Stability is predicted to return to the nation’s housing market this 12 months as rates of interest ease, however owners shouldn’t anticipate a return to the “rollicking” value good points of earlier years.

“The Canadian housing market ought to enter a interval of general stability this 12 months, with decrease resale costs, easing mortgage charges and pent-up demand doubtless serving to to set a flooring for the market,” writes BMO senior economist Robert Kavcic in a latest analysis report.

He provides {that a} return to earlier value highs in some places is “unlikely at this level.”

That’s regardless of client sentiment enhancing following the Financial institution of Canada’s newest charge maintain and market alerts that it’s doubtless accomplished climbing charges, and a rising expectation from markets that charge cuts will probably be forthcoming later this 12 months.

Like most massive banks, BMO is forecasting the Financial institution of Canada to decrease its in a single day goal charge by a full proportion level from its present 5.00%.

Downward stress on costs to proceed by means of spring

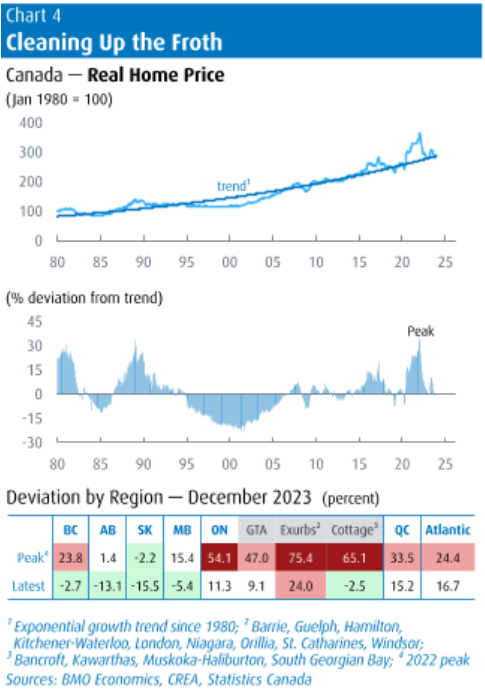

Dwelling costs have been trending downward over the previous 24 months ever for the reason that begin of the Financial institution of Canada’s rate-hike cycle.

As of December, the nationwide common promoting value was $657,145, down roughly 20% from a peak of over $816,000 reached in February 2022.

Some downward stress is predicted to proceed by means of spring, Kavcic says, notably in Ontario, which noticed a few of the heftiest value good points over the course of the pandemic.

That’s consistent with the most recent forecast from the Canadian Actual Property Affiliation (CREA), which expects the common nationwide value to rise simply 2.3% in 2024 to a value of $694,173.

Larger-than-average good points are anticipated in Alberta, Quebec and many of the Atlantic provinces, whereas CREA sees costs remaining flat in British Columbia and Ontario.

“In actual phrases, Canadian dwelling costs have now largely adjusted again to their long-term development development, suggesting that the majority froth has been cleaned out of many markets,” Kavcic wrote.

Lingering affordability challenges

Regardless of the pullback in dwelling costs, excessive rates of interest have basically cancelled out any profit in affordability for consumers, observers say.

RBC economists famous that any value restoration will probably be “restrained by lingering affordability points.”

Nationwide Financial institution’s Housing Affordability Monitor additionally recorded a “vital deterioration” in affordability as of the third quarter, which roughly coincided with a peak in bond yields and thus mounted rates of interest.

“Whereas nonetheless rising revenue was a partial offset within the third quarter, it did little to assuage the scenario,” they wrote. “Trying forward, we see a moribund outlook for affordability. On the very least, an extra worsening is within the playing cards for the final quarter of the 12 months.”

Since then, mounted mortgage charges have pulled again considerably, however it should take additional declines, together with anticipated Financial institution of Canada charge cuts later this 12 months, to make any form of significant enchancment for homebuyers.

“Affordability stays strained, which is able to restrict the scope of any rebound [in home prices],” Kavcic says. “We estimate that the present outlook for decrease rates of interest will go about midway to restoring affordability to pre-pandemic ranges, whereas the remaining would require both additional value declines or (extra doubtless) stagnant costs and a catch-up in incomes.”

The excellent news, he provides, is that the market remains to be displaying few indicators of pressured promoting.