Buyer understanding of normal insurance coverage merchandise could also be decrease than many companies realise – and decrease nonetheless because of the proliferation of tiered merchandise which usually strip out cowl and lift excesses.

In a Viewsbank survey of 1056 folks carried out in February, Shopper Intelligence discovered that information about cowl ranges and extra charges different broadly.

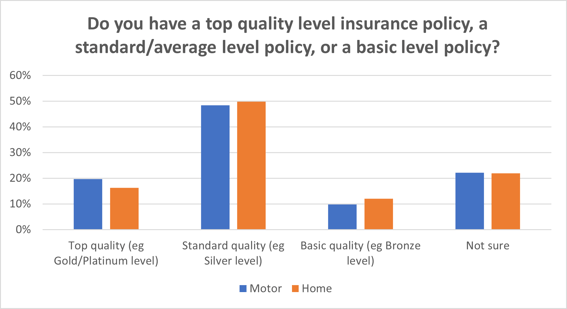

Greater than 1 in 5 of these with insurance coverage had no thought what degree of motor (22%) or dwelling (21%) cowl they’d bought – high, commonplace, or fundamental.

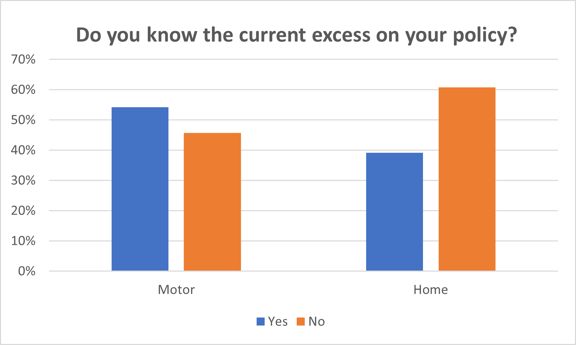

When requested in additional element in regards to the degree of canopy they’d, as many as 46% of automotive insurance coverage prospects had no thought how a lot extra they’d agreed to pay within the occasion of a declare, rising to just about 60% of dwelling prospects.

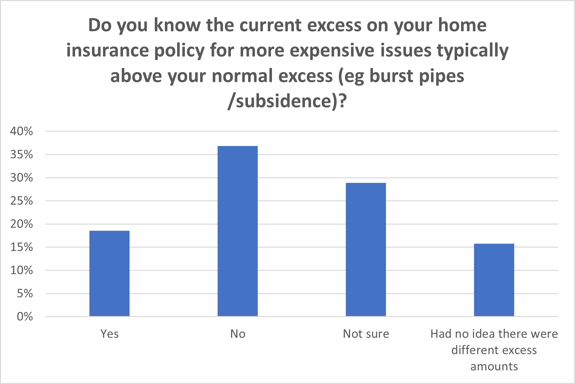

Maybe extra worryingly given the prices concerned, 15% of dwelling insurance coverage customers had no thought their dwelling insurance coverage extra may very well be larger for issues like burst pipes or subsidence, with 37% admitting they’d no thought what they is perhaps liable to pay.

Shopper Intelligence’s Head of Shopper Technique Catherine Carey explains: “We’ve seen an explosion of product tiers following the Normal Insurance coverage Pricing Practices (GIPP) reforms, with manufacturers bringing out bronze/silver/gold variations to serve totally different client budgets – and to get a bonus on the Worth Comparability Web sites.

“To be honest, it’s a technique the FCA has largely authorized of, notably because it supplies susceptible prospects – for example these scuffling with payments through the cost-of-living disaster – with reasonably priced cowl choices. However make no mistake, client understanding is a key pillar of the forthcoming Shopper Responsibility – and it seems to be like companies may have to spend extra time guaranteeing their prospects actually perceive what they’re getting – and never getting – after they go for a graded product.”

And many individuals ARE fascinated about downgrading at their subsequent renewal. Our survey discovered that 31% of motor customers would think about going for a less expensive model of their coverage with much less cowl, with 29% nonetheless on the fence. 26% of dwelling insurance coverage customers would think about a downgrade – with 25% nonetheless not sure.

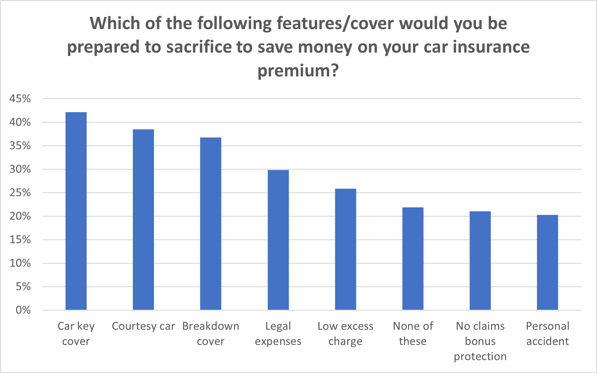

What turned actually fascinating was what folks thought they could select to sacrifice from a coverage with the intention to pay much less for it.

Key cowl was a function 4-in-10 drivers stated they may do with out, adopted by a courtesy automotive and breakdown cowl. 29% would sacrifice authorized bills, and 26% stated they’d be ready to let go of their decrease extra cost. Which when so many indicated they didn’t know what their present extra really was, appears to point an essential understanding hole.

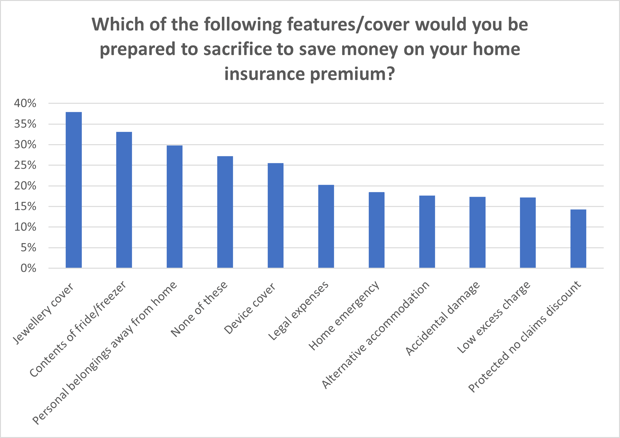

In the meantime, barely fewer householders stated they might go for sacrificing their low or decrease extra charge (17%), with the preferred factor to lose being jewelry cowl, adopted by fridge/freezer contents, after which private belongings away from the house. 1 in 4 would sacrifice gadget cowl.

With that together with costly objects like telephones and laptops, it’s once more unclear whether or not persons are really pondering via and understanding the implications of much less complete cowl.

Catherine Carey added: “The actual crux of the issue is that many lower-tiered merchandise are so priced as a result of they strip out precisely the types of parts or extras we requested folks in the event that they’d be tempted to go with out. In addition they sometimes elevate excesses in addition – presumably to a degree that many purchasers concerned about price range choices merely wouldn’t have the ability to afford.”

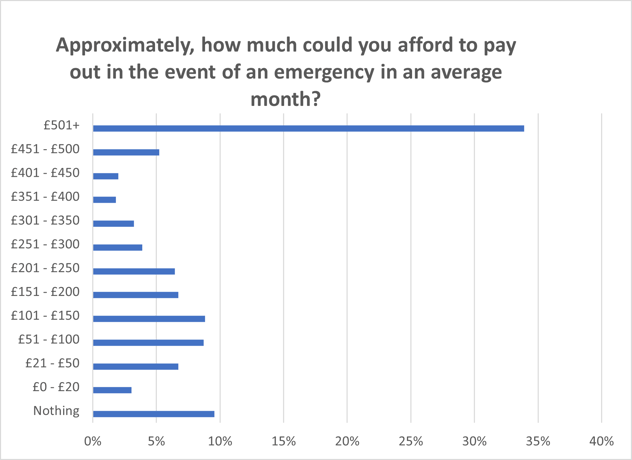

Once we requested folks about whether or not they had cash put aside in financial savings for home emergencies, we discovered that 30% admitted they didn’t. Digging down, we requested how a lot they could have the ability to afford to pay out in an emergency in a typical month. Whereas 35% may discover £500+, 10% may pay nothing. One other 10% had lower than £50 to spare.

With automotive extra on some lower-tiered insurance policies robotically set at £250+ – there’s a clear and regarding hole. And people going through the surplus charges for one thing like escape of water would discover themselves in much more issue.

They’re findings which are mirrored within the FCA’s newest Monetary Lives Survey, which discovered that 1-in-4 Brits are in monetary issue – or may rapidly discover themselves in issue in the event that they suffered even a modest monetary shock – with round 32 million already discovering it a burden to maintain up with payments.

Catherine Carey continued: “Should you can’t afford to switch your telephone, pay somebody to select you up from the aspect of the motorway, get a rent automotive to do the college/work run whereas yours is being fastened, name somebody out to repair your boiler, or pay the surplus to repair your leak – then your price range coverage all of a sudden isn’t very ‘reasonably priced’ is it? The FCA needs to verify folks perceive that commerce off earlier than they purchase.

“Our job as an trade is to supply folks with a security internet. If we’re concentrating on price range merchandise at individuals who in actuality gained’t have the ability to use them within the occasion of a declare, we’re open ourselves as much as poor client outcomes.

“Sure, the FCA wants us to cater for susceptible prospects – however they’ve been very clear that that’s THROUGH a lens of Shopper Responsibility. It’s time to consider whether or not your price range traces are actually providing honest worth, and whether or not they’re actually serving to those that actually need assistance – exactly after they want it most.”

Perceive the wants and motivations of your prospects or target market.

Our Viewsbank panel helps our prospects with all kinds of tasks starting from detailed thriller purchasing to demographically focused analysis surveys. The analysis helps our purchasers make knowledgeable choices primarily based on true understanding of the buyer’s voice.

.png#keepProtocol)