The U.S. householders insurance coverage section posted its worst underwriting ends in over a decade in 2023, in line with an evaluation by S&P World Market Intelligence.

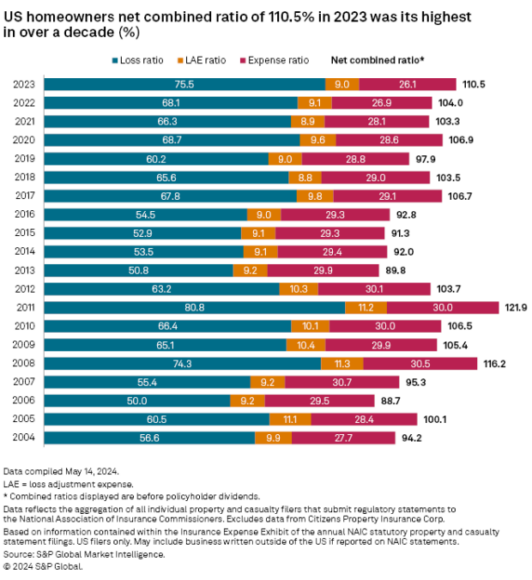

The online mixed ratio for the householders enterprise, excluding policyholders’ dividends, was 110.5 in 2023, the best since 2011 (121.9).

S&P stated inflationary pressures, the devastating wildfire in Hawaii and a record-breaking variety of billion-dollar loss occasions from convective storms weighed on the business’s outcomes.

Regardless of boosting charges throughout the U.S., householders insurers noticed web underwriting losses of about $15 billion in 2023, in comparison with about $5.9 billion throughout the earlier 12 months, excluding state-backed insurers of final resort, S&P stated in its market evaluation.

U.S. householders insurers noticed their web losses and loss changes bills leap to about $101.3 billion in 2023, a year-over-year enhance of 21.3%, whereas web premiums earned grew by 10.8% to about $119.9 billion. Different underwriting bills equaled $33.4 billion throughout the 12 months in comparison with $30.6 billion throughout 2022, in line with the evaluation.

Among the many 20 largest U.S. householders insurers, solely Chubb Ltd. and Amica Mutual Insurance coverage Co. noticed mixed ratios underneath 100 in 2023. Chubb’s web mixed ratio was 89.6 in 2023, whereas Amica posted a mixed ratio of 97.4.

Florida’s Residents Property Insurance coverage Corp. grew to become one of many 10 largest U.S. householders underwriters in 2023, knocking Progressive into the No. 11 spot. Residents reported direct premiums written of about $3.2 billion—up 42.2% % year-over-year.

In mixture, the P/C householders business recorded $152.5 billion in direct premiums written throughout the latest 12 months in comparison with $133.8 billion in 2022.

See the total S&P World Market Intelligence report for extra data.

Subjects

USA

Carriers

Owners

Was this text useful?

Listed below are extra articles you might get pleasure from.

Involved in Carriers?

Get computerized alerts for this matter.