PAN card issued by the Earnings Tax Division of India is a compulsory requirement to file Earnings Tax Returns or to make banking transactions exceeding Rs. 50,000. Furthermore, PAN card can also be thought-about as one of many vital identification paperwork for opening a checking account, buying a property, investing in mutual funds, making use of for a debit/bank card, and many others.

With the Earnings Tax Division’s free and immediate e-PAN card facility utilizing Aadhaar primarily based e-KYC, you may safe an e-PAN on-line in simply 10 minutes and with none documentation. Your PAN card utility is immediately processed utilizing your Aadhaar card particulars.

Allow us to now perceive 5 vital issues for immediate PAN Card Software utilizing Aadhaar Card.

Eligibility for Immediate e-PAN by Aadhaar Card

The moment e-PAN is a digital PAN card that’s equally legitimate as a bodily PAN. Nevertheless, there are just a few stipulations that you could contemplate when you want to avail an immediate e-PAN:

- You’ve by no means been allotted a PAN card

- You shouldn’t be a minor on the date when requesting your immediate e-PAN

- You need to have a legitimate Aadhaar and a cell quantity linked to Aadhaar

- Your full date of start needs to be obtainable in your Aadhaar Card (DD/MM/YY)

- You shouldn’t be lined below the definition of Consultant Assessee u/s 160 of the Earnings Tax Act

Get FREE Credit score Report from A number of Credit score Bureaus

Examine Now

Learn how to Get Immediate e-PAN by Aadhaar Card

Here’s a step-by-step information on learn how to avail Immediate e-PAN by Aadhaar card:

Step 1: Go to the e-Submitting portal homepage and below the Fast Hyperlinks part, click on on the “Instant e-PAN” choice

Step 2: On the e-PAN web page, click on on “Get New e-PAN”

Step 3: Subsequent, enter your 12-digit Aadhaar quantity, choose the “I affirm” checkbox and click on on “Proceed”

Step 4: Click on on “I have learn the consent phrases and comply with proceed additional” and click on on the “Proceed” button

Step 5: Fill within the 6-digit OTP despatched in your Aadhaar linked cell quantity, choose the checkbox to validate the Aadhaar particulars with UIDAI and click on on “Proceed”

Step 6: On the Validate Aadhaar Particulars web page, choose I Settle for that checkbox and click on on “Proceed”. Be aware that, validating your electronic mail deal with (registered along with your Aadhaar) is optionally available.

Step 7: After profitable submission, a hit message is displayed on the display screen together with an Acknowledgement Quantity. Do maintain a word of the Acknowledgement ID for future reference. Additionally, you will get a affirmation message in your cell quantity linked with Aadhaar.

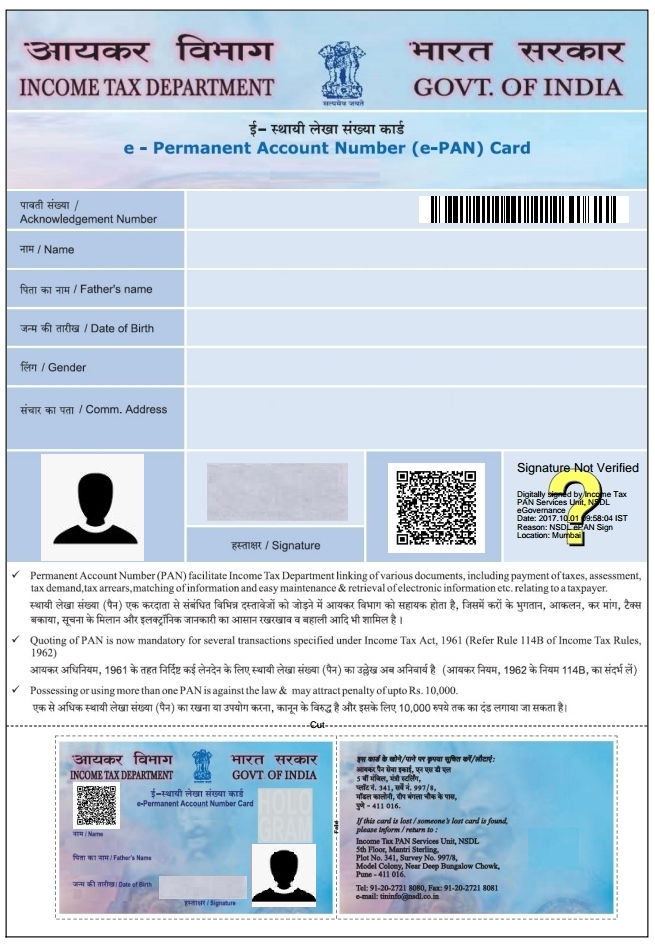

Format of Immediate e-PAN Card

The issued immediate e-PAN Card is in PDF format which additionally has a QR code containing all of the demographic info reminiscent of your identify, date of start, gender and {photograph} too. Furthermore, this immediate e-PAN might be downloaded utilizing the 15-digit acknowledgement quantity despatched to you in your registered cell quantity and electronic mail deal with as soon as the method of PAN Card utility is accomplished. Furthermore, additionally, you will be despatched a mushy copy of your PAN Card in your electronic mail deal with (if registered with Aadhaar Card and talked about within the utility kind).

Be aware: Typically, the candidates get confused whether or not the moment e-PAN is taken into account equally legitimate or not, however as per the current guidelines of the Earnings Tax Division of India, the e-PAN is equal to a bodily PAN Card.

Costs for Immediate e-PAN Card by Aadhaar Card

You may get an immediate e-PAN fully freed from value by the Earnings Tax e-Submitting web site utilizing an Aadhaar e-KYC primarily based course of. Nevertheless, this immediate e-PAN is a digital PAN. To avail a bodily PAN card, it’s good to go to the official web site of NSDL or UTIITSL and apply for a similar by paying the relevant PAN card utility charges and fees.

Learn extra about: PAN Card Charges and Costs

Paperwork Required for Immediate PAN Software

There isn’t any documentation required for the immediate PAN utility facility by Aadhaar Card as the info is mechanically fetched from UIDAI’s database when you enter your Aadhaar quantity.

Get FREE Credit score Report from A number of Credit score Bureaus

Examine Now

Learn how to Examine Standing of Immediate PAN Software

You may as well verify the standing of your Immediate e-PAN utility by following the steps talked about beneath:

Step 1: Go to the e-Submitting portal homepage and click on on “Immediate e-PAN”

Step 2: On the e-PAN web page, click on on “Proceed” below the “Examine Standing / Obtain PAN” choice

Step 3: Enter your 12-digit Aadhaar quantity and click on on “Proceed”

Step 4: On the OTP Validation web page, enter the 6-digit OTP that you just obtain in your Aadhaar registered cell quantity and click on on “Proceed”

Step 5: You’ll be able to view the standing of your e-PAN request on the “Present standing of your e-PAN request” web page. In case your new e-PAN has been generated and allotted, click on on “View e-PAN” to view or “Obtain e-PAN” to obtain a duplicate of your PAN card.

FAQs

Q. Can I get hardcopy of immediate e-PAN?

No, immediate e-PAN is just a digital PAN card. In case you want to avail a bodily PAN card, it’s good to apply for a similar by NSDL (Protean) or UTIITSL web site by paying the relevant payment.

Q. Can I get the moment e-PAN issued within the digilocker app?

No, immediate e-PAN can solely be issued by the revenue tax e-Submitting web site.

Q. Does UMANG app assist the e-PAN facility?

Sure, you should utilize your immediate e-PAN on the UMANG app

Learn extra about: UMANG App : Obtain, Registration, Login, Providers & Advantages

Q. Can I present my immediate e-PAN for opening a brand new financial savings account?

Sure, the moment e-PAN is equally legitimate as a bodily PAN card.

Q. Will my immediate e-PAN be legitimate for making use of for loans and bank cards?

Sure, you should utilize your immediate e-PAN to use for loans and bank cards.

Q. What is going to occur to my immediate e-PAN if I apply for the hardcopy of PAN card by NSDL or UTIITSL portal?

You’ll be able to proceed utilizing your immediate e-PAN as it’s. The hardcopy generated is solely a bodily type of the identical PAN.

Q. Can I take advantage of my immediate e-PAN for id proof?

Sure, you should utilize your immediate e-PAN as an id proof.

Q. Can I take advantage of my immediate e-PAN for deal with proof?

Sure, immediate e-PAN can be utilized as a legitimate deal with proof.

The put up Immediate ePAN Card utilizing Aadhaar Card: 5 Issues to Know appeared first on Evaluate & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.