unable to alternate the invoice, you possibly can ship it to the Bureau of Engraving and Printing (BEP). The BEP is accountable for producing and sustaining US forex, they usually have a Mutilated Forex Division that handles broken payments. Ship the invoice to the BEP for analysis, and if deemed authentic, they may change it with a brand new one.

To Summarize

So, whereas it’s nonetheless doable to pay utilizing a ripped greenback invoice, it’s best to keep away from utilizing broken forex as a lot as doable. Not solely does it create inconveniences for transactions, however it additionally poses a risk to the economic system. When you do end up with a broken invoice, then comply with the right steps to alternate it for a brand new one. And keep in mind, it’s all the time higher to have a crisp and intact greenback invoice in your pockets than a torn one.

Learn Extra

Listed here are 38 Methods To Make Cash You Can Do As we speak

Can You Deposit A Ripped Examine?