Nobody can predict the way forward for actual property, however you possibly can put together. Discover out what to organize for and choose up the instruments you’ll want on the immersive Digital Inman Join on Nov. 1-2, 2023. And don’t miss Inman Join New York on Jan. 23-25, 2024, the place AI, capital and extra shall be heart stage. Wager large on the roaring future, and be part of us at Join.

Lengthy-term rates of interest climbed Friday after Federal Reserve Chairman Jerome Powell delivered some powerful speak on inflation on the Jackson Gap Financial Symposium, however quickly leveled off as traders digested whether or not Powell’s message was a lot of a departure from previous statements.

“It’s the Fed’s job to deliver inflation right down to our 2 p.c objective, and we are going to achieve this,” Powell stated proper off the bat, addressing critics who’ve questioned whether or not that is still a practical benchmark within the face of the economic system’s resilience.

“Now we have tightened coverage considerably over the previous yr,” Powell continued. “Though inflation has moved down from its peak — a welcome growth — it stays too excessive. We’re ready to lift charges additional if acceptable, and intend to carry coverage at a restrictive stage till we’re assured that inflation is shifting sustainably down towards our goal.”

Take Inman’s Inaugural Survey On Agent Commissions

As Powell delivered his remarks, yields on 10-year Treasurys — which regularly predict the place mortgage charges are headed — surged six foundation factors to 4.28 p.c.

However by Friday afternoon, 10-year yields have been again to the place they’d closed on Thursday as markets digested Powell’s recognition that inflation information has been headed in the correct route currently and that future selections on how excessive and the way lengthy to maintain rates of interest elevated shall be information dependent.

Powell began with a transparent message: That the Fed is ready to lift charges additional if acceptable and maintain them there till it’s assured that inflation is shifting towards its 2 p.c objective, Pantheon Macroeconomics Chief Economist Ian Shepherdson stated in a be aware to purchasers.

Ian Shepherdson

However “markets have heard [that message] earlier than, many occasions, with few variations,” Shepherdson stated. “Our take is that the speech breaks no new floor. The Fed believes it’s tight, however is open to the concept it might need to be tighter. The information are headed in the correct route, however not but definitively. It’s all in regards to the information.”

Whereas Pantheon analysts assume the Fed is finished elevating charges, it’s a 60-40 name, Shepherdson stated, “not least as a result of we don’t but see clear proof of a critical break in job development … and that may hold the Fed nervous.”

The fear amongst some economists is that the Fed gained’t start to reverse course till the economic system is on the trail to recession. However after Powell’s speech, Chicago Fed President Austan Goolsbee instructed CNBC he nonetheless sees the potential for a tender touchdown.

“I nonetheless really feel like there’s a path, I hold calling it the “golden path,” that we may get inflation down with out having a giant recession,” Goolsbee stated. “That will be nearly unprecedented for inflation to return down as a lot as we’d like it. However to date, it’s been going okay. We nonetheless want extra info coming in, however nothing’s occurred within the final two months that will make me assume that the golden path’s unimaginable.”

Of their newest forecast, economists at Fannie Mae stated they’re anticipating a “gentle recession” within the first half of 2024, however that the bigger danger to housing is that inflation picks up once more, forcing the Federal Reserve to renew rate of interest hikes.

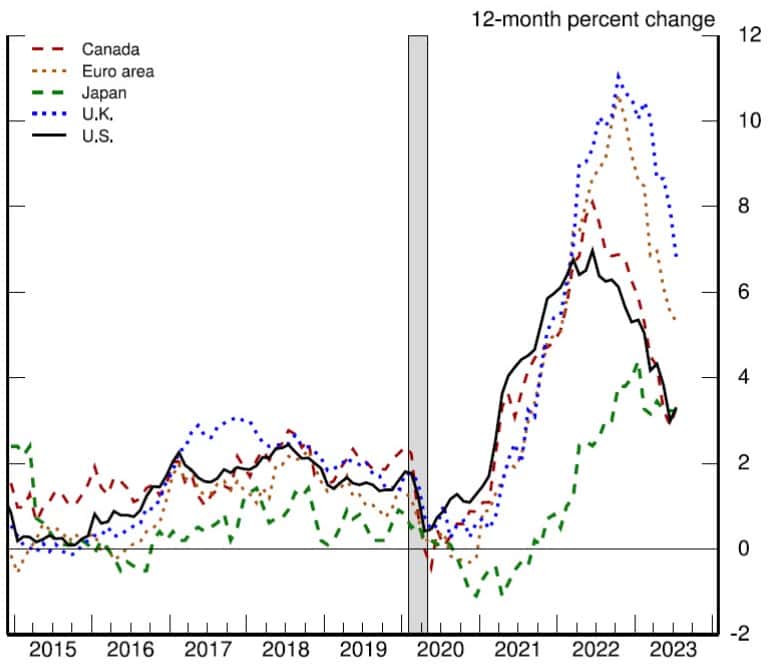

Headline inflation

Supply: Bureau of Financial Evaluation, Haver Analytics through Federal Reserve

After peaking at 7 p.c in June 2022, annual “headline” inflation — private consumption expenditures (PCE) together with meals and vitality — has principally been headed in the correct route however bounced to three.3 p.c in July.

“The results of Russia’s conflict in opposition to Ukraine have been a major driver of the adjustments in headline inflation all over the world since early 2022,” Powell stated. “Headline inflation is what households and companies expertise most instantly, so this decline is superb information. However meals and vitality costs are influenced by world elements that stay risky, and might present a deceptive sign of the place inflation is headed.”

Core PCE inflation

Supply: Bureau of Financial Evaluation, Haver Analytics through Federal Reserve

The Fed’s most well-liked measure of inflation, core PCE, omits the meals and vitality parts and stays farther from the central financial institution’s objective of bringing inflation right down to 2 p.c per yr. At 4.3 p.c in July, annual core PCE inflation was down from a peak of 5.4 p.c in February, and month-to-month declines in June and July have been welcome, Powell stated.

However “two months of fine information are solely the start of what it is going to take to construct confidence that inflation is shifting down sustainably towards our objective” of attaining 2 p.c inflation, Powell stated.

On an annual foundation, “core items inflation stays effectively above its pre-pandemic stage,” he stated. “Sustained progress is required, and restrictive financial coverage is named for to attain that progress.”

Housing nonetheless an inflation fear

The Fed is wanting intently at three parts of core PCE inflation: Inflation for items, for housing companies and for all different “nonhousing companies” like well being care, meals companies, transportation and lodging, Powell stated.

Inflation has fallen sharply for sturdy items like automobiles as “the pandemic and its results have waned, manufacturing and inventories have grown and provide has improved,” whereas increased rates of interest weigh on demand Powell stated.

Whereas inflation in nonhousing companies has proven enchancment when measured over the previous three and 6 months, it’s moved sideways within the final yr.

“A part of the rationale for the modest decline of nonhousing companies inflation thus far is that many of those companies have been much less affected by world provide chain bottlenecks and are usually considered much less interest-sensitive than different sectors, corresponding to housing or sturdy items,” Powell stated.

The housing sector is “extremely” delicate to rates of interest, nevertheless it takes a while for falling rents and residential costs to impression inflation measures, Powell famous.

The impacts of the Fed’s rate of interest hikes “turned obvious quickly after liftoff,” Powell acknowledged. “Mortgage charges doubled over the course of 2022, inflicting housing begins and gross sales to fall and home value development to plummet. Progress in market rents quickly peaked after which steadily declined.”

Powell — who warned eventually yr’s Jackson Gap convention that the Fed was decided to get inflation below management, even when increased charges would “deliver some ache to households and companies” — stated the housing sector may nonetheless frustrate the Fed from reaching its inflation goal.

“After decelerating sharply over the previous 18 months, the housing sector is displaying indicators of choosing again up,” Powell stated. “Extra proof of persistently above-trend development may put additional progress on inflation in danger and will warrant additional tightening of financial coverage.”

Goolsbee, who was a College of Chicago economics professor earlier than being appointed president of the Chicago Fed in January, stated he thought Powell struck the correct tone.

Austan Goolsbee

“I believe he was correctly sober,” Goolsbee stated. “Let’s not conclude an excessive amount of. We’ve gotten a few good months of enchancment within the information on inflation. We noticed progress within the areas that we’ve been eager to see progress — on items, on the start of housing — however there’s nonetheless an extended technique to go. So I believe if the chair had gotten up and stated ‘mission achieved,’ that looks as if it’d be untimely.”

However Shepherdson took difficulty with Powell’s assertion that the housing sector is displaying indicators of choosing up.

“Mortgage functions are nonetheless falling, pointing to decrease complete dwelling gross sales,” Shepherdson stated. “New dwelling gross sales are rising as a result of homebuilders are taking market share because of the lack of present dwelling stock, however that doesn’t imply the general market is beginning to get well. Complete dwelling gross sales probably will hit new lows over the winter.”

On Wednesday, the Mortgage Bankers Affiliation reported that homebuyer demand for buy mortgages fell to the bottom stage since 1995 final week as mortgage charges hit new post-pandemic highs.

Get Inman’s Mortgage Transient Publication delivered proper to your inbox. A weekly roundup of all the largest information on the earth of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E-mail Matt Carter