In these instances, double down — in your expertise, in your information, on you. Be a part of us Aug. 8-10 at Inman Join Las Vegas to lean into the shift and be taught from the perfect. Get your ticket now for the perfect worth.

Mortgage servicing big Mr. Cooper continues to make inroads on its quest to construct a $1 trillion mortgage servicing portfolio — which it intends to wring most earnings from by changing many name heart staff with synthetic intelligence and by getting a bounce begin on different lenders when householders are able to refinance.

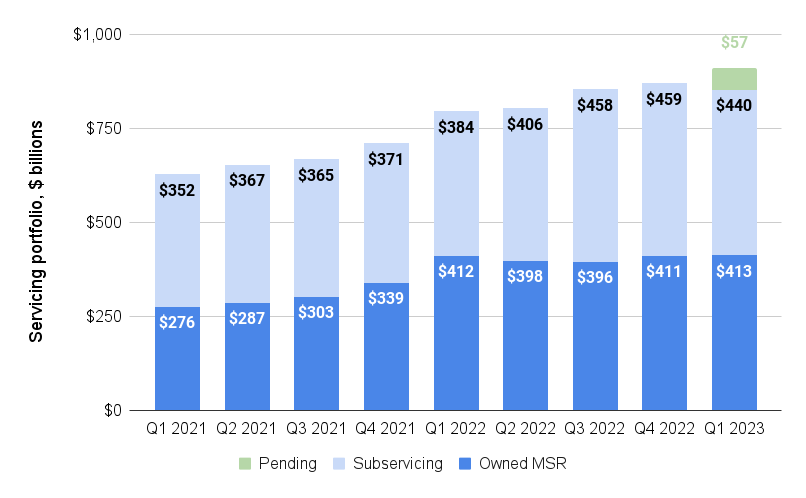

In reporting a $37 million first-quarter web revenue Wednesday, Dallas, Texas-based Mr. Cooper stated it grew its mortgage servicing portfolio — mortgages it collects funds on, on behalf of traders — by 7 p.c from a 12 months in the past to $853 billion.

That determine doesn’t embody a further $57 billion in mortgage servicing rights for which Mr. Cooper has lately signed offers. Add these pending offers to the combo, and Mr. Cooper will quickly be servicing greater than $900 billion in mortgage debt.

Mr. Cooper’s servicing portfolio approaching $1T

Mr. Cooper mortgage servicing rights (MSR) portfolio in billions of {dollars} | Supply: Mr. Cooper regulatory filings

That’s regardless of dropping $30 billion in subservicing rights in the course of the first quarter to a shopper that acquired their very own servicing platform and is taking their mortgage portfolio in-house, Mr. Cooper Vice Chairman and President Christopher Marshall stated on a name with funding analysts.

Mr. Cooper’s subservicing portfolio — loans that the corporate collects funds on underneath contract with lenders who retain possession of these servicing rights — shrank by 4 p.c from the fourth quarter to $440 billion.

Chris Marshall

“You would see extra volatility in our complete ebook over the steadiness of the 12 months,” Marshall stated. “However total, we really feel nice about our subservicing enterprise, and I’d be aware that we’ve already changed a considerable portion of this loss with development from different purchasers.”

Pending acquisitions of Rushmore Mortgage Administration Providers LLC’s $37 billion mortgage subservicing platform, together with an earlier settlement to accumulate mother or father firm Roosevelt Administration Firm LLC, are anticipated to shut by midyear. Marshall stated Mr. Cooper will onboard “a number of hundred folks” as a part of the deal.

Mr. Cooper’s owned mortgage servicing rights (owned MSR) portfolio grew by simply $2 billion from the earlier quarter to $413 billion — about the place it was a 12 months in the past.

Though Mr. Cooper Chairman and CEO Jay Bray stated the corporate expects to make “lots of progress” this 12 months towards the corporate’s aim of constructing a $1 trillion servicing portfolio, he additionally pegged that quantity as “an absolute minimal for the place we are able to go” in the long term.

Jay Bray

“The alternatives we’re seeing proper now are as thrilling as something we’ve checked out in current reminiscence, and I count on us to exit this a part of the cycle as a bigger, extra worthwhile and much more dominant competitor,” Bray stated on a name with funding analysts.

Mortgage servicers can generate profits in two methods — by gathering charges from the traders who really personal the mortgages they accumulate cost on and by offering loans when householders are able to refinance.

When rates of interest rise, mortgage servicers make much less cash refinancing, however the worth of their mortgage servicing rights will increase, as a result of debtors are much less prone to refinance out of their servicing portfolio.

Bray stated Mr. Cooper — which slashed greater than 1,000 jobs final 12 months as originations dwindled — thinks it will probably trim not less than $50 million in annual bills from its name facilities by utilizing synthetic intelligence to deal with buyer calls.

Mr. Cooper has made a “large funding” in interactive voice response (IVR) to take buyer calls utilizing AI, Bray stated.

“If you concentrate on what we’re attempting to do, it’s actually to duplicate the Amazon mannequin,” Bray stated. “I’m positive everybody on this name makes use of Amazon and but I doubt anybody has ever spoken to anybody at Amazon. That’s since you don’t need to.”

Bray stated Mr. Cooper spends “a number of hundred million {dollars} a 12 months” on name heart operations and expects to attain $50 million in annual financial savings on the outset of what’s anticipated to be “a multiyear challenge.”

“We now have lots of work forward of us, however we predict it’s an enormous alternative, huge alternative not simply to remove expense however to make the expertise a lot, a lot better for our prospects,” Bray stated.

Mortgage originations dwindle

Mr. Cooper mortgage originations by channel, in billions of {dollars} | Supply: Mr. Cooper regulatory filings

One other approach Mr. Cooper expects to revenue from its rising mortgage rights servicing portfolio is by offering loans when householders are able to refinance or purchase their subsequent dwelling — incomes charges because the mortgage originator and retaining the borrower within the firm’s servicing portfolio.

Mr. Cooper acquires mortgages originated by correspondent lenders, and in addition “recaptures” debtors by providing refinancing on to householders from which it’s gathering funds. Marshall stated Mr. Cooper’s recapture fee is about double the {industry} fee.

“For somebody who has already executed a transaction with us that we’ve already refinanced, we seize approaching 80 p.c,” he stated.

Whereas Mr. Cooper’s mortgage originations enterprise has largely dried up — the $2.7 billion in first quarter originations represented an 89 p.c drop from two years in the past — the corporate expects lending to select up when the financial system cools and rates of interest come again down.

“You’ve seen us show industry-leading recapture charges quarter over quarter, 12 months after 12 months, and you already know that on the proper level within the cycle, we are able to generate origination earnings properly over $1 billion,” Bray stated. “A key a part of our technique is to maintain investing in our direct-to-consumer platform in order that we’re ready every time the cycle turns, to do much more.”

Xome REO stock and gross sales climb

Xome stock and gross sales, by quarter | Supply: Mr. Cooper regulatory filings

Along with servicing and originating mortgages, Mr. Cooper’s Xome subsidiary operates an public sale platform for foreclosed and real-estate-owned (REO) properties.

Through the first quarter of 2023, stock on the platform climbed 48 p.c from a 12 months in the past to 27,003 properties. Gross sales had been up 26 p.c from a 12 months in the past to 1,494, surpassing the 2022 peak of 1,285.

Marshall stated Xome is on observe to turn into worthwhile within the second half of the 12 months as properties flowed onto the platform at a file tempo in March.

“A part of that is providers getting extra comfy with their compliance processes, however our group has additionally been actively promoting to new prospects,” Marshall stated. “And because of this, our market share of Ginnie Mae foreclosures is now rising above the 40 p.c goal we laid out for you a 12 months in the past.”

Whereas Marshall has stated prior to now that Mr. Cooper has been in discussions with potential traders about spinning off Xome, he didn’t present additional insights on Wednesday’s name.

Noting that the 37 p.c quarterly development in Xome gross sales was consistent with our projections, he stated Mr. Cooper expects that quantity to develop once more within the second quarter.

“We’re seeing extra investor exercise on the change, which incorporates extra visits to our web site, stronger bidding exercise, extra bids per asset and bettering pull-through charges,” Marshall stated.

Get Inman’s Mortgage Transient E-newsletter delivered proper to your inbox. A weekly roundup of all the most important information on this planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E mail Matt Carter