Do you face delays attributable to gradual community pace whereas making funds via UPI usually? Do you make small funds as much as Rs. 200 recurrently? Is your account assertion stuffed with small transactions made each day? If any of your solutions to those questions is in affirmative, NPCI has supplied an answer to your considerations. NPCI has launched UPI Lite, a fee resolution that can let folks make low-value transactions beneath Rs. 200 via UPI very quickly.

You should be questioning how UPI Lite will clear up most of our considerations. Allow us to take you thru the entire idea of introducing this facility. The aim behind introducing this facility is to make low-value transactions simpler for customers. This mode of doing transactions is kind of handy and hassle-free. UPI Lite is an on-device pockets that gives a easy and customer-friendly interface. Transactions performed via this medium are sooner, user-friendly, and suitable with all banks. Cash will be transferred with out utilizing UPI PIN, which makes certain that the cash is transferred immediately to the opposite checking account.

As beneficial by RBI, this service will help monetary transactions with out hitting financial institution servers each time. Under-mentioned are the important thing transactions and utilization parameters outlined to make use of UPI Lite:

- Most restrict per transaction – Rs. 200

- Most Retailer Worth restrict in pockets – Rs. 2,000

- Cumulative most every day spend restrict – Rs. 4,000

Get Free Credit score Report with month-to-month updates.

Examine Now

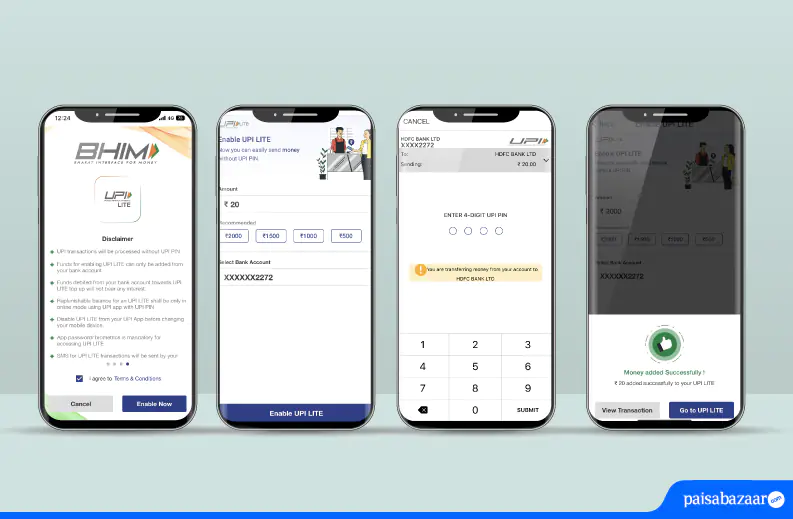

Learn how to Create UPI Lite Account

Creating UPI Lite account is simple, you simply need to open your BHIM or Paytm app and this account will be merely activated from these accounts. Should you don’t have BHIM, PhonePe, Paytm, and so on. You simply need to obtain the app from play/app retailer and comply with the below-mentioned steps to activate this service:

Step 1: Upon downloading the app, arrange the app and settle for the required phrases and circumstances to register

Step 2: Create your account by choosing your checking account linked to UPI and add worth to your account

Step 3: Enter your UPI PIN to authenticate the transaction

Step 4: As soon as your UPI PIN is verified, your UPI Lite account will probably be created

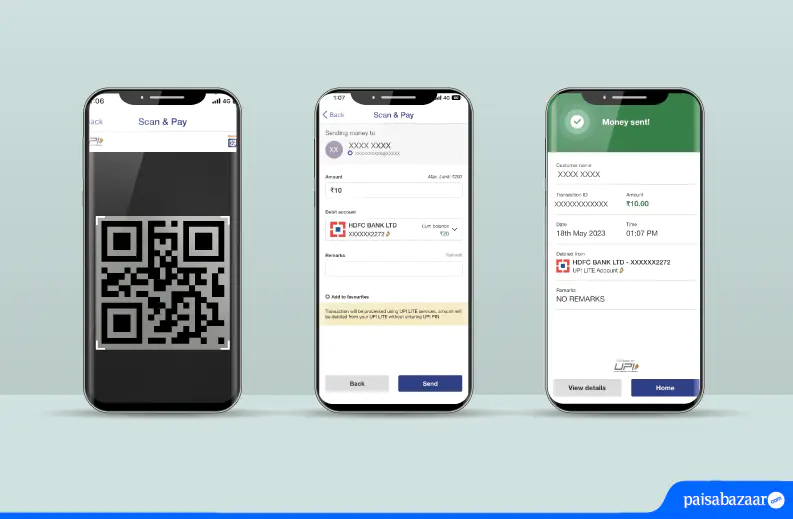

Learn how to Make Funds from UPI Lite Account

As soon as your UPI app is about up and cash is added to the UPI Lite account, you can begin availing its companies. Making funds from this pockets account is kind of possible now and requires only a click on. As the quantity transferred via this platform is restricted to Rs. 200 per transaction, NPCI has enabled one-touch fee to hurry up your transactions with out requiring the PIN to authenticate the transaction. The below-mentioned steps clarify tips on how to make transactions by way of this facility:

Step 1: Open UPI Lite app and scan the QR code

Step 2: Add the quantity that must be paid to the service provider

Step 3: Click on on ‘Pay Now’ to finish the transaction

Step 4: Upon clicking on ‘Pay Now’, your transaction will probably be accomplished and ‘Fee performed’ will probably be displayed on the display screen with the main points of the fee made

Be aware: UPI Lite fee system is not going to function on ‘jail damaged’ gadgets.

Get Free Credit score Report with month-to-month updates.

Examine Now

Advantages of UPI Lite

UPI Lite fee technique will present below-mentioned advantages:

- Improved success fee of UPI transactions

- Much less load on the core banking system

- No extra cluttered passbooks for customers

- No must authenticate small transactions by offering UPI PIN

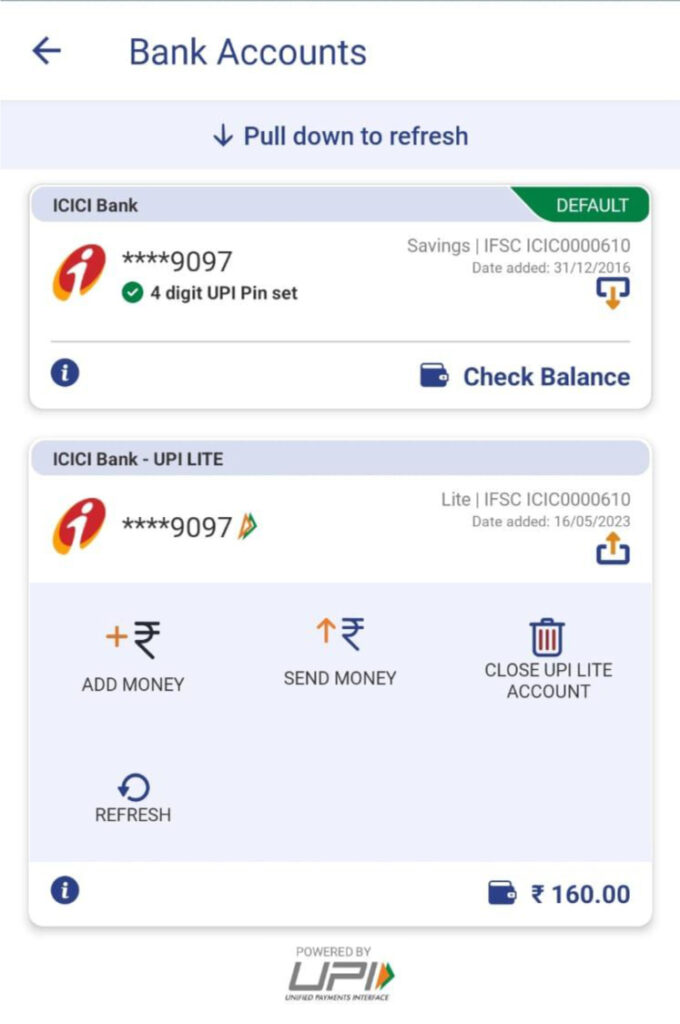

Course of to Disable UPI Lite Account

To disable your UPI Lite account could be very simple. Simply click on in your all energetic UPI accounts in your app. You may then choose an account from which you wish to disable this service. There will probably be an choice to disable UPI Lite account as proven within the picture beneath.

Banks Stay on UPI Lite

| AU Small Finance Financial institution | Axis Financial institution Restricted |

| Canara Financial institution | Central Financial institution of India |

| HDFC Financial institution | ICICI Financial institution |

| Indian Financial institution | Kotak Mahindra Financial institution |

| Paytm Funds Financial institution | Punjab Nationwide Financial institution |

| UCO Financial institution | State Financial institution of India |

| Union Financial institution of India | Utkarsh Small Finance Financial institution Restricted |

Get Free Credit score Report with month-to-month updates.

Examine Now

UPI Lite FAQs

Q. How a lot time does it take for UPI Lite High-up?

Ans. UPI- Lite High-Up doesn’t take time in any respect. It’s a real-time course of.

Q. I’ve modified my cell machine, will I be capable of entry my UPI Lite stability on my new machine?

Ans. It is very important notice that you could disable UPI Lite account in your earlier machine in an effort to activate it in your new machine. Your account is not going to be synced routinely in your new machine. In a brand new machine, you’ll have to register for this service once more.

Q. Will I get my a reimbursement on disabling UPI Lite account?

Ans. Sure. Your cash will probably be refunded again to your financial savings account after disabling your UPI Lite account.

Q. How will UPI LITE be efficient for the banking ecosystem?

Ans. UPI Lite will guarantee that there’s much less load on the banking system whereas doing small-value transactions. It is going to assist banks in decreasing visitors digitally as a result of main transactions performed as of late are from UPI. This facility will help banks in getting off the load of doing small-value transactions.

Q. Will my passbook show UPI Lite transactions?

Ans. No. Your passbook is not going to have UPI Lite transaction entries. Nevertheless, you’ll obtain an SMS out of your financial institution upon doing such transactions. Solely pockets top-up transaction particulars will probably be entered within the passbook.

Q. Will there be any fees for utilizing this companies?

Ans. No. The service is not going to appeal to any fees.

Q. Do I must obtain BHIM app to avail this service?

Ans. You may avail this facility on many of the UPI apps. Nevertheless, if you wish to use this service on BHIM, you possibly can obtain it by clicking right here for android.

Q. Can I activate UPI Lite account once more if I’ve deactivated it?

Ans. Sure, you possibly can activate and deactivate this account any variety of occasions relying upon your comfort.

The submit UPI Lite – Small Worth Transactions Made Simpler appeared first on Examine & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.