As rates of interest for rental properties lastly begin to fall after a few years of painful heights, many actual property buyers are renewing their curiosity in rates of interest once more. With decrease charges, particularly on the favored DSCR mortgage product that permits qualification based totally on the DSCR ratio, a comparability of rents and bills (together with curiosity expense), as a substitute of the DTI ratio primarily based on private earnings, rental property purchases financed by these loans are beginning to look very enticing once more.

We’ve lined DSCR loans right here on BiggerPockets, together with a information on how rates of interest and charges are primarily decided by three key metrics: LTV ratio, DSCR ratio, and credit score rating. We’ve additionally put out an superior technique information that reveals how extra secondary components additionally assist decide your fee—similar to prepayment penalties, mounted vs. ARM construction, and hire qualification kind (i.e., LTR vs. STR, and so on.).

Nevertheless, we’ll go additional and present you precisely how these components are utilized to get that actual rate of interest quantity you are quoted, pulling again the curtain on how DSCR lenders and mortgage brokers calculate the speed and factors you see in your DSCR quotes.

Fee Sheets and State of affairs Instruments: The Calculator Constructed for Brokers and Lenders

Regardless of typically showing complicated and typically esoteric, the instruments utilized to create your fee are not a lot completely different than a semi-basic calculator software and contain fairly easy math. Lenders will sometimes begin day-after-day with what’s referred to as a “fee sheet,” which reveals a spread of rates of interest from the lender’s minimal fee and most fee.

Every rate of interest—sometimes provided in 12.5-basis level increments, or an eighth of a p.c—has a corresponding “premium” quantity, sometimes round 100. These are referred to as the bottom charges and function the place to begin for calculating the rate of interest on a mortgage mortgage.

Along with these base charges, the speed sheets will function what are referred to as loan-level value changes (LLPAs) that transfer the premium quantity up and down primarily based on in the event that they point out a higher-risk mortgage (strikes the premium down) or a lower-risk mortgage (strikes the premium up). The bottom charges are sometimes primarily based on prevailing market charges, as described on this article (macro components), whereas LLPAs are primarily based on the person deal (for DSCR loans, primarily property components, but additionally primarily based on the borrower’s credit score profile too), or micro components.

DSCR lenders will provide decrease charges for loans which have a better threat of default and are, subsequently, extra dangerous. These are often intuitive—similar to loans with greater LTVs (much less distinction between the worth of the mortgaged property and mortgage quantity) and decrease DSCR ratios (much less money circulation earned from the property) assessed as greater threat. Conversely, loans which have debtors with greater credit score scores, for instance, are thought of to have a decrease threat of default, and debtors will take pleasure in decrease rates of interest resulting from their private creditworthiness.

Beginning with a base rate of interest and premium, DSCR lenders will sometimes enter all of the related pricing components of the mortgage with their related changes (LLPAs) that add or subtract to the premium quantity. Then, as soon as all of the components have been enter, the lender will “resolve” for the speed that produces a premium variety of 100 (or a goal premium quantity similar to 102 or 103). Thus, the speed is created.

Buckets

One word earlier than diving in: DSCR lenders will sometimes use mini-ranges for various metrics, typically referred to as buckets, when figuring out components as a substitute of particular, exacting numbers. For instance, the speed sheets utilized by lenders will nearly definitely have LLPAs primarily based on buckets for various inputs such as pricing for credit score scores between 700 and 719, scores between 720 and 739, and so on., moderately than particular person changes for particular scores.

So, for instance, a qualifying FICO rating of 705 and 709 would have the identical adjustment, and the borrower may solely safe a better fee by bettering the rating to 720 or above to achieve the following bucket.

Major LLPAs—the Matrix

Whereas many buyers are doubtless acquainted with the “large three” components for figuring out DSCR rates of interest (LTV, DSCR, and credit score rating), with regards to calculating the speed, the vast majority of DSCR direct lenders will use a matrix that includes LTV and credit score rating as the highest most influential components (satirically, not that includes the DSCR ratio, the namesake of the mortgage kind).

DSCR lenders will make the most of what is usually referred to as a pricing matrix as the primary LLPA that adjusts the bottom fee and premium. It’s a easy two-way matrix plotting rows and columns, the place every mixture of credit score rating bucket and LTV bucket creates the primary LLPA, which is commonly pretty important.

Moreover, some combos of credit score rating and LTV won’t be eligible as a result of perceived threat. For instance, as proven in an instance FICO/LTV matrix, a lender might lend as much as 80% LTVs, however solely debtors with a 720 or greater qualifying credit score rating could be eligible.

As you may see within the pattern matrix, maximizing leverage, particularly maximizing leverage with less-than-perfect credit score, will end in considerably adverse LLPAs, which is able to have the impact in the calculations of requiring a a lot greater fee. You may as well see how (and why) low LTV offers, particularly mixed with a robust credit score profile, can lead to extraordinarily favorable rates of interest.

It’s essential to notice that such a pricing is never linear, that means each improve in LTV bucket doesn’t outcome within the similar change in LLPA—as a leap from the 50.1%-55% LTV bucket to the 55.1%-60% LTV bucket is just a 12.5 bps adverse change, whereas an equal 5% bucket improve from 70.1%-75% LTV to 75.01%-80% LTV leads to a 62.5 bps adverse change!

When optimizing your rate of interest on a DSCR mortgage, the extra conservative you might be leverage-wise and the higher you retain your credit score, the happier you might be likelier to be if you get your rate of interest.

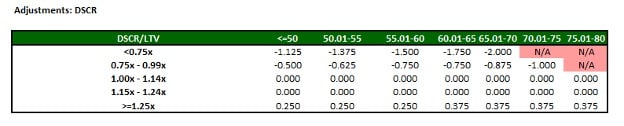

DSCR LLPAs

Regardless of not being within the major “matrix” of most DSCR lenders, the DSCR ratio will sometimes have a major impact on your fee calculation as effectively. Like credit score rating and LTV, DSCR ratios shall be in buckets, together with for DSCR ratios under 1.00x!

Most DSCR lenders could have minimums of 1.00x and surprisingly deal with properties not too otherwise with regards to optimistic DSCRs, i.e., less-than-expected variations between a property with a 1.45x DSCR ratio and a 1.15x DSCR ratio, for instance. Some DSCR lenders will even lend on properties with DSCR ratios underneath 1.00x, or even underneath 0.75x (typically referred to as no ratio DSCR loans).

At first look, this will likely appear surprising. Nevertheless, there are some eventualities the place DSCR loans on properties with lower than 1.00x DSCR ratios make sense. However regardless of the shocking no ratio DSCR mortgage choice, LLPAs for these conditions are fairly harsh, and sometimes restricted to the decrease LTV buckets. A pattern DSCR LLPA matrix illustrates how these can have an effect on pricing calculations.

Mortgage Dimension LLPAs

After the LTV, credit score rating (FICO) and DSCR ratio are enter, and the ensuing main changes are computed. The DSCR lender will then begin inputting secondary LLPAs that, whereas sometimes not as significant as the primary three pricing drivers, will additional alter the related premium favorably (addition) or negatively (subtraction).

Mortgage measurement is usually an LLPA for DSCR loans. Just like the well-known Goldilocks and the Three Bears fable, the best mortgage measurement for DSCR lenders is usually between the extremes—not too large and never too small.

Why? Mortgage sizes too giant, sometimes when you get to the $1.5 million or above vary, point out very high-value properties and may fluctuate in worth extra dramatically (and thus signify greater threat), primarily as a result of the marketplace for the related high-end properties is of course smaller (fewer folks can afford them if delivered to market, and fewer to hire them at eye-watering rents if used as a long-term rental). As such, many DSCR lenders will assess some minor adverse LLPAs for loans effectively into the seven figures to account for elevated threat.

Moreover, when the mortgage measurement is simply too small, sometimes within the low-$100,000 vary and even 5 figures, there’s not solely much less margin for error (misreading the worth by just some thousand has a a lot bigger impact), nevertheless it hurts the lender’s economics. The quantity of labor (and related working prices) to originate a $100,000 DSCR mortgage and a $1 million DSCR mortgage are sometimes typically the identical, however the lender will sometimes make a lot much less cash on the mortgage (lender economics are sometimes primarily based on a proportion of the mortgage quantity). Thus, to make smaller loans price it economically, many DSCR lenders will assess a better LLPA penalty for smaller loans.

The sweet-spot mortgage quantity for many DSCR lenders is thus not too large, not too small, sometimes all through the six-figure vary in 2024 (~$250,000 to $1 million). These will typically not have any adverse pricing changes and end in the most effective charges.

Property Sort LLPAs

One other essential LLPA for DSCR loans is the property kind. At a excessive degree, the chance (and thus LLPA) is derived by the liquidity and salability of the underlying property. DSCR lenders mitigate their threat primarily by the secured collateral—and the power to foreclose and promote the property in case of default with a view to be made complete or reduce losses on loans that go dangerous.

Much like the instance on mortgage measurement, the place there’s much less threat for loans round $350,000 versus $3.5 million, primarily as a result of there are such a lot of extra prepared and ready consumers of properties within the $500,000 worth vary than the $5 million vary, there shall be adverse pricing changes for property varieties which have a smaller market of potential consumers.

As such, the marketplace for single-family residences (SFRs) is very giant (together with the overwhelming majority of owner-occupants), and vanilla single-family leases will sometimes not have a adverse LLPA. Nevertheless, for different property varieties, adverse pricing changes (and decrease LTV most eligibility) shall be typical. Since there are fewer potential consumers for condos, duplexes, or different multiunit properties, these are riskier for the lender (tougher to promote in case of a foreclosures), and thus there will sometimes be subtractions to the pricing within the type of adverse pricing LLPAs.

Mortgage Goal LLPAs

Mortgage function is usually outlined as both an acquisition (self-explanatory, utilizing a DSCR mortgage to purchase a property), rate-term refinance (a refinance transaction, the place cash-out proceeds are lower than $2,000 or the borrower has to convey “cash to the desk”), or cash-out refinances (a refinance, the place the proceeds put money in pocket, when the distinction between mortgage quantity and prior mortgage being paid off plus closing prices/escrows is better than $2,000, or when the property was beforehand owned free and clear).

Usually, there shall be adverse LLPA changes for refinances and never acquisitions, primarily due to much less certainty over worth. Whereas DSCR lenders ought to at all times be using an impartial third-party appraisal, a market worth is extra sure in an acquisition transaction (by definition, the property was simply listed and offered available on the market) versus a refinance transaction (appraiser estimate solely). The adverse LLPA will thus be assessed on refinances to account for this greater threat (much less certainty on worth).

Moreover, cash-out refinances typically have harsher refinances for a number of causes. Lenders have discovered that psychologically, buyers with much less “pores and skin within the sport” after having cashed out fairness usually tend to default. Moreover, actual property fraud schemes that focus on lenders are most certainly to be by cash-out refinance transactions, so mitigation of this elevated threat is funneled to a adverse LLPA within the fee computation.

Mortgage Construction LLPAs

DSCR fee sheets may even sometimes function a number of LLPAs primarily based on the provisions within the mortgage mortgage paperwork. Typical mortgage construction changes that may lower premium (and improve required fee) embrace selecting an “interest-only” choice (really solely partially interest-only for DSCR loans, with principal funds required for the final 20 years of the time period) versus a completely amortizing construction.

Lots of lenders may even sometimes provide what are referred to as hybrid ARM choices, the place the rate of interest can alter after a sure initially fixed-rate interval, similar to after 5 or seven years, as a substitute of selecting a 30-year mounted fee construction. Selecting a hybrid ARM is often a optimistic LLPA since DSCR loans which might be hybrid ARMs will usually have a value flooring that restricts the rate of interest on the mortgage to at all times float under the preliminary fee, even when market charges enhance over the lifetime of the mortgage.

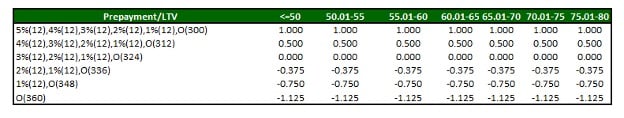

Many buyers who’ve utilized DSCR loans or explored the DSCR mortgage choice versus different funding property mortgage varieties (together with typical and different non-QM mortgage varieties) have doubtless found that prepayment penalty provisions, or a proportion charge that is assessed if the borrower prepays early, are a key LLPA function of DSCR loans. These prepayment LLPAs are optimistic LLPAs, whereby including a prepayment penalty that’s excessive in each size (what number of months the penalty interval is in impact) and severity (how excessive the charge is, expressed as a proportion of excellent mortgage stability) can add considerably to the computed premium, and thus generate a decrease fee.

DSCR loans with prepayment penalties excessive in proportion charge and size (though sometimes by no means greater than 5% and 5 years of the 30-year time period) are sometimes the most effective match for buyers with a very long time horizon and no plans to promote within the close to time period, as these DSCR charges might be equal and even decrease than different typical mortgage choices.

See the instance prepayment penalty LLPA matrix displaying the numerous optimistic results of prepayment penalties on the computation of DSCR mortgage rates of interest.

Different LLPAs

These LLPAs are typically customary throughout nearly all DSCR lenders. Whereas changes and minimums and maximums will fluctuate, typically, all DSCR lenders will function them on their pricing calculators. DSCR lenders, not like typical lenders, do have differentiated pointers and mortgage packages, nonetheless, and these are examples of LLPA changes chances are you’ll encounter when getting a DSCR mortgage, however fluctuate from lender to lender, or be absent on some DSCR fee sheets.

Hire qualification

DSCR lenders can vary from not lending on properties utilized as short-term leases to short-term rental-friendly lenders that use aggressive underwriting pointers similar to qualifying with instruments similar to AirDNA. For lenders that do lend on STRs, some will view long-term leases as much less dangerous and thus have optimistic LLPAs for LTRs and adverse changes if the property should qualify as a short-term rental.

Investor expertise

DSCR lenders will sometimes fluctuate in how they deal with debtors who’re shopping for their first funding property. Lenders that do present DSCR loans to first-time buyers will typically have adverse LLPA changes to account for this threat, however it’s extra widespread for these lenders to have decrease LTV or mortgage quantity maximums than charging first timers greater charges.

Poor credit score historical past

Vital adverse occasions in your credit score historical past round actual property, similar to current 30+-day delinquencies on mortgage loans, or a critical “credit score occasion” in current historical past such as a chapter, foreclosures, quick sale, or deed-in-lieu, elevate large crimson flags amongst DSCR lenders. Latest credit score issues round actual property debt clearly point out a doubtlessly greater probability of future issues.

Many DSCR lenders will nonetheless lend to debtors with these warts on their credit score historical past, however the LLPAs are sometimes very adverse and important, leading to a lot greater rates of interest to account for this threat. In the event you see a DSCR mortgage with an rate of interest that appears effectively above market charges, it’s doubtless as a result of the borrower doubtless has had current issues on their credit score report associated to actual property loans.

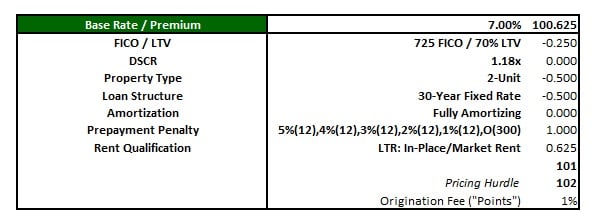

Pricing Instance

The chart reveals a typical instance of how this all flows collectively and a DSCR fee quote is computed. On this case, the DSCR lender has a pricing hurdle of 102—that means they should earn 2% on the transaction to cowl prices and function the enterprise.

As is illustrated, a base fee and premium of seven% and 100.625, respectively, is the place to begin (these are primarily based on normal market components), and there are a collection of adverse LLPA changes (the mixture of a 725 qualifying credit score rating and 70% LTV ratio), optimistic LLPA changes (a 5/4/3/2/1 prepayment penalty and qualifying as a long-term rental), and impartial LLPA changes (no adjustment optimistic or adverse for a 1.18x DSCR within the 1.15x-1.24x DSCR bucket and using a completely amortizing construction as a substitute of any interest-only choices).

As illustrated, including and subtracting all of the LLPAs from the 100.625 place to begin will get to a sum of 101, which requires a 1-point origination charge to make up the distinction between the worth of the mortgage and the required pricing premium hurdle. Due to this fact, for this state of affairs, the borrower can safe a DSCR mortgage with an rate of interest of seven% and a 1% level paid for a closing charge.

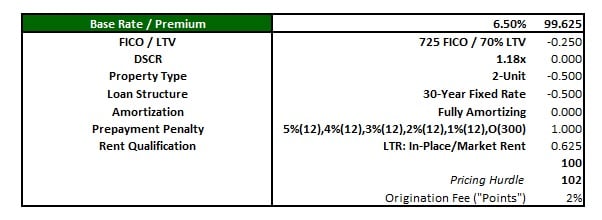

Fee Purchase-Downs

Generally, mortgage lenders will enable debtors to purchase down an rate of interest, an choice through which the borrower can safe a decrease rate of interest by paying extra origination charges at closing. This is what it means to “purchase down an rate of interest.”

The instance will present what it may appear to be when a borrower desires to purchase down their fee. Taking the identical pattern state of affairs, on this computation, an rate of interest of 6.5% is quoted, which has a corresponding base premium of 99.625 as a substitute of 100.625. With all the identical LLPAs, the sum now involves 100, requiring a 2% origination charge as a substitute of 1%. On this instance, the borrower buys down the speed 0.5% (from 7% to six.5%) for the worth of 1% of the mortgage quantity within the type of a further 1% closing charge.

Closing Ideas

Hopefully this helps illuminate the computation course of for rates of interest and shutting charges for mortgage loans, significantly DSCR loans. Many rental property investments are closely affected by the numbers—significantly the mortgage fee and rate of interest—and using this information to tailor your funding expectations may assist make the distinction between successful leases and downside properties.

Comply with the writer of this text, Straightforward Avenue Capital companion Robin Simon, on a number of social platforms, together with X and BiggerPockets, for extra insights into charges and tendencies out there for DSCR loans and to remain updated on all the present pricing of loans for rental properties.

This text is introduced by Straightforward Avenue Capital

Straightforward Avenue Capital is a personal actual property lender headquartered in Austin, Texas, serving actual property buyers across the nation. Outlined by an skilled crew and progressive mortgage packages, Straightforward Avenue Capital is the best financing companion for actual property buyers of all expertise ranges and specialties. Whether or not an investor is fixing and flipping, financing a cash-flowing rental, or constructing ground-up, now we have an answer to suit these wants.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.