With the worth of gasoline rising yearly, lots of people are in search of bank cards that might assist them save on their gasoline bills. Whereas a lot of the playing cards supply a specific amount of gasoline surcharge waiver monthly, there are playing cards designed particularly to cater to your gasoline wants. Such playing cards aid you save within the type of cashback, accelerated reward factors, co-branded advantages and extra. Among the finest gasoline bank cards in India come from main card issuers like SBI Card, HDFC Financial institution and Axis Financial institution.

Unique Card Affords from India’s prime banks are only a click on away

Edit

Error: Please enter a sound quantity

Here’s a checklist of the highest gasoline bank cards in India that can you save in your gasoline bills:

| Credit score Card | Annual Price | Gasoline Profit |

| BPCL SBI Card Octane | Rs. 1,499 | 25X reward factors on gasoline purchases at BPCL petrol pumps |

| ICICI HPCL Tremendous Saver Credit score Card | Rs. 500 | 4% cashback on all gasoline spends at HPCL gasoline pumps |

| IndianOil Axis Financial institution Credit score Card | Rs. 500 | 4% worth again on gasoline buy at IOCL shops |

| HDFC Bharat Cashback Credit score Card | Rs. 500 | 5% cashback on gasoline spends |

| IndianOil HDFC Credit score Card | Rs. 500 | 5% of gasoline spends as gasoline factors |

| ICICI HPCL Coral Credit score Card | Rs. 199 | 2.5% cashback at HPCL gasoline stations |

| BPCL SBI Card | Rs. 499 | As much as 4.25% worth again on gasoline bills |

1. BPCL SBI Card Octane

Becoming a member of Price: Rs. 1,499

Annual Price: Rs. 1,499 (Waived off on spending Rs. 2 lakh within the earlier yr)

BPCL SBI Card Octane is a premium model of BPCL SBI Card and comes with further benefits. With this card, you may get 7.25% worth again on Bharatgas on-line funds via the web site and cell app. This card additionally provide you with a great begin with a welcome bonus of 6,000 reward factors. Among the key options are as follows:

Gasoline Advantages:

- 25 reward factors per Rs. 100 spent on BPCL Gasoline, Lubricants & Bharat Fuel (web site & app solely)

- 6.25% + 1% gasoline surcharge waiver on each transaction as much as Rs. 4,000 (relevant throughout all BPCL petrol pumps in India)

Different Advantages:

- 10 reward factors on each Rs. 100 spent at eating, departmental shops, grocery & films

- 1 reward level per Rs. 100 spent on different retail purchases (besides cell pockets add & non-BPCL gasoline spends)

- Welcome advantage of 6,000 bonus reward factors equal to Rs. 1,500 on the cost of annual charge

- 4 complimentary visits per calendar yr to home VISA lounges in India

- Reward vouchers price Rs. 2,000 from associate manufacturers on annual spends of Rs. 3 lakh

Advised: Finest Rewards Credit score Playing cards in India | Examine Your Eligibility

2. ICICI Financial institution HPCL Tremendous Saver Credit score Card

Becoming a member of Price: Rs. 500

Annual Price: Rs. 500

ICICI Financial institution HPCL Tremendous Saver Credit score Card is a co-branded bank card that rewards you in your gasoline transactions at HPCL petrol pumps. It can save you as much as 4% each time you utilize your card for gasoline transactions. This bank card additionally gives advantages throughout different classes, equivalent to journey, leisure, eating and extra. Beneath talked about are among the main advantages offered by this ICICI Financial institution Credit score Card:

Gasoline Advantages:

- 4% cashback on gasoline spends at HPCL gasoline pumps

- Extra 1.5% again in reward factors on gasoline spends on cost at HPCL gasoline shops by way of the HP Pay app

- Welcome profit of two,000 reward factors on card activation and cost of becoming a member of charge and Rs. 100 cashback on HP Pay app

Different Advantages:

- 5% again in reward factors on grocery, departmental shops and utility invoice spends

- 2 reward factors on each Rs. 100 spent on retail purchases anticipate gasoline

- 25% low cost on BookMyShow and INOX on minimal two tickets per transaction as much as Rs. 100

- 1 complimentary airport lounge entry per quarter on spending Rs. 5,000 in a calendar quarter

Advised: ICICI HPCL Tremendous Saver Credit score Card Assessment | Examine Your Eligibility

3. IndianOil Axis Financial institution Credit score Card

Becoming a member of Price: Rs. 500

Annual Price: Rs. 500 (Waived off on spending Rs. 50,000 within the earlier yr)

IndianOil Axis Financial institution Credit score Card provides you respectable returns on gasoline spends in addition to different on-line spends. It’s actually a great card that rewards you with 4% return on gasoline bills as EDGE rewards. The cardboard is designed in such a means that it is smart to get it in case you have gasoline spends within the vary of Rs. 4,000 to Rs. 5,000 monthly, with which additionally, you will get an annual charge waiver. Particulars concerning the identical are talked about under:

Gasoline Advantages:

- 4% worth again on gasoline transactions by incomes 20 reward factors per Rs. 100 at any IOCL gasoline outlet in India

- Accelerated reward factors at IOCL gasoline shops on gasoline transactions between Rs. 100 to Rs. 5,000 monthly

- 1% gasoline surcharge waiver on gasoline transactions between Rs. 200 to Rs. 5,000

Different Advantages:

- 100% cashback (Max. Rs 250) on all gasoline transactions inside 30 days of card issuance

- 1% worth again on on-line purchasing by incomes 5 reward factors on each Rs. 100 spent

- 1 EDGE reward level for each Rs. 100 spent by way of this card

- As much as 15% low cost at associate eating places beneath Axis Financial institution Eating Delights

- 10% low cost on reserving film tickets from BookMyShow

Advised: IndianOil Axis Credit score Card Assessment | Examine Your Eligibility

4. HDFC Bharat Cashback Credit score Card

Becoming a member of Price: Rs. 500

Annual Price: Rs. 500

HDFC Bharat Cashback Credit score Card is a beginner-level bank card that’s finest suited to customers looking for cashback on gasoline. The cardboard gives 5% cashback on gasoline bills, railway ticket bookings, groceries, invoice cost, cell recharge and spends on PayZapp/EasyEMI/ SmartBUY. It can save you as much as Rs. 3,600 yearly via this bank card. Among the key options and advantages of this bank card are talked about under:

Gasoline Advantages:

- 5% cashback on gasoline bills

- 1% gasoline surcharge waiver on a minimal transaction of Rs. 400

Different Advantages:

- 5% month-to-month cashback on IRCTC tickets, groceries, invoice funds and cell recharges

- 5% cashback on spends by way of PayZapp/ EasyEMI/ SmartBUY

- Annual financial savings of as much as Rs. 3,600 by way of this bank card

- As much as 50 interest-free days from the date of buy

Advised: HDFC Bharat Cashback Credit score Card Assessment | Examine Your Eligibility

Get Finest Credit score Playing cards for all of your Wants

5. IndianOil HDFC Credit score Card

Becoming a member of Price: Rs. 500

Annual Price: Rs. 500 (Waived off on spending Rs. 50,000 in a yr)

IndianOil HDFC Financial institution Credit score Card is targeted majorly on customers from non-metro cities and cities of India and is obtainable in Visa and RuPay variants. Utilizing this card, you possibly can earn ‘gasoline factors’ throughout all spending classes and use the identical towards gasoline purchases at IndianOil gasoline stations. You may earn as much as 50 litres of free gasoline yearly by way of this bank card. Listed here are among the main advantages offered by this bank card:

Gasoline Advantages:

- As much as 50 litres of free gasoline yearly on transactions by way of this bank card

- Complimentary IndianOil XTRAREWARDSTM Program (IXRP) membership

- 5% of your spends as gasoline factors at IndianOil shops

- 1% gasoline surcharge waiver on a minimal transaction of Rs. 400

Different Advantages:

- 5% of your spends as gasoline factors on groceries and invoice funds

- 1 gasoline level for each Rs. 150 spent on all different purchases

- Curiosity-free credit score interval of as much as 50 days

Advised: IndianOil HDFC Financial institution Credit score Card Assessment | Examine Your Eligibility

6. ICICI HPCL Coral Credit score Card

Becoming a member of Price: Rs. 199

Annual Price: Rs. 199 (Reversed on spending Rs. 50,000 in a yr)

ICICI Financial institution HPCL Coral Credit score Card allows you to save as much as 3.5% on gasoline bills and likewise rewards you with respectable reward factors on different eligible spends. Furthermore, you possibly can redeem the reward factors for gasoline at any HPCL petrol pump. With this card, you may get 2.5% cashback in your gasoline purchases at HPCL pumps. It is best to apply for this card if you’re a loyal buyer of HPCL and need a gasoline bank card with low annual charge. Listed here are among the different particulars concerning this bank card:

Gasoline Advantages:

- 2.5% cashback on gasoline purchases at HPCL pumps

- 1% gasoline sucharge waiver on gasoline purchases at HPCL pumps

Different Advantages:

- 25% off (As much as Rs. 100) on film tickets booked by way of BookMyShow

- 2 reward factors for each Rs. 100 spent on retail purchases, excluding gasoline

- 2,000 PAYBACK factors will be redeemed for gasoline price Rs. 500

- 15% off on eating at over 800 eating places by way of Culinary Treats program

Advised: Finest Cashback Credit score Playing cards in India | Examine Your Eligibility

7. BPCL SBI Card

Becoming a member of Price: Rs. 499

Annual Price: Rs. 499 (Waived off on spending Rs. 50,000 within the earlier yr)

BPCL SBI Card gives a 4.25% worth again in your gasoline purchases at BPCL petrol pumps. Other than this, you may as well earn 5X factors in your spends at choose classes, which is an added benefit. This can be a good possibility if you’re in search of a card to save lots of extra in your gasoline bills. Beneath talked about are the detailed key options and advantages of this bank card:

Gasoline Advantages:

- 13X reward factors equal to 4.25% worth again on gasoline purchases at BPCL petrol pumps

- 3.25% worth again on each BPCL transaction of as much as Rs. 4,000

- 1% gasoline surcharge waiver on transactions of as much as Rs. 4,000 at any BPCL petrol pump

Different Advantages:

- Welcome present of two,000 activation bonus reward factors price Rs. 500

- 5X reward factors on each Rs. 100 spent on groceries, departmental shops, films or eating

- 1 reward level for each Rs. 100 spent on non-fuel purchases

Advised: BPCL SBI Card Assessment | Examine Your Eligibility

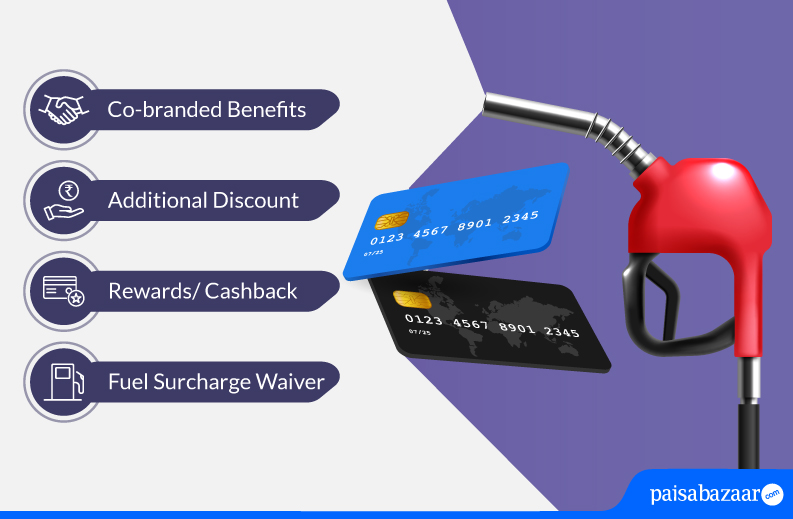

What to Search for in a Gasoline Credit score Card

Right here are some things which it is best to look in a gasoline bank card:

Co-branded Advantages

Whereas deciding on a gasoline bank card, it is best to take into account co-branded advantages supplied by the cardboard. For example, if you happen to steadily go to HPCL petrol pumps, then it is best to go for a card that provides larger advantages in your gasoline transactions at HPCL petrol pumps reasonably than having a card that provides comparable advantages throughout all petrol pumps. It is best to all the time search for a card that’s finest suited in your necessities.

Extra Low cost

Normally, bank cards supply reductions throughout numerous classes. Nevertheless, it is best to search for a card that allows you to save extra in your gasoline transactions. Some playing cards supply a further low cost in your gasoline transactions on the collaborated model. Some bank cards supply a further low cost while you obtain a sure spending milestone, whereas, some playing cards supply a further low cost for a selected time frame on the partnered petrol pump. Due to this fact, earlier than selecting a bank card, it is best to examine all of the associated phrases and situations to take advantage of out of it.

Increased Rewards/ Cashback

Gasoline bank cards provide you with a great worth again in your transactions by rewarding you with cashback or reward factors. Therefore, it is best to get a bank card that provides larger rewards or cashback on gasoline transactions. For example, IndianOil Axis Financial institution Credit score Card rewards you with a 1% worth again in your on-line transactions, whereas, relating to gasoline bills, this bank card gives a price again of 4%, which is larger as in comparison with different classes. So, it is best to select a bank card that provides larger rewards on the gasoline class.

Gasoline Surcharge Waiver

The gasoline surcharge is a cost that’s levied in your gasoline transactions throughout all of the petrol pumps. Gasoline bank cards allow you to save this surcharge by offering a gasoline surcharge waiver in your transactions. This can be a primary profit that’s supplied by a lot of the bank cards. So, if you’re somebody who hardly ever makes gasoline transactions and are in search of an possibility to save lots of in your gasoline transactions, it is best to get a card that provides a gasoline surcharge waiver.

Advised learn: High Credit score Playing cards in India

Select the Finest Gasoline Credit score Card

There is no such thing as a doubt that gasoline bank cards may help you save lots in your gasoline transactions. However, solely choosing the proper bank card may help you maximize your advantages. Right here are some things that it is best to remember whereas deciding on a bank card:

Determine your wants

Earlier than deciding on a bank card, it is best to all the time analyze your necessities to take advantage of out of it. For example, if you’re somebody who commutes every day and prefers to make use of IndianOil as an alternative of HPCL, then getting a bank card that provides larger advantages on IndianOil gasoline transactions makes extra sense reasonably than getting a card that provides advantages on gasoline transactions by way of HPCL. Due to this fact, it is very important determine your want and spending behaviour to make an knowledgeable choice.

Decide your cost capability

Each bank card has a distinct plan and value. To search out the fitting bank card, it is very important analyze how a lot you’re able to pay for it. Many of the bank cards include a becoming a member of or annual charge. Earlier than finalizing a bank card, it is best to analyze whether or not the charge charged by the issuer justifies the advantages supplied on the bank card. In case you are not getting sufficient advantages, then there isn’t any level in making use of for that bank card.

Evaluate a number of choices

On the subject of deciding on the fitting bank card, it is best to all the time evaluate a number of playing cards to just remember to are getting the most effective deal. Whereas evaluating bank cards, it is best to evaluate gasoline advantages, annual charge, rewards program and extra to make an knowledgeable choice. There could be a chance that different bank cards supply higher advantages in your gasoline transactions at an analogous annual charge. After you have in contrast a number of playing cards, apply for one bank card at a time that matches your life-style the most effective.

Advised learn: Finest Buying Credit score Playing cards | Finest Lifetime Free Credit score Playing cards | Finest Entry-level Credit score Playing cards

The put up 7 Finest Gasoline Credit score Playing cards in India April 2023 appeared first on Evaluate & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.